Do checks need address?

Summary of the Article: What Information is Required on a Personal Check

1. What information is required on a personal check?

A personal check includes your account number, routing number, the date, the recipient’s name, and the amount of money. You also need to sign your name on the check.

2. Do I need to write my name and address on a check?

Writing your address on a check is optional, but many merchants may require or expect to see it. You can write your current address on the check.

3. Why do you need a bank address on a check?

The bank address on a check indicates where the money comes from and helps in cashing the check at any branch of that bank.

4. How should a check be addressed?

To address a check, fill in the date in the upper right-hand corner, write the payee’s name on the “Pay to the Order of” line, fill in the check amount (numeric and written out), add a memo, and sign the check.

5. What makes a personal check invalid?

A personal check may be invalid if you don’t have proper identification, don’t have an account with the bank, fill out the check incorrectly, or if the check is too old. Ensure you meet all the requirements before depositing a check.

6. Is it okay to use a check with an old address?

You can still use a check with an old address as long as it has the correct routing and account numbers. The routing and account numbers identify the bank and account from which the money should come to pay the check.

7. What makes a check invalid?

Checks may be rejected by banks for various reasons, including insufficient funds, unreadable or invalid account and routing numbers, improper formatting, missing or invalid signature, or if too much time has passed since the printed date.

8. Can you put someone else’s name on your check?

In general, many banks allow you to put someone else’s name on a check. However, it is essential to follow your financial institution’s rules to avoid the check being voided.

9. Do you need proof of address for a checking account?

Requirements may vary, but generally, you’ll need a government-issued photo ID (driver’s license, passport, or military ID) and proof of address, such as a lease agreement, mortgage document, utility bill, or bank or credit card statement, to open a bank account.

10. Is it okay to put an address label on a check?

Yes, you can use address labels instead of writing the address with a pen on a check to achieve a cleaner look. Various types of labels are available for this purpose.

11. Are personal checks still valid if the address is wrong?

As long as the routing and account numbers on the check are correct, personal checks with an old or incorrect address can still be used.

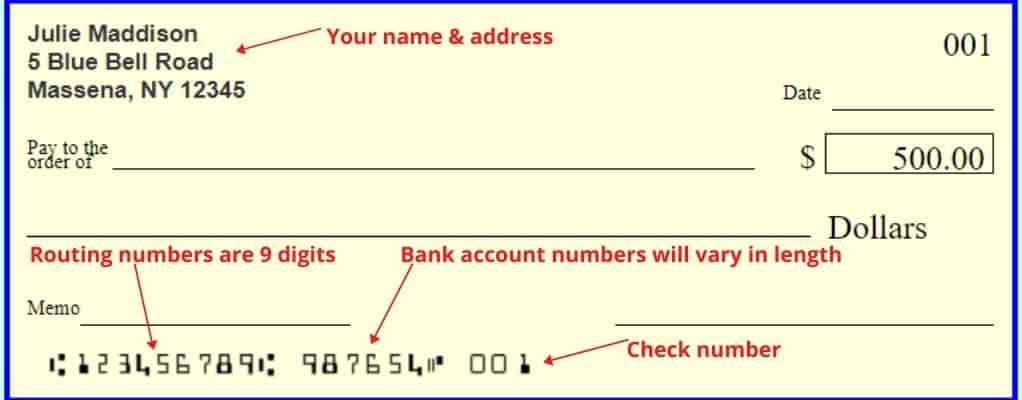

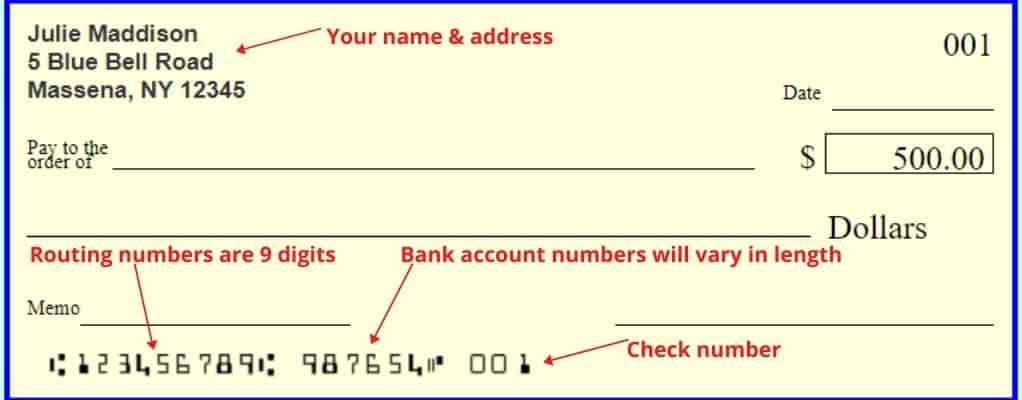

What information is required on a personal check

A personal check is a piece of paper that shows the account number and routing number for your checking account. To write a check, you fill in the date, the recipient's name and the amount of money. You also sign your name.

