Does check need address?

Summary of the Article:

Do Checks Need an Address: Checks do not need to have an address printed on them. However, if you choose to omit an address (say, because you know you’ll likely be moving soon), some businesses may hesitate to accept the check. They might ask for a form of ID or a phone number in case they need to contact you.

Do I need to write my name and address on a check: Having your address on a check is technically optional, but many merchants will want or expect to see it. You can always write your current address on the check.

Why do you need a bank address on a check: Your Bank’s Contact Information: If you received a check from somebody, this section tells you where they bank and where the money will come from. If you want to cash the check, you may be able to do it at that bank (any branch location—it doesn’t necessarily have to be at the same address shown on the check).

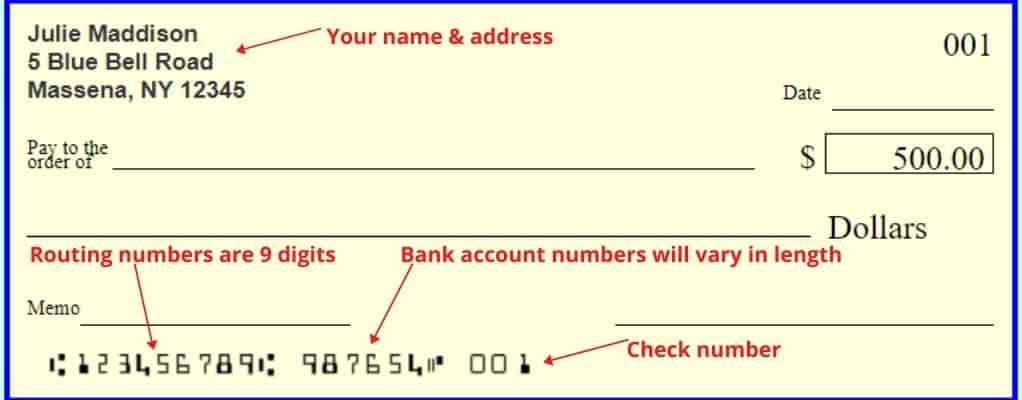

What information is required on a personal check: A personal check is a piece of paper that shows the account number and routing number for your checking account. To write a check, you fill in the date, the recipient’s name, and the amount of money. You also sign your name.

What makes a check invalid: The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

How should a check be addressed: You’d fill out the: Date. Write the date you’re mailing the check in the upper right-hand corner of the check. Payee. Write the payee’s name on the line that says “Pay to the Order of,” unless your statement lists another name to use. Check amount (numerical). Check amount (written out). Memo. Signature.

What happens if a check is sent to the wrong address: The check writer should contact their bank and while awaiting that resolution, should send you another check.

What makes a personal check invalid: Some reasons why a bank won’t cash a check include not having a proper ID, not having an account with that bank, the check is filled out incorrectly, or the check being too old. Ensure you comply with all the required criteria before attempting to deposit a check.

Is it OK to use a check with an old address: You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

What will make a check void: How to Write a Void Check: Write VOID in big letters across the entire face of the check. Or, write VOID in the: date line. payee line. amount box. amount line. signature line.

What can cause a check to bounce: There are a variety of reasons a check might bounce, including: The account lacks funds. The account has been closed. A stop payment order was issued. The check was not written properly. The check is too old. The check is fraudulent.

Questions:

1. Is address required on checks?

Checks do not need to have an address printed on them. However, if you choose to omit an address (say, because you know you’ll likely be moving soon), some businesses may hesitate to accept the check. They might ask for a form of ID or a phone number in case they need to contact you.

2. Do I need to write my name and address on a check?

Having your address on a check is technically optional, but many merchants will want or expect to see it. You can always write your current address on the check.

3. Why do you need a bank address on a check?

If you received a check from somebody, this section tells you where they bank and where the money will come from. If you want to cash the check, you may be able to do it at that bank (any branch location—it doesn’t necessarily have to be at the same address shown on the check).

4. What information is required on a personal check?

A personal check is a piece of paper that shows the account number and routing number for your checking account. To write a check, you fill in the date, the recipient’s name, and the amount of money. You also sign your name.

5. What makes a check invalid?

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

6. How should a check be addressed?

You’d fill out the: Date. Write the date you’re mailing the check in the upper right-hand corner of the check. Payee. Write the payee’s name on the line that says “Pay to the Order of,” unless your statement lists another name to use. Check amount (numerical). Check amount (written out). Memo. Signature.

7. What happens if a check is sent to the wrong address?

The check writer should contact their bank and while awaiting that resolution, should send you another check.

8. What makes a personal check invalid?

Some reasons why a bank won’t cash a check include not having a proper ID, not having an account with that bank, the check is filled out incorrectly, or the check being too old. Ensure you comply with all the required criteria before attempting to deposit a check.

