Can you get ITIN without SSN?

Summary of the Article:

1. What are the requirements for an ITIN number?

– Acceptable documents as proof of identity and foreign status:

– Passport (stand-alone document)

– National identification card (must show photo, name, current address, date of birth, and expiration date)

– U.S. driver’s license

– Civil birth certificate (required for dependents under 18 years of age)

2. Can you get a TIN without a Social Security Number?

– An ITIN (Individual Taxpayer Identification Number) is available for nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN).

3. Can an undocumented immigrant apply for ITIN?

– Yes, undocumented individuals can apply and file for an ITIN if they are not eligible for an SSN.

4. What is the easiest way to get an ITIN number?

– You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll-free number) if you are outside the United States.

5. How much does it cost to open an ITIN number?

– Good news, an ITIN number is completely free. All you need to do is complete the form and supply the correct documents.

6. Does an ITIN number allow you to work?

– An ITIN is for tax reporting purposes only and does not authorize a person to work in the U.S. or provide eligibility for Social Security benefits.

7. Why use a TIN instead of SSN?

– The major difference between a Social Security Number (SSN) and other tax ID numbers is that an SSN is primarily used by individuals for filing taxes, while tax ID numbers like the Employer Identification Number (EIN) are used by businesses to file their taxes.

8. How long does it take to get the ITIN number?

– If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number usually within seven weeks (up to 11 weeks if requested during peak tax time or from abroad).

9. Is working with an ITIN illegal?

– An ITIN does not provide legal immigration status or work authorization, and it cannot be used to prove legal presence or work eligibility on an I-9 form.

10. Can you be denied an ITIN number?

– If your ITIN application is rejected, you have the option to re-apply with a new application and ensure all supporting documents are enclosed and the application is filled out correctly.

11. How much does it cost to get an ITIN number in the USA?

– The cost to apply for an ITIN number is free. If you need to locate a copy of your ITIN number that you have previously applied for, you can call the IRS at 1-800-829-1040.

