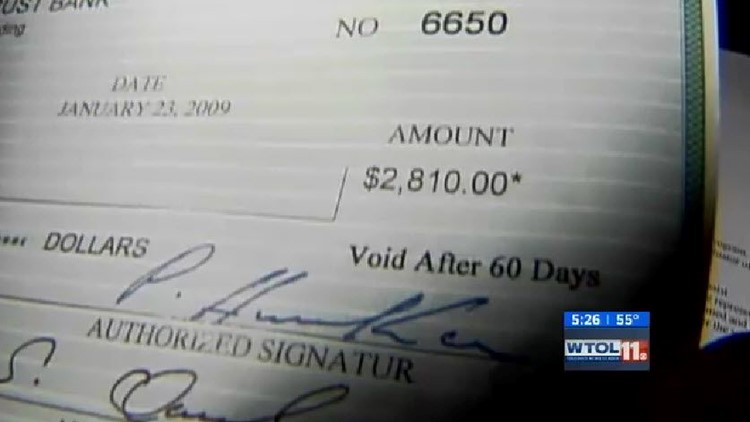

Are checks really void after 60 days?

Are checks really void after 60 days?

Answer: Banks are not required to accept checks that are more than 6 months (180 days) old. However, they can still process an old check if they believe the funds are good.

What to do if a check is void after 90 days and has not been cashed?

Answer: Cashier’s checks may not be accepted for deposit after 90 days because the issuing bank could return the check unpaid. If you have a cashier’s check that’s more than 90 days old, contact the issuing bank for a new check.

Why does a check void after 90 days?

Answer: Some personal checks have pre-printed voiding instructions like “Void after 90 days” to encourage timely cashing. However, most banks still honor personal checks for up to 6 months (180 days) after the issue date.

How do I cash an expired check?

Answer: If your check is expired, it’s up to the bank’s discretion whether they will cash it or not. They might contact the account holder for approval before cashing it. It’s best to contact the issuer and ask for a new check.

What happens if a check is never cashed?

Answer: Checks that remain outstanding for a long time become void. Some checks become stale after 60 or 90 days, while others become void after 6 months. These are known as stale checks.

Does the date on a check matter?

Answer: A signed check becomes legal tender immediately, and the bank can deposit or cash it before the indicated date. Therefore, a bank will accept a check if it is dated and signed.

Can I still cash a check if I wrote “void” on it?

Answer: Yes, even if you write “void” on a check, it can still be cashed.

Can a check take months to clear?

Answer: In most cases, a check should clear within 1 or 2 business days. However, there may be exceptions, such as large deposit amounts or international checks. Check your bank’s policies for more information.

Can I get in trouble for depositing an expired check?

Answer: Although banks may allow you to cash or deposit an outdated check, they are not required to do so. It’s best to check with your bank to determine their policy.

What happens if I deposit an expired check?

Answer: Your bank may accept the check for deposit regardless of the issue date, but the issuing bank could reject it. In that case, the funds might be withdrawn from your account, and you may have to pay a fee. The check could also bounce.

What happens when a check fails to be claimed after six months?

Answer: If a check issued to you remains unclaimed after six months, it becomes an outstanding check. The specific actions or consequences depend on the situation and the issuing party.

What happens if I deposit a check that says void after 180 days

Banks don't have to accept checks that are more than 6 months (180 days) old. That's according to the Uniform Commercial Code (UCC), a set of laws governing commercial exchanges, including checks. Banks are still allowed to process an old check as long as the institution believes the funds are good.

Cached

What to do if check is void after 90 days and have not cashed

Cashier's Checks

Banks might not accept a cashier's check for deposit after 90 days because the issuing bank could return the check unpaid after that time. 4 If you have a cashier's check that's more than 90 days old, contact the issuing bank to get a new check.

Cached

Why does my check void after 90 days

You may, on occasion, see personal checks with pre-printed voiding instructions — “Void after 90 days,” as an example. In most cases, this is a way to nudge people to cash checks in a timely manner. Most banks still honor personal checks for a full six months (180 days) after the issue date.

