Can you turn off Discover Card?

Can you turn off Discover Card?

Yes, you can turn off or cancel your Discover credit card by contacting the credit card company’s customer service department and requesting cancellation. You will need to call the number on the back of your card and let them know you want to cancel the account. Once you have canceled the card, it is important to destroy it to prevent any unauthorized use.

What does it mean to deactivate Discover card?

If you want to temporarily deactivate your Discover card instead of freezing it, there is an option available. This allows you to use your card number for card-not-present transactions, such as online or over-the-phone purchases, while preventing the physical card from being used. It provides an added layer of security for your account.

How do I lock my Discover card?

To lock your Discover Bank debit card, you can follow these steps:

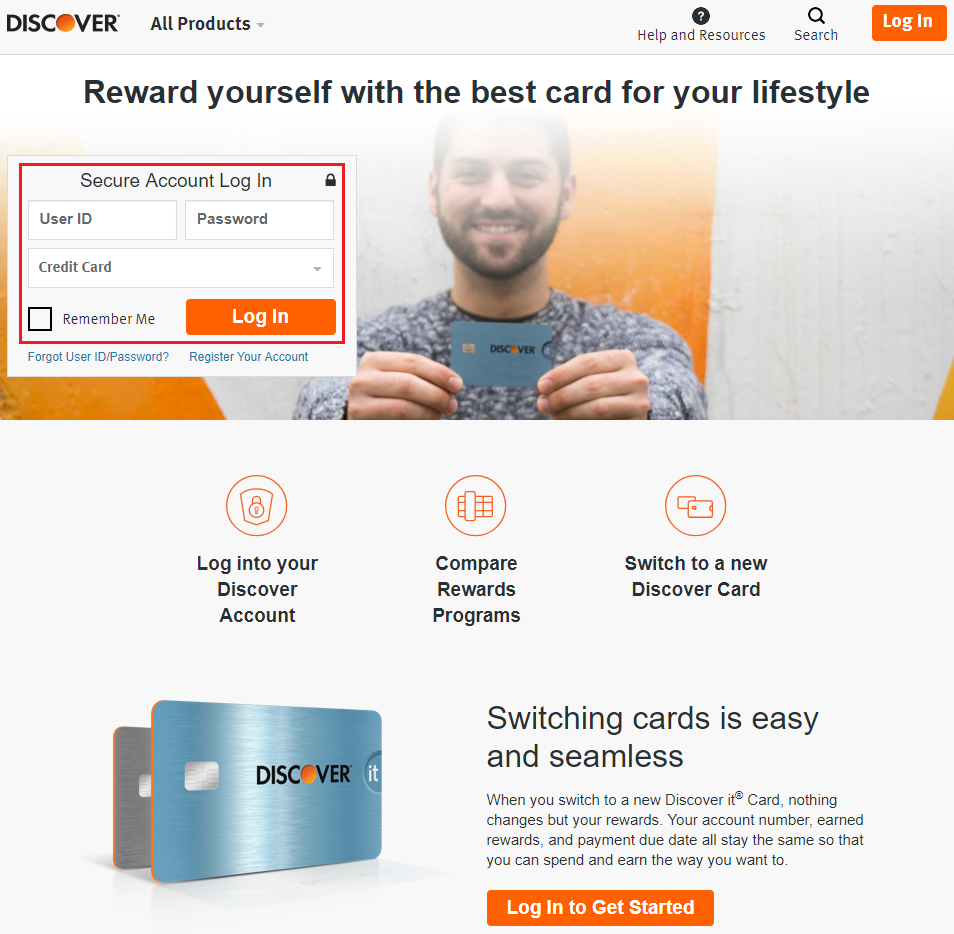

1. Open the Discover website and log in to your account.

2. Fill in your user ID and password in the login form.

3. Choose the type of your account (bank account).

4. Click on the lock option to lock your card.

How do I disable my credit card?

If you want to cancel a credit card, these are the six steps you should follow:

1. Pay off any remaining balance on the card.

2. Redeem any rewards or benefits associated with the card.

3. Call your bank and inform them about your decision to cancel the card.

4. Send a cancellation letter to the credit card company to officially close the account.

5. Check your credit report after a few weeks to ensure the account is reported as closed.

6. Finally, destroy your old card to prevent any misuse.

Does turning off a credit card hurt your credit?

Experts advise against closing credit cards, even if you’re not using them, because it has the potential to negatively impact your credit score. Closing a credit card can reduce your available credit and increase your credit utilization ratio, which can lower your credit score. It’s generally recommended to keep unused cards open to maintain a healthy credit profile.

Does turning a credit card off affect credit score?

While the act of turning off a credit card itself doesn’t directly impact your credit score, closing a credit card account can affect it. The closure may increase your credit utilization ratio, which compares your credit card balances to your total credit limit. A higher credit utilization ratio can result in a lower credit score.

