Can I reopen my closed Capital One account?

Can I reopen my closed Capital One account?

Does Capital One do second chances?

Capital One may give you a second chance, as it offers second chance credit cards to people with poor credit and has a reconsideration process that gives rejected applicants a second chance at approval.

Can a closed account be reopened?

Can you reopen a closed bank account? In most circumstances, once a bank account is closed it can’t be reopened. You’ll have to open a new bank account with your institution or bank somewhere else if you’re unable to find an account that interests you.

Can you reopen your credit account if it gets closed?

Contact your credit card issuer. Once you understand the reason why your credit card account has been closed, call your issuer’s customer service to ask about reopening the account. When you do, you may be asked to provide some information, such as your name and Social Security number.

Can a closed account be reinstated?

It may be possible to reopen a closed credit card account, depending on the credit card issuer, as well as why and how long ago your account was closed. But there’s no guarantee that the credit card issuer will reopen your account. For example, Discover says it won’t reopen closed accounts at all.

How often does an account get reopened with Capital One?

In most cases, once an account has been closed, it is a permanent move. It’s very rare for Capital One to be able to reopen an account once it has closed.

Will Capital One reconsider?

Capital One Reconsideration Line. There is not a dedicated line for reconsideration of Capital One Credit Card applications. You will need to call one of the customer service numbers or the credit card application line.

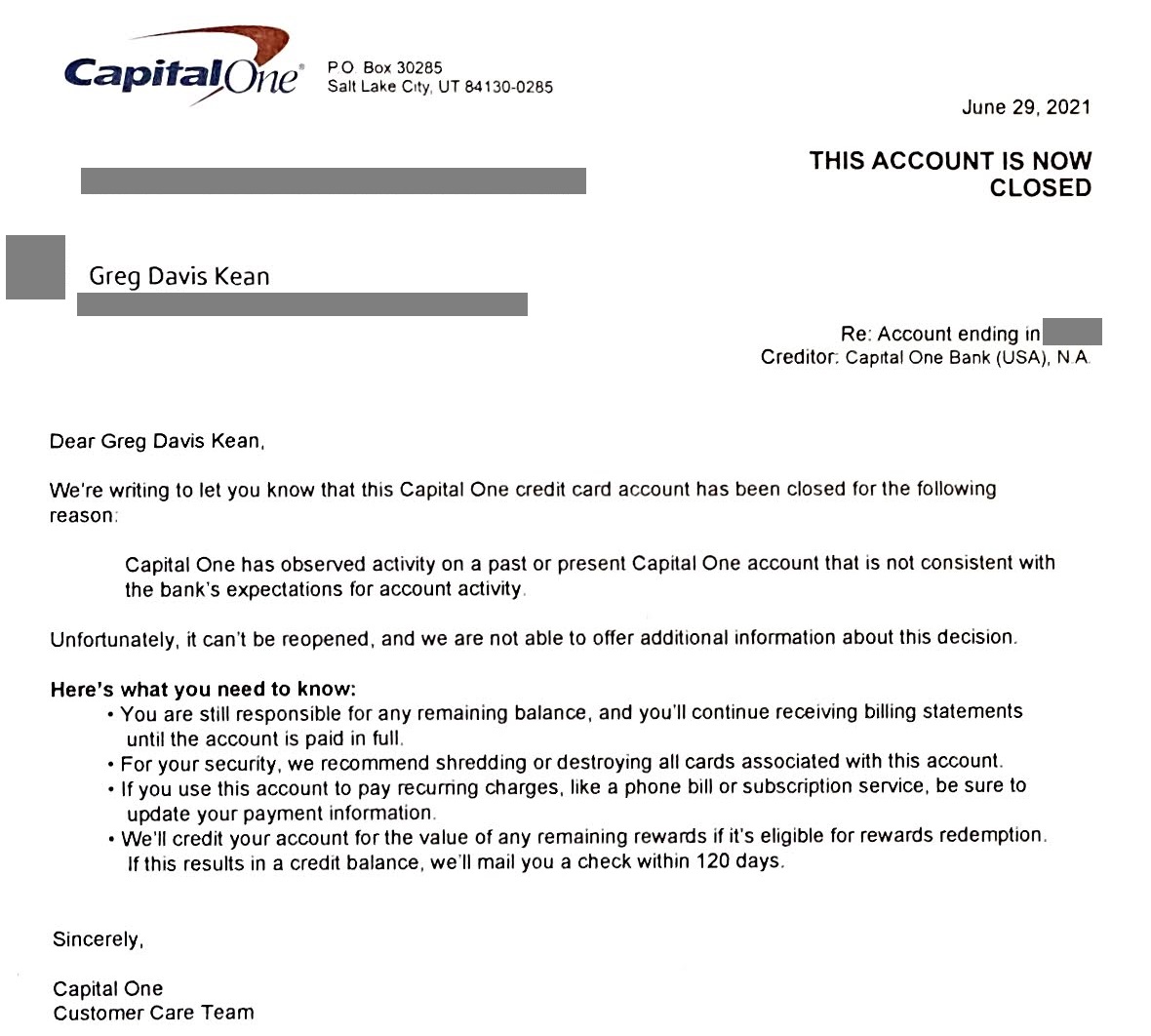

Why would Capital One closed my account?

