Can you cancel TransUnion Online?

Summary of the article:

Here are the key points from the article:

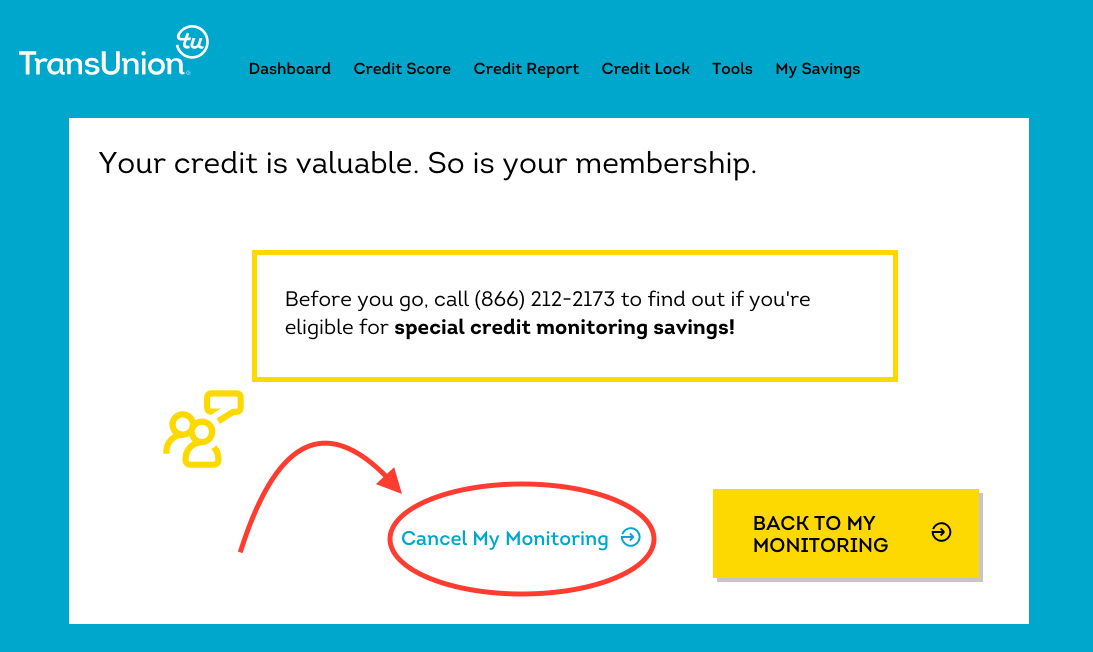

1. How do I delete my TransUnion account online?

Visit https://www.transunion.com/home-story to cancel transunion membership online.

2. How much does it cost to cancel TransUnion monthly?

It doesn’t cost anything to cancel a TransUnion account. However, you will not receive any prorated payments for the outstanding month.

3. Is TransUnion a monthly subscription?

Yes, the subscription price is $29.95 per month (plus tax where applicable). Cancel anytime.

4. Can I remove my information from TransUnion?

You aren’t able to delete your credit report with TransUnion. However, you can dispute credit report information if you believe it to be inaccurate.

5. How long does an account stay on TransUnion?

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. Accounts with adverse information may stay on your credit report for up to seven years.

6. Does TransUnion charge a fee?

The three national credit reporting agencies—TransUnion, Experian, and Equifax—are required by federal law to provide you with a free annual credit report.

7. Is it worth paying TransUnion?

TransUnion’s credit monitoring service isn’t cheap, but if you want an additional layer of identity protection, it may be worth the cost to you. It’s important to weigh your options when selecting a credit score service.

8. What is TransUnion monthly fee?

One of the main disadvantages is the monthly fee of $19.95, which is relatively expensive compared to other companies that provide credit ratings and reports.

9. Do you have to pay to use TransUnion?

Your annual credit report is now available weekly. And it’s still free. The three national credit reporting agencies—TransUnion, Experian, and Equifax—are required by federal law to provide you with a free annual credit report.

10. Should I go off of TransUnion or Equifax?

Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

11. How do I remove my name from TransUnion?

The simplest way to clear your name from the credit bureau is to pay off the debt. According to TransUnion, one of South Africa’s biggest credit bureaus, this will usually result in your name being removed from the blacklist within 7 – 20 days.

12. Do closed accounts hurt your credit?

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn’t.

Questions and Answers:

Here are the questions and detailed answers:

1. How do I delete my TransUnion account online?

Answer: Visit https://www.transunion.com/home-story to cancel TransUnion membership online.

2. How much does it cost to cancel TransUnion monthly?

Answer: It doesn’t cost anything to cancel a TransUnion account. However, you will not receive any prorated payments for the outstanding month.