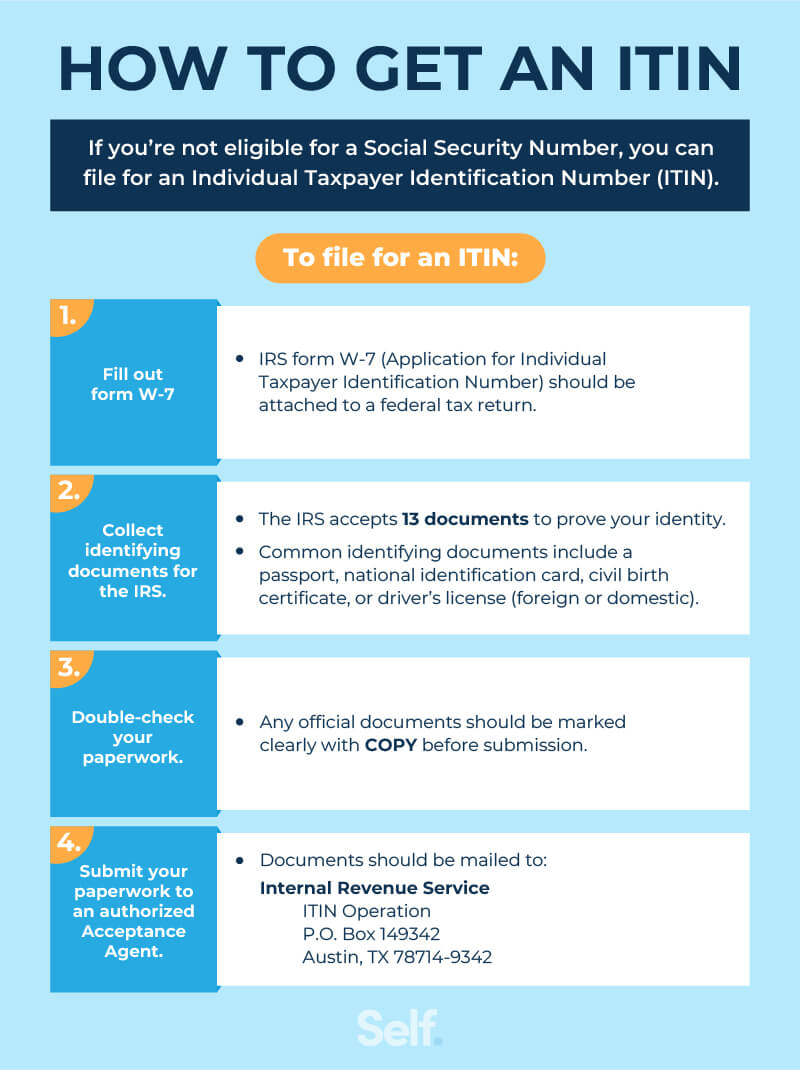

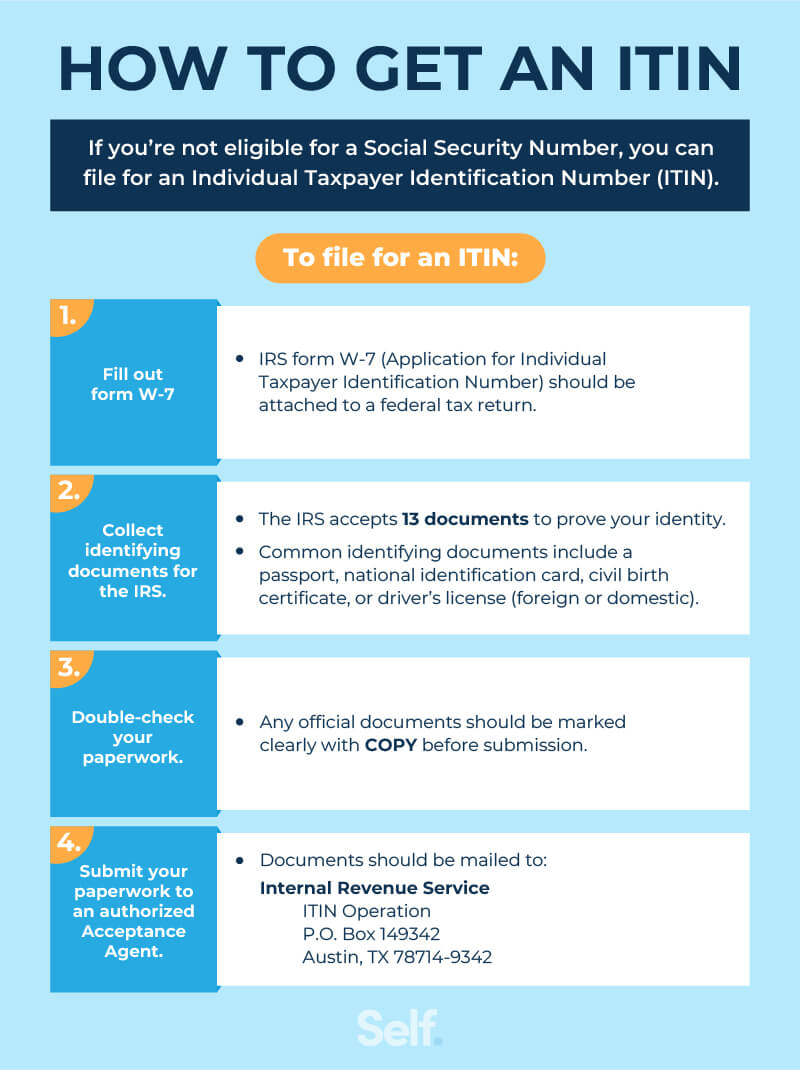

What are the requirements for an ITIN number

What documents are acceptable as proof of identity and foreign statusPassport (stand-alone document) *National identification card (must show photo, name, current address, date of birth, and expiration date)U.S. driver's license.Civil birth certificate (required for dependents under 18 years of age)

Can you get a TIN without a Social Security Number

ITIN. An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN).

CachedSimilar

Can an undocumented immigrant apply for ITIN

Frequently Asked Questions. Can undocumented individuals apply for an ITIN Yes. Any individual not eligible for a SSN may apply and file for an ITIN.

Cached

What is the easiest way to get an ITIN number

You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll-free number) if you are outside the United States.

How much does it cost to open an ITIN number

completely free

Good news, an ITIN number is completely free. All you need to do is complete the form and supply the correct documents.

Does an ITIN number allow you to work

The IRS issues ITINs for federal tax purposes, and ITINs should be used for tax reporting only. ITINs do not authorize a person to work in the U.S. or provide eligibility for Social Security benefits.