When a credit card account goes 180 days (a full 6 months) past due, the credit card company must close and charge off the account. This means the account is permanently closed and written off as a loss to the company, although the debt is still owed.

Do closed accounts hurt my credit score?

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn’t.

Does closed accounts hurt your credit?

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn’t.

How long does it take for credit to recover from a closed account?

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How long does it take to recover from a closed account?

Even if they do show as closed, any account closed in good standing (meaning it has no late payment history) will remain on your credit report for 10 years. As long as the account appears in your credit report, it will be factored into your scores.

Does Capital One do second chances

Capital One may give you a second chance, as it offers second chance credit cards to people with poor credit and has a reconsideration process that gives rejected applicants a second chance at approval.

Can a closed account be reopened

Can you reopen a closed bank account In most circumstances, once a bank account is closed it can't be reopened. You'll have to open a new bank account with your institution or bank somewhere else if you're unable to find an account that interests you.

Cached

Can you reopen your credit account if it gets closed

Contact your credit card issuer

Once you understand the reason why your credit card account has been closed, call your issuer's customer service to ask about reopening the account. When you do, you may be asked to provide some information, such as: Your name. Your Social Security number.

Cached

Can a closed account be reinstated

It may be possible to reopen a closed credit card account, depending on the credit card issuer, as well as why and how long ago your account was closed. But there's no guarantee that the credit card issuer will reopen your account. For example, Discover says it won't reopen closed accounts at all.

Cached

How often does an account get reopened with Capital One

In most cases, once an account has been closed, it is a permanent move. It's very rare for Capital One to be able to reopen an account once it has closed.

Will Capital One reconsider

Capital One Reconsideration Line

There is not a dedicated line for reconsideration of Capital One Credit Card applications. You will need to call one of the customer service numbers or the credit card application line.

Why would Capital One closed my account

When a credit card account goes 180 days (a full 6 months) past due, the credit card company must close and charge off the account. This means the account is permanently closed and written off as a loss to the company, although the debt is still owed.

Do closed accounts hurt my credit score

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Does closed accounts hurt your credit

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

How long does it take for credit to recover from a closed account

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How long does it take to recover from a closed account

Even if they do show as closed, any account closed in good standing (meaning it has no late payment history) will remain on your credit report for 10 years. As long as the positive information remains, it contributes to a stronger credit history.

What does it mean when Capital One closes your account

When a credit card account goes 180 days (a full 6 months) past due, the credit card company must close and charge off the account. This means the account is permanently closed and written off as a loss to the company, although the debt is still owed.

Are closed accounts on credit report bad

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

How long do I have to wait to reapply for Capital One

six months

As we have already mentioned, Capital One is one company that requires cardholders to wait at least six months before putting in an application for a second credit card.

Does Capital One have a recon line

Capital One: 1-800-625-7866.

Does closing a Capital One account affect credit score

Before closing a credit card, you may want to be aware of any impacts it may have on your credit report. Closing an account can affect the age of your credit and your credit utilization ratio, which may hurt your credit scores.

Should I be worried if the bank closed my account

Banks and financial institutions can close your bank account for several reasons without warning or notice. If your bank account is closed, you should find out why and clear up any unpaid balances; any amount owed is still due even when the account is no longer active.

How much does credit score drop for a closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Should I pay off a closed account

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

How long does a closed account stay on credit

10 years

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Do closed accounts hurt your credit

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Does a closed account look bad on your credit

Closed accounts that were never late can remain on your credit report for up to 10 years from the date they were closed. If the accounts you mentioned are showing as potentially negative, it's likely due to delinquencies noted in the history of the account.

What is the 5 24 rule for Capital One

The most important rule to consider in collecting points is the “5/24 rule.” The rule is simple: If you get 5 personal credit cards in any 24-month period, you're automatically prohibited from getting a 6th Chase or Capital One card.

Why did Capital One deny me a checking account

Your report could trigger a checking account denial if it includes: Frequent bounced checks. Recurring overdrafts. Involuntary account closures.

Why is Capital One permanently closed

During the pandemic, Capital One decided to close some of its physical locations to prevent spreading the coronavirus. Some bank buildings are still closed as a pandemic precaution, while others are closed and being sold as part of a long-term strategy to rethink the business model.