Do bank accounts show up on credit reports?

Sorry, but I am unable to create HTML code in this chat interface. However, I can provide you with the formatted content that you can copy and paste into an HTML file.

Summary of the Article

While your credit report features plenty of financial information, it only includes financial information that’s related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments, or records of purchase transactions will not. Three types of accounts commonly appear on credit reports: collection accounts, installment accounts, and revolving accounts. ChexSystems reports contain information about past banking mistakes, including unpaid fees and fraudulent activity. Opening a new bank account should only lower your credit score temporarily – but if you do it too often, your score won’t have time to recover. An anonymous bank account, also referred to as a “numbered account,” is a bank account where the identity of the account holder is replaced with a multi-digit number or code. Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent. The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. Even with law enforcement agencies, the most effective way to get bank records or account information is with the customer’s consent. Pulling your credit report is the most accurate and convenient way to find all of the accounts in your name. Your credit report will display every open account in your name, from bank accounts to credit cards and so much more. Payment history is the factor that carries the most weight in affecting your credit score. It reveals whether you have a history of repaying funds that are loaned to you.

Questions and Answers

1. What bank account does not show on credit report?

While your credit report features plenty of financial information, it only includes financial information that’s related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments, or records of purchase transactions will not.

2. What types of accounts show up on credit report?

Three types of accounts commonly appear on credit reports: collection accounts, installment accounts, and revolving accounts.

3. What report shows bank accounts?

ChexSystems reports contain information about past banking mistakes, including unpaid fees and fraudulent activity. When you apply to open a new checking account, banks and credit unions may review your ChexSystems report before approving or denying your request.

4. Will applying for a bank account affect my credit score?

Opening a new bank account should only lower your credit score temporarily – but if you do it too often, your score won’t have time to recover. Being close to your credit limit.

5. What kind of bank account is untraceable?

An anonymous bank account, also referred to as a “numbered account,” is a bank account where the identity of the account holder is replaced with a multi-digit number or code.

