Can I see a fraud alert on my credit report?

Does a Fraud Alert Show Up on Credit Report?

Placing a fraud alert does not affect your credit scores.

How Do I Find Fraud on My Credit Report?

Periodically check your credit reports. Coming across suspicious activity on your credit reports, such as new accounts you don’t recognize, is a quick way to identify potential fraud. You can get free copies of your credit reports from all three major credit bureaus through AnnualCreditReport.com.

How Do I Check My Equifax Fraud Alert?

Once you have placed a fraud alert or active duty alert, you’ll be able to verify its status through your myEquifax account. You can also call Equifax at (800) 525-6285 or send a request by mail to place a fraud alert or active duty alert.

How Long Does It Take for a Fraud Alert to be Removed?

The credit bureaus don’t share information about how long it takes for a fraud alert to be removed from your credit account. However, most consumers report that their alerts were lifted anywhere from 1-5 days after the agency received their request.

What Are the Consequences of a Fraud Alert?

Placing a fraud alert on your credit reports will have no effect on your credit score, according to TransUnion. At the same time, however, the fraud alert could prevent someone else from obtaining credit under your name and subsequently harming your credit score by defaulting on loans or credit cards.

How Do You Check If My SSN is Being Used?

To see if someone’s using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How Long Does a Fraud Alert Stay on a Credit Report?

An initial fraud alert will last for one year. If you’re not sure you’ve been a victim, but are concerned about identity theft, an initial fraud alert is a good option.

How Long Does It Take to Remove a Fraud Alert?

The credit bureaus don’t share information about how long it takes for a fraud alert to be removed from your credit account. However, most consumers report that their alerts were lifted anywhere from 1-5 days after the agency received their request.

How Do I Check to See If Someone Is Using My Social Security Number?

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

Does Removing Fraud Alert Affect Credit Score?

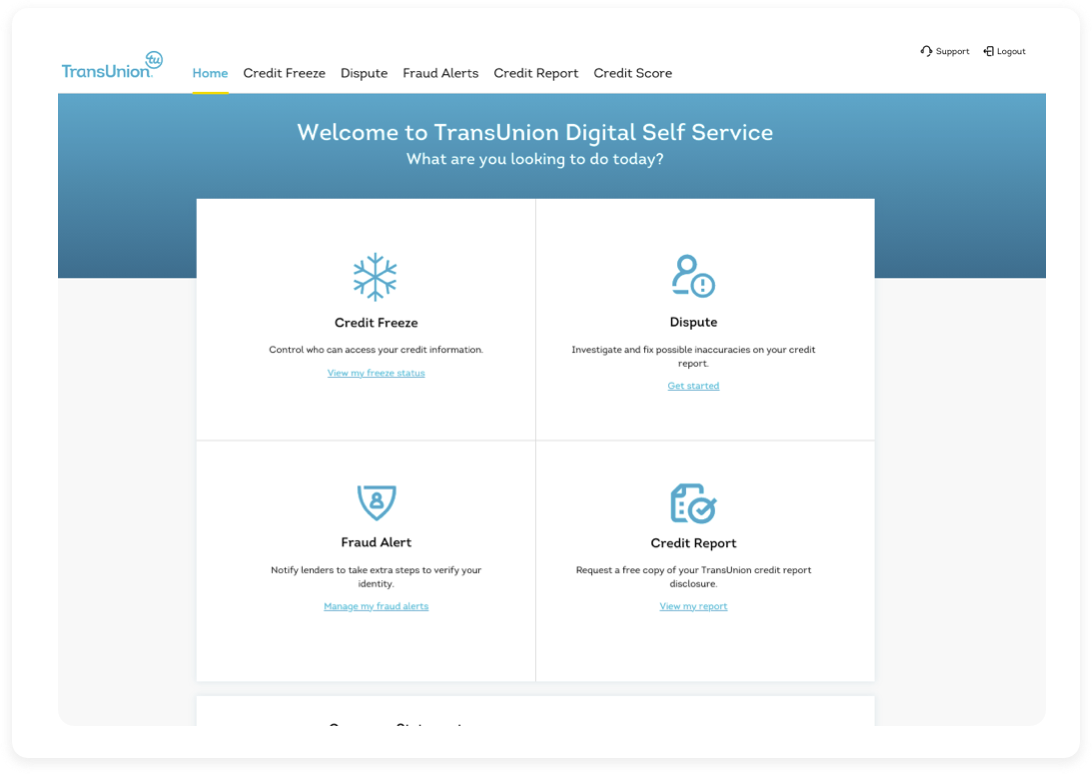

A fraud alert is free and notifies creditors to take extra steps to verify your identity before extending credit. You can add a 1-year, 7-year, or Active Duty Military fraud alert. Remove a TransUnion fraud alert any time using our online Service Center with no effect on your credit score.

