Does identity theft include credit card theft?

Summary of the Article:

Your wallet is a goldmine for identity thieves. They are not only after your credit, debit, or social security cards. Your driver’s license can be the key that opens the door for synthetic identity theft.

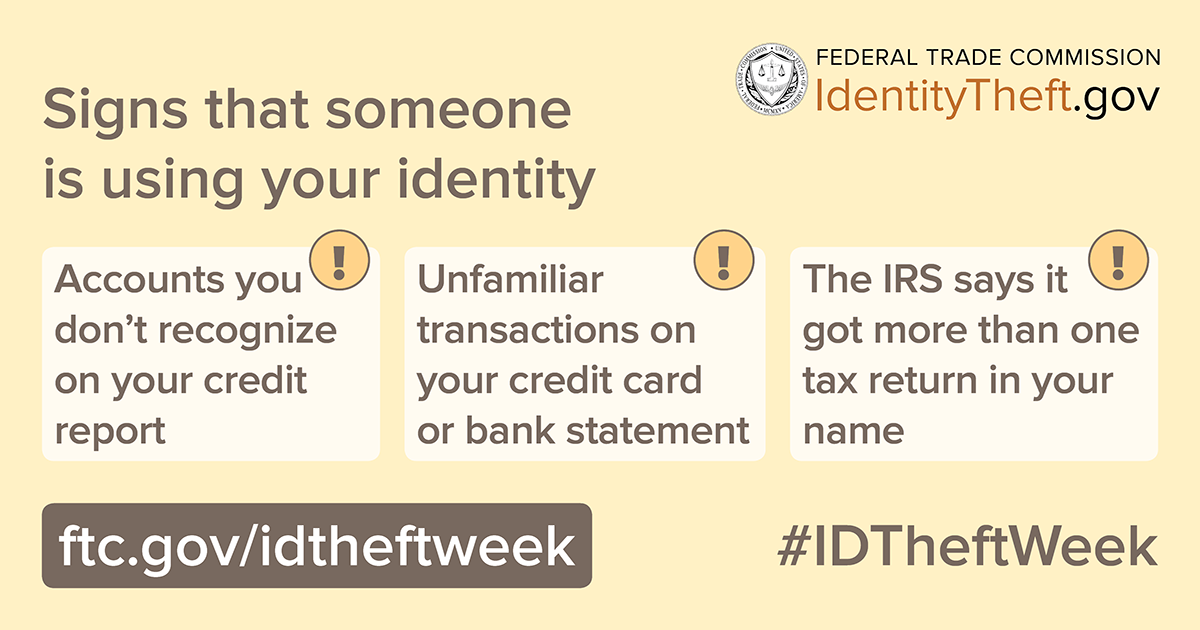

Identity theft happens when someone takes your name and personal information, like your social security number, and uses it without your permission. They can open new accounts, use your existing accounts, or obtain medical services.

Identity theft insurance does not generally cover stolen money or direct financial losses from fraudulent purchases. It typically only reimburses the costs of the reporting and recovery process.

There are various methods used to steal identities, including physical theft (such as dumpster diving or mail theft) and technology-based theft (such as phishing or malware).

If someone steals your ID and credit cards, they can ask your credit card company to issue a new card, change the account passwords, and even trick lenders into issuing new credit accounts in your name.

In order to open a credit card in your name, an identity thief would need to obtain personal details such as your name, birthdate, and social security number. Doing so is a federal crime and can result in jail time.

Identity thieves are typically interested in account numbers, passwords, social security numbers, and other confidential information that they can use for financial gain. They can take out loans, obtain credit cards, and even driver’s licenses in your name.

The three most common types of identity theft are financial, medical, and online identity theft.

The four types of identity theft include medical, criminal, financial, and child identity theft.

If you have bad credit and are not keeping track of your credit report, you are an ideal victim for an identity thief. They can use your data and enjoy perks in your name without you knowing.

Questions and Detailed Answers:

Q: Can someone steal your identity with your ID and credit card?

A: Your ID and credit card can provide enough information for identity thieves to steal your identity and engage in fraudulent activities.

Q: What does identity theft include?

A: Identity theft occurs when someone uses your personal information without permission, such as opening new accounts or obtaining medical services.

Q: What does identity theft not cover?

A: Identity theft insurance typically does not cover direct financial losses from fraudulent purchases, but it may cover the costs of reporting and recovery.

Q: What is the most common method used to steal your identity?

A: Identity theft can be carried out through physical theft (e.g., dumpster diving) or technology-based methods (e.g., phishing or malware).

Q: What can someone do with your ID and credit card?

A: With your ID and credit card, someone can request a new card, change account passwords, and even apply for new credit accounts in your name.

Q: Can someone open a credit card in my name without my Social Security number?