Cached

How do I cash an expired check

If your check is expired, it's up to the bank's discretion if they cash it or not. If they decide to do so, they might contact the account holder for approval before cashing it. The best thing you can do in this situation is contact the issuer yourself and ask them to give you a new check.

What happens if a check is never cashed

Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months. Outstanding checks that remain so for a long period of time are known as stale checks.

Does the date on a check matter

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

Can I still cash a check if I wrote void on it

Yes, even a check that has VOID written in big letters on the front can be cashed.

Can a check take months to clear

Bottom line. In most cases, a check should clear within one or two business days. There are a few cases in which a check might be held for longer, such as if it's a large deposit amount or an international check. Make sure to review your bank's policies for what to expect in terms of check hold times.

Can I get in trouble for depositing an expired check

Generally, a “stale check” (also called a “stale-dated check”) is an uncashed check that's more than six months old. Although banks, credit unions or other financial institutions might let you cash or deposit an outdated check into your account, the law doesn't require them to do so.

What happens if I deposit an expired check

Your bank may let you deposit the check, regardless of the issue date, but the issuing bank could still reject it. If this happens, the funds might be withdrawn from your account and you might have to pay a fee. The check could bounce.

What happens when a check was failed to be claimed after six months

Outstanding Checks Issued to You

If a check was issued to you and it's still outstanding after six months, contact the check issuer and request a replacement. As mentioned above, you may need to return the original check or sign documents confirming the check is lost or destroyed.

What is the check date rule

the issue date in alphanumeric on old format checks may be written in any sequence, i.e., Month-Day-Year or Day-Month-Year or Year-Month-Day. However, alphanumeric Month-Day-Year sequence is preferable for consistency with the MM-DD-YYYY sequence prescribed for issue date in numeric format.”

What would make a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

What happens if a check voids

Voiding a check prevents the check from being used by anyone, especially thieves who could write a large sum of money out to themselves. Typically, a voided check is used to get information needed for electronic payments because it includes details such as your routing number, account number, and check number.

What’s the longest a check can take to clear

Here's how long it generally takes for a check to clear:Usually within two business days for personal checks but up to seven for some accounts.Usually one business day for government and cashier's checks and checks from the same bank that holds your account.

Can you cash a check 6 months later

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will honor those checks for up to 180 days and the pre-printed language is meant to encourage people to deposit or cash a check sooner than later.

What happens if I deposit a stale check

Checks which are at least 180 days old (6 months) are considered stale. Tellers in banks will sometimes reject a check if the date is over that limit. This does not prevent a check from clearing the bank when deposited through other means than a teller.

Do banks accept expired checks

While your first instinct might be to cash it, bear this in mind: A bank is not required to pay a check that's more than six months old. The Uniform Commercial Code says banks are under no obligation to accept checks, personal or business, more than 180 days old.

Will a company reissue an expired check

The employer must verify that the check was never cashed, but once that is done, the employer must reissue a check.

Does the date on a check really matter

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

How long is a check date good for

6 months

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks.

Can I deposit a check that says void

A voided check cannot be filled in, cashed or deposited. That might make it seem useless, but in fact a voided check has a specific purpose, which is to make it easier for you to share your banking information with someone else.

Why are checks taking so long to clear

A bank may hold a check longer if it's an unusual deposit, such as if you've never deposited a check from that payer before. A check may take also longer to clear if it's for a larger amount or is from an international bank. Checks from foreign banks usually require longer hold times because they take longer to verify.

Do banks have to honor stale checks

Checks that are more than six months old are called “stale checks.” A bank or credit union may choose to honor such a check and different states have different requirements, but federal law does not require it to do so.

How long are you responsible for an uncashed check

What happens to an uncashed personal check Like business checks, personal checks are generally considered invalid after six months (180 days). Outstanding personal checks can cause budgeting problems, but you may have an easier time reminding a friend or family member to cash a check than a business payee.