Do I need to write my name and address on a check

Having your address on a check is technically optional, but many merchants will want or expect to see it. You can always write your current address on the check.

Why do you need a bank address on a check

Your Bank's Contact Information

If you received a check from somebody, this section tells you where they bank and where the money will come from. If you want to cash the check, you may be able to do it at that bank (any branch location—it doesn't necessarily have to be at the same address shown on the check).

Cached

How should a check be addressed

You'd fill out the:Date. Write the date you're mailing the check in the upper right-hand corner of the check.Payee. Write the payee's name on the line that says “Pay to the Order of,” unless your statement lists another name to use.Check amount (numerical).Check amount (written out).Memo.Signature.

Cached

What makes a personal check invalid

Some reasons why a bank won't cash a check include not having a proper ID, not having an account with that bank, the check is filled out incorrectly, or the check being too old. Ensure you comply with all the required criteria before attempting to deposit a check.

Is it OK to use a check with an old address

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

What makes a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Can you put someone else’s name on your check

In general, many banks and credit unions allow this. However, you'll want to check with your financial institution before you initiate the process. If you do not follow their specified rules, it can result in the check being voided.

Do you need proof of address for checking account

While requirements can vary from bank to bank, these are typically the things you'll need to open a bank account in the U.S.: Government-issued photo ID like a driver's license, passport, or military ID. Proof of address which could be a lease agreement, mortgage document, utility bill, bank or credit card statement.

Is it OK to put an address label on a check

Can I put an address label on a check If you prefer a cleaner look, you can use address labels instead of using a pen. There are many different types of labels on the market.

Are personal checks still valid if address is wrong

The Takeaway

As long as the routing and account numbers on the check are accurate, it's possible to use a check with an old, incorrect address on it. That said, it's a good idea to order new checks with the correct address on them to help lessen any confusion the wrong address might cause with check recipients.

What makes a bank reject a check

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Can I deposit a check if my address is different

Correct address is not a requirement of a valid check. You may cross off the address and write the new address under it or in the memo line or put a sticker over the old address. Be sure to change the address in your bank's record though.

Will a check bounce if the address is wrong

The Takeaway

As long as the routing and account numbers on the check are accurate, it's possible to use a check with an old, incorrect address on it. That said, it's a good idea to order new checks with the correct address on them to help lessen any confusion the wrong address might cause with check recipients.

What will make a check void

How to Write a Void CheckWrite VOID in big letters across the entire face of the check.Or, write VOID in the: date line. payee line. amount box. amount line. signature line.

Can I deposit my wife’s check without her signature

If the check is issued to two people, such as John and Jane Doe, the bank or credit union generally can require that the check be signed by both of them before it can be cashed or deposited. If the check is issued to John or Jane Doe, generally either person can cash or deposit the check.

What happens if you cash a check that’s not yours

You may be responsible for repaying the entire amount of the check. While bank policies and state laws vary, you may have to pay the bank the entire amount of the fraudulent check that you cashed or deposited into your account. You may have to pay overdraft fees.

Can I get a bank account with no address

To open an account to manage your finances otherwise known as a bank account, you now only need proof of ID using either a valid driving license, passport or National ID card. Modern online financial institutions can now help customers open a bank account with no proof of address.

Do banks verify addresses

Address verification is one way banks and merchants can reduce the likelihood of fraud. You can take steps to further protect your credit card information by creating secure passwords and avoiding sharing your credit card information.

Are checks supposed to have your name on it

Signature. Sign your name on the line at the bottom right corner of the check. Your signature is mandatory—the recipient will not be able to cash the check without it. Double-check to make sure you have written out your signature before you hand over or mail the check.

What are 5 reasons why a bank may dishonor a check

Below are six common reasons for dishonour.Account Concerns. If you have insufficient funds in your account to pay someone, don't write a cheque.Your Signature Doesn't Match.Check Date.Unclear Value.Damage.Excess Writing.

What would make a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Will a check go through if the address is wrong

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

Can I deposit check with wrong address

Just deposit it. Correct address is not a requirement of a valid check. You may cross off the address and write the new address under it or in the memo line or put a sticker over the old address. Be sure to change the address in your bank's record though.

What are the 3 steps to voiding a check

Steps to voiding a checkFind a blue or black pen.Write “VOID” across the front of the check in large letters, making sure to avoid covering the account number and routing number at the bottom of the check.Dispose of the voided check.