A: Opening a credit card in your name without your Social Security number is difficult, as it is a federal crime. However, it’s essential to protect all personal information to avoid any unauthorized use.

Q: What 4 pieces of information does an identity thief need?

A: Account numbers, passwords, Social Security numbers, and other confidential information are sought by identity thieves to carry out fraudulent activities.

Q: What are the three types of identity theft stealing?

A: The three most common types of identity theft are financial, medical, and online identity theft.

Q: What are four types of identity theft crimes?

A: The four types of identity theft include medical, criminal, financial, and child identity theft.

Q: What are the four types of identity theft?

A: The four types of identity theft include medical, criminal, financial, and child identity theft.

Q: Can someone steal your identity if you have bad credit?

A: Yes, if you are not regularly monitoring your credit report, you are more vulnerable to identity theft. Identity thieves can use your information without your knowledge or consent.

Can someone steal your identity with your ID and credit card

Your wallet is a goldmine for identity thieves. But they're not just after your credit, debit, or Social Security cards. Your driver's license can be the key that opens the door for synthetic identity theft.

What does identity theft include

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

What does identity theft not cover

What does identity theft insurance not cover It's important to note that these insurance policies typically don't cover stolen money or direct financial losses from fraudulent purchases and other unauthorized use of credit accounts. They typically reimburse you only for the costs of the reporting and recovery process.

What is the most common method used to steal your identity

Physical Theft: examples of this would be dumpster diving, mail theft, skimming, change of address, reshipping, government records, identity consolidation. Technology-Based: examples of this are phishing, pharming, DNS Cache Poisoning, wardriving, spyware, malware and viruses.

What can someone do with your ID and credit card

If your debit or credit cards were in the same wallet as your stolen ID, the thief can ask your credit card company to issue a new card, change the address or your account passwords, and even trick lenders into issuing new credit accounts in your name.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

What 4 pieces of information does an identity theft need

What they want are account numbers, passwords, Social Security numbers, and other confidential information that they can use to loot your checking account or run up bills on your credit cards. Identity thieves can take out loans or obtain credit cards and even driver's licenses in your name.

What are the three types of identity theft stealing

The three most common types of identity theft are financial, medical and online.

What are four types of identity theft crimes

The four types of identity theft include medical, criminal, financial and child identity theft.

What are the four 4 types of identity theft

The four types of identity theft include medical, criminal, financial and child identity theft.

Can someone steal your identity if you have bad credit

FACT: If you don't know your credit score and are not keeping up with your credit report routinely, you're the ideal victim to an identity thief. The thief can use your data and enjoy lots of perks in your name while you're unaware that anything is going on.

How can I find out if someone opened my credit card in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

Can the bank find out who used my credit card

Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

What are the first two things you need to do if your identity is stolen

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What are 6 common forms of identity theft

The 6 Types of Identity Theft#1 New Account Fraud. Using another's personal identifying information to obtain products and services using that person's good credit standing.#2 Account Takeover Fraud.#3 Criminal Identity Theft.#4 Medical Identity Theft.#5 Business or Commercial Identity Theft.#6 Identity Cloning.

What are the three D’s of identity theft

The three D's of identity theft are deter, detect, and defend. Answers will vary, but should be similar to the following:“Deter” is to prevent identity theft by protecting personal information from others.

What is the most common identity theft

Financial identity theft

These are some of the most common types of identity theft, as well as steps you can take to help combat them: Financial identity theft. This is the most common form of identity theft — when someone uses another person's information for financial gain.

Can someone open a bank account in my name if my credit is frozen

Here's an explanation for how we make money . A credit freeze is a security measure you can take to prevent new accounts from being fraudulently opened in your name. But that also means you can't open a new account yourself while the freeze is in place.

Can someone open a credit card with my SSN

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name. Then, when they use the credit cards and don't pay the bills, it damages your credit.

Do credit card thieves get caught

It really depends on the actions taken by a cardholder after they notice a possible attack and the prevention methods a bank or card issuer takes to detect fraud. Some estimates say less than 1% of credit card fraud is actually caught, while others say it could be higher but is impossible to know.

What happens if someone fraudulently uses your credit card

Notify Your Credit Card Issuer

Some issuers allow for fraud reporting in their app or on their website, though you may need to call the number on the back of your card. If fraud is confirmed, the issuer will likely cancel that card and issue you a new one with different numbers.

What 3 things should you do if you feel your identity has been stolen

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What is the number 1 type of identity theft

Financial identity theft.

This is the most common form of identity theft — when someone uses another person's information for financial gain.

Can someone open a credit card in my name without my Social Security Number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

Why would someone fraudulently open a bank account in my name

Why accounts are opened in other people's names. Scammers may open a bank account fraudulently in someone else's name to bounce checks or overdraw the account. Others may intend to use the account for storing illicitly obtained funds.