Why use a TIN instead of SSN

Social Security Number, the most important aspect that stands out is that SSN is a type of TIN. The major difference between Social Security number (SSN) and any other tax id is that this number is primarily used by individuals for filing taxes while a tax ID number like EIN is used by businesses to file their taxes.

How long does it take to get the ITIN number

within seven weeks

Q11: How long does it take to get an ITIN A11: If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number usually within seven weeks (up to 11 weeks if requested during peak tax time (January 15 through April 30) or from abroad).

Is working with an ITIN illegal

An ITIN does not provide legal immigration status and cannot be used to prove legal presence in the United States. An ITIN does not provide work authorization and cannot be used to prove work authorization on an I-9 form.

Can you be denied an ITIN number

If the ITIN application is rejected with a CP567 notice letter issued, you have an option to re-apply with a new ITIN application by completing Form W7 and ensuring the supporting documents are enclosed and the new application is filled out correctly this time.

How much does it cost to get an ITIN number in USA

The cost to apply for your ITIN number is free. If you have already applied for one in the past and are trying to locate a copy of the number, you can call the IRS at 1-800-829-1040.

Can you hire someone with only an ITIN number

Do not accept an ITIN in place of an SSN for employee identification or for work. An ITIN is only available to resident and nonresident aliens who are not eligible for U.S. employment and need identification for other tax purposes.

Can you open a bank account with just an ITIN

You can still get a bank account with an ITIN, or an individual taxpayer identification number. ITINs are used by the Internal Revenue Service to process taxes. They're available only to noncitizens in the U.S. who are not eligible for a Social Security number; their spouses and dependents can also obtain an ITIN.

What does an itin number do for illegal immigrants

While undocumented individuals may not qualify to file and pay taxes with a social security number, they can obtain an Individual Taxpayer Identification Number (ITIN). An ITIN works like a social security number for the purpose of filing taxes only.

Can you work at Walmart with ITIN

An ITIN cannot be used for employee identification or work. ITINs are only available to resident and nonresident aliens who are not eligible to work in the U.S.

Is it better to use ITIN or SSN

It is not the same as a social security number, as an ITIN is not to be used for employment purposes. An ITIN number is only used for tax purposes. That is, in order to be employed you need an SSN. If you are just receiving a scholarship or fellowship and are not employed otherwise, then you need an ITIN.

How do I get an ITIN number for a non resident alien

Applying by Mail or In Person – You can apply for your ITIN by mail or in person at designated IRS Taxpayer Assistance Centers (TACs) in the United States. TACs operate by appointment only.

Can you work at Walmart with an ITIN

If an employee does not receive an SSN or gets turned down for one, they cannot legally work for you. Do not accept an ITIN in place of an SSN. An ITIN cannot be used for employee identification or work. ITINs are only available to resident and nonresident aliens who are not eligible to work in the U.S.

How much is an itin number for illegal immigrants

How much does it cost to get an ITIN number The is no charge from the IRS for an ITIN.

Can you legally work in the US with an ITIN number

Filing with an ITIN

The IRS issues ITINs for federal tax purposes, and ITINs should be used for tax reporting only. ITINs do not authorize a person to work in the U.S. or provide eligibility for Social Security benefits.

Can I work at Walmart with an ITIN number

Can you work in the U.S. with an ITIN number Employers cannot legally hire individuals as employees unless they have a valid SSN.

What happens if you work with an ITIN number

Employers cannot accept an ITIN as a valid employee identification for work eligibility. The IRS will penalize companies and resident and non-resident aliens who use ITINs for U.S. employment verification purposes. Anyone assigned an ITIN who becomes eligible to work in the U.S. must apply for a social security card.

What bank does not require SSN and ITIN

Bank of America: You can open an account with an ITIN, but it's not required. Chase: You need an ITIN and a photo ID. Citibank: No SSN or ITIN required; you will need to verify your address. PNC: No SSN or ITIN required.

What do I need to open a bank account if I’m undocumented

An undocumented immigrant will need an alternative to the Social Security number, or SSN, in order to open a bank account. This number is called an Individual Taxpayer Identification Number, or ITIN, and you can apply for one through the RIS. Many financial institutions will accept an ITIN in place of a SSN.

Can you work at Chick Fil A with a ITIN number

Can you work in the U.S. with an ITIN number Employers cannot legally hire individuals as employees unless they have a valid SSN.