3. Is TransUnion a monthly subscription?

Answer: Yes, the subscription price is $29.95 per month (plus tax where applicable). Cancel anytime.

4. Can I remove my information from TransUnion?

Answer: You aren’t able to delete your credit report with TransUnion. However, you can dispute credit report information if you believe it to be inaccurate.

5. How long does an account stay on TransUnion?

Answer: An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. Accounts with adverse information may stay on your credit report for up to seven years.

6. Does TransUnion charge a fee?

Answer: The three national credit reporting agencies—TransUnion, Experian, and Equifax—are required by federal law to provide you with a free annual credit report.

7. Is it worth paying TransUnion?

Answer: TransUnion’s credit monitoring service isn’t cheap, but if you want an additional layer of identity protection, it may be worth the cost to you. It’s important to weigh your options when selecting a credit score service.

8. What is TransUnion monthly fee?

Answer: One of the main disadvantages is the monthly fee of $19.95, which is relatively expensive compared to other companies that provide credit ratings and reports.

9. Do you have to pay to use TransUnion?

Answer: Your annual credit report is now available weekly. And it’s still free. The three national credit reporting agencies—TransUnion, Experian, and Equifax—are required by federal law to provide you with a free annual credit report.

10. Should I go off of TransUnion or Equifax?

Answer: Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

11. How do I remove my name from TransUnion?

Answer: The simplest way to clear your name from the credit bureau is to pay off the debt. According to TransUnion, one of South Africa’s biggest credit bureaus, this will usually result in your name being removed from the blacklist within 7 – 20 days.

12. Do closed accounts hurt your credit?

Answer: While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn’t.

How do I delete my TransUnion account online

Visit https://www.transunion.com/home-story to cancel transunion membership online. For more assistance, dial (855) 681-3196 and speak to customer service.

Cached

How much does it cost to cancel TransUnion monthly

It doesn't cost anything to cancel a TransUnion account for you or a loved one. However, you will not receive any prorated payments for the outstanding month.

Cached

Is TransUnion a monthly subscription

Subscription price is $29.95 per month (plus tax where applicable). Cancel anytime.

Can I remove my information from TransUnion

You aren't able to delete your credit report with TransUnion. However, you can dispute credit report information if you believe it to be inaccurate.

How long does an account stay on TransUnion

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Does TransUnion charge a fee

The three national credit reporting agencies—TransUnion, Experian and Equifax—are required by federal law to provide you with a free annual credit report.

Is it worth paying TransUnion

TransUnion's credit monitoring service isn't cheap, but if you want an additional layer of identity protection, it may be worth the cost to you. It's important to weigh your options when selecting a credit score service.

What is TransUnion monthly fee

One of the main disadvantages is the monthly fee of $19.95, which is relatively expensive compared to other companies that provide credit ratings and reports.

Do you have to pay to use TransUnion

Your annual credit report is now available weekly. And it's still free. The three national credit reporting agencies—TransUnion, Experian and Equifax—are required by federal law to provide you with a free annual credit report.

Should I go off of TransUnion or Equifax

Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

How do I remove my name from TransUnion

The simplest way to clear your name from the credit bureau is to pay off the debt. According to TransUnion, one of South Africa' biggest credit bureaus, this will usually result in your name being removed from the blacklist within 7 – 20 days.

Do closed accounts hurt your credit

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Is 750 TransUnion score good

A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850.

Is TransUnion usually the lowest credit score

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Is it better to use Equifax or TransUnion

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is it better to have higher TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Why is TransUnion so much higher than Equifax

The biggest difference between your TransUnion credit report and Equifax credit score is that the TransUnion credit score reports your employment history and personal information. The other two credit reporting agencies or credit bureaus report only the name of your employer.

Is a TransUnion credit score of 650 good

A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850.

How do I clean up my TransUnion credit report

You submit an investigation request (dispute).

If you believe that an item contained in your TransUnion credit report is inaccurate or needs updating, send TransUnion a request for investigation or request to change information. You can start your investigation online. You can also submit a dispute by phone or mail.

How do I remove myself from the credit bureau

How do I clear my name from being BlacklistedApply for Debt Counselling with The National Debt Review Center. or.Pay and close your outstanding debt.Check your credit report from all major credit bureaus and dispute any wrongfully listed information.Get an attorney or Debt Counsellor.

How much does credit score drop for a closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

How many points does your credit score drop when you close an account

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

How rare is an 820 credit score

Membership in the 800+ credit score club is quite exclusive, with fewer than 1 in 6 people boasting a score that high, according to WalletHub data.

Can I buy a house with 735 credit score

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Do banks look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.