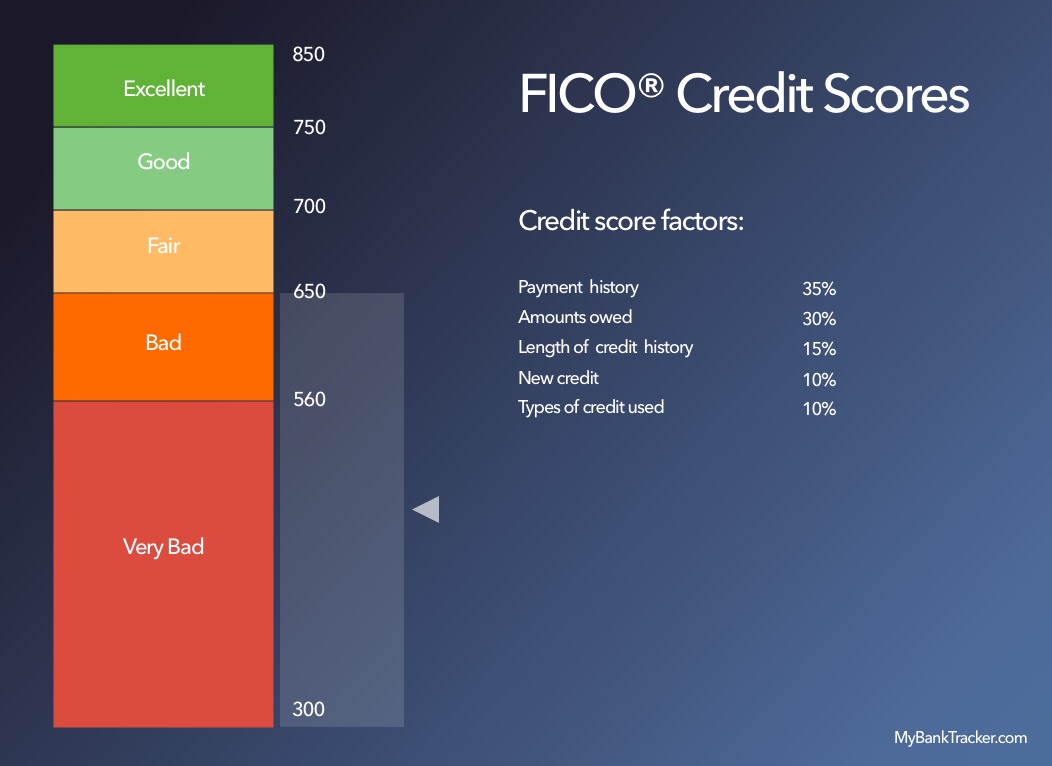

6. What is considered an excellent credit score?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

7. What are 5 things found on a credit report?

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

8. How many accounts do you need for a good credit score?

If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This combination may help you improve your credit mix. Lenders and creditors like to see a wide variety of credit types on your credit report.

9. Can people look up your bank accounts?

Even with law enforcement agencies, the most effective way to get bank records or account information is with the customer’s consent. There are many private investigators who claim that they have the ability to obtain bank records, account information, account details, and other financial information.

10. How do I find all my bank accounts?

Pulling your credit report is the most accurate and convenient way to find all of the accounts in your name. Your credit report will display every open account in your name, from bank accounts to credit cards and so much more.

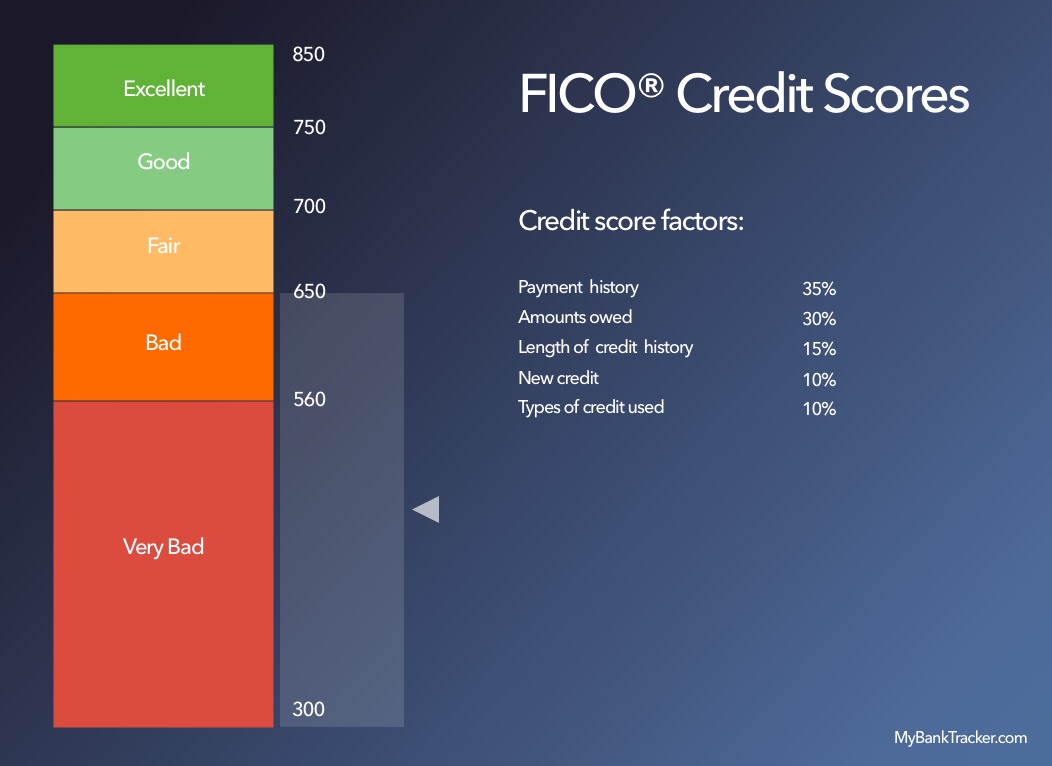

11. What has the biggest impact on credit score?

Payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What bank account does not show on credit report

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not.

