Can I deposit an expired check?

Can I deposit an expired check?

Can I get in trouble for depositing an expired check?

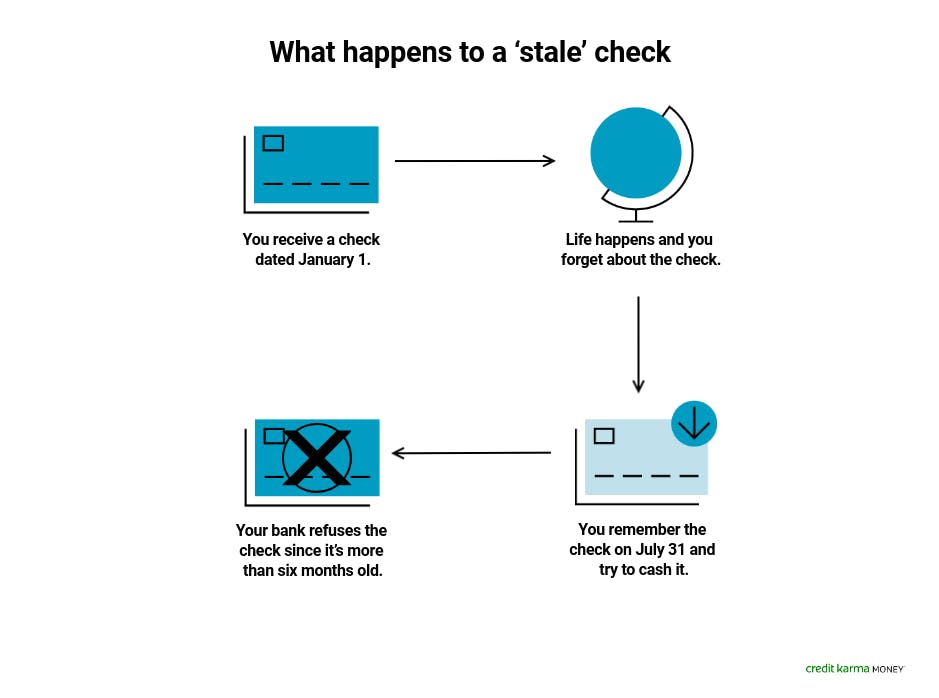

Generally, a “stale check” (also called a “stale-dated check”) is an uncashed check that’s more than six months old. Although banks, credit unions, or other financial institutions might let you cash or deposit an outdated check into your account, the law doesn’t require them to do so.

What to do if a check is expired?

As noted above, banks are legally obligated to honor a personal check for up to six months. If you find an expired check, you may want to contact whoever issued it before attempting to cash it. If you can, it’s usually best practice to cash checks when you receive them.

Can I deposit a 2-year-old check?

While your first instinct might be to cash it, bear this in mind: A bank is not required to pay a check that’s more than six months old. The Uniform Commercial Code says banks are under no obligation to accept checks, personal or business, more than 180 days old.

What happens if I deposit a stale check?

Checks which are at least 180 days old (6 months) are considered stale. Tellers in banks will sometimes reject a check if the date is over that limit. This does not prevent a check from clearing the bank when deposited through other means than a teller.

Does the date on a check matter?

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

What happens if a check is never cashed?

Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months. Outstanding checks that remain so for a long period of time are known as stale checks.

What is the check date rule?

The issue date in alphanumeric on old format checks may be written in any sequence, i.e., Month-Day-Year or Day-Month-Year or Year-Month-Day. However, alphanumeric Month-Day-Year sequence is preferable for consistency with the MM-DD-YYYY sequence prescribed for the issue date in numeric format.

Why is the date on a check important?

A signed check is immediately considered lawful currency and can be cashed or deposited by a bank before the check’s stated expiration date. Therefore, if a check is dated and signed, a bank can accept it.

What can I do with an old uncashed check?

If a check was issued to you and it’s still outstanding after six months, contact the check issuer and request a replacement.

Does the date on a check really matter?

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

How long is a check date good for?

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks.