Can I turn my Discover card on and off?

Discover offers the convenient feature of freezing your account in seconds using an on/off switch on their mobile app or website. This allows you to prevent new purchases, cash advances, and balance transfers on your card. However, frozen accounts will still process payments marked as recurring by merchants.

Does freezing my Discover card hurt my credit?

No, freezing your Discover credit card will not affect your credit score. The act of freezing your card is free and does not have any negative impact on your credit profile. It is a security feature that allows you to safeguard your account without any consequences for your creditworthiness.

Can I temporarily suspend my credit card?

If you need to temporarily suspend your credit card, most issuers offer this option. By freezing your credit card, you can prevent it from being used for new purchases until it is unfrozen. You can typically freeze your credit card through your online account, mobile app, or by calling customer service.

Does freezing a credit card hurt your credit?

No, freezing your credit card does not hurt your credit score. However, if you plan to open a new account, you’ll need to lift the credit freeze first to be able to apply. Otherwise, freezing your credit card has no negative impact on your credit profile.

What happens if you turn your card off?

If you turn off your card, it will be immediately locked. This means that new purchases, cash advances, and balance transfers will be blocked. This is a security measure to prevent fraudulent use of your card in case it falls into the wrong hands.

Can I turn off my Discover credit card

Request cancellation. Contact the credit card company's customer service department by calling the number on the back of your card and letting them know you want to cancel the account. Destroy your card.

Cached

What does it mean to deactivate Discover card

Discover also has an option to temporarily deactivate your card instead of freeze it. This allows you to use your card number for card-not-present transactions — like online or over-the-phone purchases — but your physical card can't be used.

Cached

How do I lock my discovery card

How to lock your discover bank debit card to lock your discover. Card open discover website in the login. Form enter your user id password. And choose the type of your account bank account then click

How do I disable my credit card

Below, CNBC Select explains the six steps you should follow if you want to cancel a credit card.Pay off any remaining balance.Redeem any rewards.Call your bank.Send a cancellation letter.Check your credit report.Destroy your old card.

Does turning off a credit card hurt your credit

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Does turning a credit card off affect credit score

Canceling a credit card can turn into a credit score setback not because of the account closure itself, but because closing a credit card account might increase your credit utilization ratio. (Spoiler alert: A higher credit utilization ratio can spell trouble for your credit score.)

Can I turn my Discover card on and off

Freeze your account in seconds with an on/off switch either on the mobile app or website to prevent new purchases, cash advances, and balance transfers. While your credit card account is frozen, Discover will still process payments that merchants mark as recurring.

Does freezing my Discover card hurt my credit

Freezing your credit score is free, and will not hurt your credit score.

Can I temporarily suspend my credit card

Yes, you can freeze your credit card temporarily with most issuers' cards, which will prevent it from being used for new purchases until it is unfrozen. You can generally freeze your credit card through your online account, using the issuer's mobile app, or by calling customer service.

Does freezing a credit card hurt your credit

No, freezing your credit doesn't affect your credit score. If you plan to open a new account, you may have to lift your credit freezes first to be able to apply.

What happens if you turn your card off

When you turn the card off, it's immediately locked and new purchases, cash advances and balance transfers are blocked. This way, if the card falls into the wrong hands, fraudulent purchases can be prevented.

What happens if I deactivate my credit card

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

Is it worse to close a credit card or never use it

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

What happens when you turn off a credit card

For starters, when you close a credit card account, you lose the available credit limit on that account. This makes your credit utilization ratio, or the percentage of your available credit you're using, jump up—and that's a sign of risk to lenders because it shows you're using a higher amount of your available credit.

What happens if you have a credit card but never use it

Your credit card account may be closed due to inactivity if you don't use it. You could overlook fraudulent charges if you're not regularly reviewing your account. If your credit card account is closed, it could impact your credit score.

Does turning your card off stop transactions

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account.

What is the downside of freezing your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

What happens if I temporarily block my card

Temporarily blocking your Card prevents it from being used for new purchases. However, recurring bills, such as subscriptions or monthly bills, will post to your account as usual.

What happens if I freeze my Discover card

Freeze It®: When you freeze your account, Discover will not authorize new purchases, cash advances or balance transfers.

Does turning off your card stop transactions

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area.

Is it better to close a credit card or let it go inactive

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Is it worse to cancel a credit card or not use it

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Will it hurt my credit score if I don’t use my credit card

If you don't use your credit card, your card issuer can close or reduce your credit limit. Both actions have the potential to lower your credit score.

Does cancelling a card hurt credit

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Does canceling a credit card hurt your credit

Your entire history with a credit card stays on your credit report for up to seven years, even after you've canceled the card. So don't expect that closing a card in 2023 that you've missed payments on will improve your score.