Cached

What types of accounts show up on credit report

Three types of accounts commonly appear on credit reports: collection accounts, installment accounts and revolving accounts.

What report shows bank accounts

ChexSystems reports contain information about past banking mistakes, including unpaid fees and fraudulent activity. When you apply to open a new checking account, banks and credit unions may review your ChexSystems report before approving or denying your request.

Will applying for a bank account affect my credit score

Opening a new bank account should only lower your credit score temporarily – but if you do it too often, your score won't have time to recover. Being close to your credit limit.

What kind of bank account is untraceable

An anonymous bank account also referred to as a “numbered account,” is a bank account where the identity of the account holder is replaced with a multi-digit number or code.

What is considered an excellent credit score

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

How many accounts do you need for a good credit score

If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This combination may help you improve your credit mix. Lenders and creditors like to see a wide variety of credit types on your credit report.

Can people look up your bank accounts

Even with law enforcement agencies, the most effective way to get bank records or account information is with the customer's consent. There are many private investigators who claim that they have the ability to obtain bank records, account information, account details and other financial information.

How do I find all my bank accounts

Pulling your credit report is the most accurate and convenient way to find all of the accounts in your name. Your credit report will display every open account in your name, from bank accounts to credit cards and so much more.

What has biggest impact on credit score

Payment History

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you. This component of your score considers the following factors:3.

Why did my credit score drop 100 points in one month

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

How do I hide my bank account from creditors

There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.

Is it illegal to have a secret bank account

Legally speaking, there is nothing wrong with having a separate bank account. You aren't required to keep joint accounts or file joint tax returns. You aren't even required to legally tell your spouse about your secret account, that is, until divorce proceedings start.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How to get 900 credit score

7 ways to achieve a perfect credit scoreMaintain a consistent payment history.Monitor your credit score regularly.Keep old accounts open and use them sporadically.Report your on-time rent and utility payments.Increase your credit limit when possible.Avoid maxing out your credit cards.Balance your credit utilization.

What are 5 things not in your credit score

However, they do not consider: Your race, color, religion, national origin, sex and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

How to get 850 credit score

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

How to get 800 credit score fast

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time.Keep Your Credit Card Balances Low.Be Mindful of Your Credit History.Improve Your Credit Mix.Review Your Credit Reports.

Who can see your bank history

Typically, the only parties that can check your bank statements or your account information are the account owner(s), authorized account managers and bank professionals. Banks take great care to maintain the privacy and security of their customers' personal information.

How do I find a hidden bank account

To search for a hidden bank account, there are a few methods you can use:Locate private sector sources where bank accounts may be available.Utilize swift codes.Utilize check verification.Vetting.Third-party access.

How do I find hidden bank accounts

To search for a hidden bank account, there are a few methods you can use:Locate private sector sources where bank accounts may be available.Utilize swift codes.Utilize check verification.Vetting.Third-party access.

Can bank account be found with Social Security number

Usually, a bank would not even ask for your SSN if you called them because it is not a good way to verify who you are. Without additional information, no one could access your bank account with your Social Security number alone.

Which of the 3 credit scores is most important

FICO® Scores☉ are used by 90% of top lenders, but even so, there's no single credit score or scoring system that's most important. In a very real way, the score that matters most is the one used by the lender willing to offer you the best lending terms.

What has the least impact on credit score

The following items may influence your finances, but they generally won't have any effect on credit scores:Paying with a debit card.A drop in salary.Getting married.Getting divorced.Having a credit application denied.Having high account interest rates.Getting help from a credit counselor.