Does a fraud alert show up on credit report

Does placing a fraud alert hurt my credit scores Placing a fraud alert does not affect your credit scores.

How do I find fraud on my credit report

Periodically check your credit reports.

Coming across suspicious activity on your credit reports, such as new accounts you don't recognize, is a quick way to identify potential fraud. You can get free copies of your credit reports from all three major credit bureaus through AnnualCreditReport.com.

How do I check my Equifax fraud alert

Once you have placed a fraud alert or active duty alert, you'll be able to verify its status through your myEquifax account. You can also call Equifax at (800) 525-6285 or send a request by mail to place a fraud alert or active duty alert.

How long does it take for a fraud alert to be removed

How Long Does It Take for a Fraud Alert To Be Removed The credit bureaus don't share information about how long it takes for a fraud alert to be removed from your credit account. However, most consumers report that their alerts were lifted anywhere from 1–5 days after the agency received their request.

What are the consequences of a fraud alert

Placing a fraud alert on your credit reports will have no effect on your credit score, according to TransUnion. At the same time, however, the fraud alert could prevent someone else from obtaining credit under your name and subsequently harming your credit score by defaulting on loans or credit cards.

How do you check if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How long does a fraud alert stay on a credit report

one year

An initial fraud alert will last for one year. If you're not sure you've been a victim, but are concerned about identity theft, an initial fraud alert is a good option.

How long does it take to remove a fraud alert

How Long Does It Take for a Fraud Alert To Be Removed The credit bureaus don't share information about how long it takes for a fraud alert to be removed from your credit account. However, most consumers report that their alerts were lifted anywhere from 1–5 days after the agency received their request.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

Does removing fraud alert affect credit score

A fraud alert is free and notifies creditors to take extra steps to verify your identity before extending credit. You can add a 1-year, 7-year, or Active Duty Military fraud alert. Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score.

How long does a fraud alert stay on your report

Initial fraud alerts and active-duty alerts expire after one year, and extended fraud alerts remain on your credit reports for seven years unless you request the alert to be removed sooner.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

How do I check to see if my identity has been stolen

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

How long does Experian take to remove a fraud alert

An initial fraud alert remains on your credit report for one year.

What to do after fraud alert

Article: 6 Steps to Take after Discovering FraudDon't pay any more money.Collect all the pertinent information and documents.Protect your identity and accounts.Report the fraud to authorities.Check your insurance coverage, and other financial recovery steps.

Can I check to see if my SSN has been compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear.

How do I check to see if someone is using my social security number to file taxes

Know the Signs of Identity TheftYou get a letter from the IRS inquiring about a suspicious tax return that you did not file.You can't e-file your tax return because of a duplicate Social Security number.You get a tax transcript in the mail that you did not request.

Do you have to contact all 3 credit bureaus for fraud alert

You can contact any of the three nationwide credit bureaus to request a fraud alert. Once you have placed a fraud alert on your credit report with one of the bureaus, that bureau will send a request to the other two bureaus to do the same, so you do not have to contact all three.

How do I find out if a credit card has been opened in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do you check if your SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How can I check to see if someone is using my Social Security number

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How much does Experian charge for a fraud alert

free

Requesting to add or remove a fraud alert is always free. For all three types of alerts, you only need to submit the request to one of the three major credit bureaus—Experian, TransUnion or Equifax—and it will forward your request on to the other two.

How do I stop someone from using my social security number

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

How can I check to see if my SSN has been used

Make a single request for all three credit bureau reports at Annual Credit Report Request Form, (Disclaimer) or by calling 1-877-322-8228. File a report with your local police or the police in the community where the identity theft took place.

How can I see if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.