Can I get in trouble for depositing an expired check

Generally, a “stale check” (also called a “stale-dated check”) is an uncashed check that's more than six months old. Although banks, credit unions or other financial institutions might let you cash or deposit an outdated check into your account, the law doesn't require them to do so.

Cached

What to do if a check is expired

As noted above, banks are legally obligated to honor a personal check for up to six months. If you find an expired check, you may want to contact whoever issued it before attempting to cash it. If you can, it's usually best practice to cash checks when you receive them.

Cached

Can I deposit a 2 year old check

While your first instinct might be to cash it, bear this in mind: A bank is not required to pay a check that's more than six months old. The Uniform Commercial Code says banks are under no obligation to accept checks, personal or business, more than 180 days old.

CachedSimilar

What happens if I deposit a stale check

Checks which are at least 180 days old (6 months) are considered stale. Tellers in banks will sometimes reject a check if the date is over that limit. This does not prevent a check from clearing the bank when deposited through other means than a teller.

Cached

Does the date on a check matter

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

What happens if a check is never cashed

Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months. Outstanding checks that remain so for a long period of time are known as stale checks.

What is the check date rule

the issue date in alphanumeric on old format checks may be written in any sequence, i.e., Month-Day-Year or Day-Month-Year or Year-Month-Day. However, alphanumeric Month-Day-Year sequence is preferable for consistency with the MM-DD-YYYY sequence prescribed for issue date in numeric format.”

Why is the date on a check important

A signed check is immediately considered lawful currency and can be cashed or deposited by a bank before the check's stated expiration date. Therefore, if a check is dated and signed, a bank can accept it.

What can I do with an old uncashed check

If a check was issued to you and it's still outstanding after six months, contact the check issuer and request a replacement.

Does the date on a check really matter

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

How long is a check date good for

6 months

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks.

What makes a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

How important is the date on a check

The date on the check serves as a “timer” that indicates when the check can be deposited or cashed.

Can a bank refuse to deposit a check

There is no federal law that requires a bank to cash a check, even a government check.

How do you know if a check is valid

Check with the bank that supposedly issued the check to make sure it is real. Make sure you look up the phone number on the bank's official website and don't use the phone number printed on the check (that could be a phone number controlled and answered by the scam artist).

Why would a check deposit be declined

The check image isn't readable. The check is folded or torn. The check isn't signed on the front or on the back. The check does not include the “For Mobile Deposit Only at TCU” endorsement on the back.

Why would a bank decline a check deposit

Banks have to protect themselves against check fraud. Without proper proof of identity, a bank can legally refuse to cash a check made out to your name. Always carry proper government-issued identification such as a driver's license or passport when you intend to cash a check.

What would make a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

What happens if you deposit a bad check that you did not write

The bank can close or freeze your account.

If you deposit a fake check, your bank can decide to freeze or even completely close your account. Review your bank deposit account agreement to see in what scenarios your bank can close your account.

When can you not deposit a check

6 months

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will honor those checks for up to 180 days and the pre-printed language is meant to encourage people to deposit or cash a check sooner than later.

Why wont my bank let me deposit a check

Banks have to protect themselves against check fraud. Without proper proof of identity, a bank can legally refuse to cash a check made out to your name. Always carry proper government-issued identification such as a driver's license or passport when you intend to cash a check.

How long does it take a bank to reject a check

Checks typically take two to three business days to clear or bounce. At this point, the bank has either received funds from the check writer's bank or discovered that it will not receive those funds.

What happens if you don’t cash a check within 90 days

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will honor those checks for up to 180 days and the pre-printed language is meant to encourage people to deposit or cash a check sooner than later.

What makes a check void

Writing “VOID” on a check means that the check can't be deposited or cashed. When you void something it means you've made it empty, of no effect, or null. So if a written check is full of the monetary amount you write on it, voiding the check makes that check financially empty.

Why would a check fail to deposit

No Payee Indicated – If the Paid to the Order of line (your name) is blank on the check, you will not be able to deposit the check. Before attempting to deposit a check, be sure that all crucial areas of information are written down – such as payee, check amount and payer's signature.