9. Is it OK to use a check with an old address?

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

10. What will make a check void?

How to Write a Void Check: Write VOID in big letters across the entire face of the check. Or, write VOID in the: date line. payee line. amount box. amount line. signature line.

11. What can cause a check to bounce?

There are a variety of reasons a check might bounce, including: The account lacks funds. The account has been closed. A stop payment order was issued. The check was not written properly. The check is too old. The check is fraudulent.

Is address required on checks

Do Checks Need an Address Checks do not need to have an address printed on them. However, if you choose to omit an address (say, because you know you'll likely be moving soon), some businesses may hesitate to accept the check. They might ask for a form of ID or a phone number in case they need to contact you.

Do I need to write my name and address on a check

Having your address on a check is technically optional, but many merchants will want or expect to see it. You can always write your current address on the check.

Why do you need a bank address on a check

Your Bank's Contact Information

If you received a check from somebody, this section tells you where they bank and where the money will come from. If you want to cash the check, you may be able to do it at that bank (any branch location—it doesn't necessarily have to be at the same address shown on the check).

Cached

What information is required on a personal check

A personal check is a piece of paper that shows the account number and routing number for your checking account. To write a check, you fill in the date, the recipient's name and the amount of money. You also sign your name.

What makes a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

How should a check be addressed

You'd fill out the:Date. Write the date you're mailing the check in the upper right-hand corner of the check.Payee. Write the payee's name on the line that says “Pay to the Order of,” unless your statement lists another name to use.Check amount (numerical).Check amount (written out).Memo.Signature.

What happens if a check is sent to the wrong address

The check writer should contact their bank and while awaiting that resolution, should send you another check.

What makes a personal check invalid

Some reasons why a bank won't cash a check include not having a proper ID, not having an account with that bank, the check is filled out incorrectly, or the check being too old. Ensure you comply with all the required criteria before attempting to deposit a check.

Is it OK to use a check with an old address

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

What will make a check void

How to Write a Void CheckWrite VOID in big letters across the entire face of the check.Or, write VOID in the: date line. payee line. amount box. amount line. signature line.

What can cause a check to bounce

There are a variety of reasons a check might bounce, including:The account lacks funds.The account has been closed.A stop payment order was issued.The check was not written properly.The check is too old.The check is fraudulent.

Can you address a check with or

The word “Or” allows just one party on the check to control the funds. “Or” is often a better choice for convenience of the payees. A check payable to two parties without either conjunction is subject to the interpretation of the financial institution handling the item.

Can you cash a check not addressed to you

Banks will allow you to cash or deposit a personal check for someone else. This is especially useful for people without a bank account, as it means a friend or family member can cash in a personal check for you.

What makes a bank reject a check

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

How is a personal check valid

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will honor those checks for up to 180 days and the pre-printed language is meant to encourage people to deposit or cash a check sooner than later.

Can I deposit a check if my address is different

Correct address is not a requirement of a valid check. You may cross off the address and write the new address under it or in the memo line or put a sticker over the old address. Be sure to change the address in your bank's record though.

What are the 3 steps to voiding a check

Steps to voiding a checkFind a blue or black pen.Write “VOID” across the front of the check in large letters, making sure to avoid covering the account number and routing number at the bottom of the check.Dispose of the voided check.

Can you just write void on a check to void it

How Do I Void a Blank Check You can void a blank check or a filled-out check exactly the same way: Write “VOID” in large letters across the entire check. Once you've done this, no one will be able to deposit the check.

What happens if someone writes me a bad check and I deposit it

If you deposit a fake check, your bank can decide to freeze or even completely close your account. Review your bank deposit account agreement to see in what scenarios your bank can close your account. It can damage your credit.

Will a bank cash a check with the wrong address

When You Can Use a Check With an Old Address. You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

What are 5 reasons why a bank may dishonor a check

Below are six common reasons for dishonour.Account Concerns. If you have insufficient funds in your account to pay someone, don't write a cheque.Your Signature Doesn't Match.Check Date.Unclear Value.Damage.Excess Writing.

What would make a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Will a bank accept a voided check

A voided check cannot be filled in, cashed or deposited. That might make it seem useless, but in fact a voided check has a specific purpose, which is to make it easier for you to share your banking information with someone else.

Will a fake check clear

Fake Checks and Your Bank

By law, banks have to make deposited funds available quickly, usually within two days. When the funds are made available in your account, the bank may say the check has “cleared,” but that doesn't mean it's a good check. Fake checks can take weeks to be discovered and untangled.

Can someone steal your bank info from a check

Checks include the name and address information that criminals use as part of identity theft. They can open bank accounts and apply for loans on behalf of the victim, Maimon said.