Does your address have to be on a check?

Summary of the Article:

Does my address have to be on my checks

Checks do not need to have an address printed on them. However, if you choose to omit an address (say, because you know you’ll likely be moving soon), some businesses may hesitate to accept the check. They might ask for a form of ID or a phone number in case they need to contact you.

Questions and Detailed Answers:

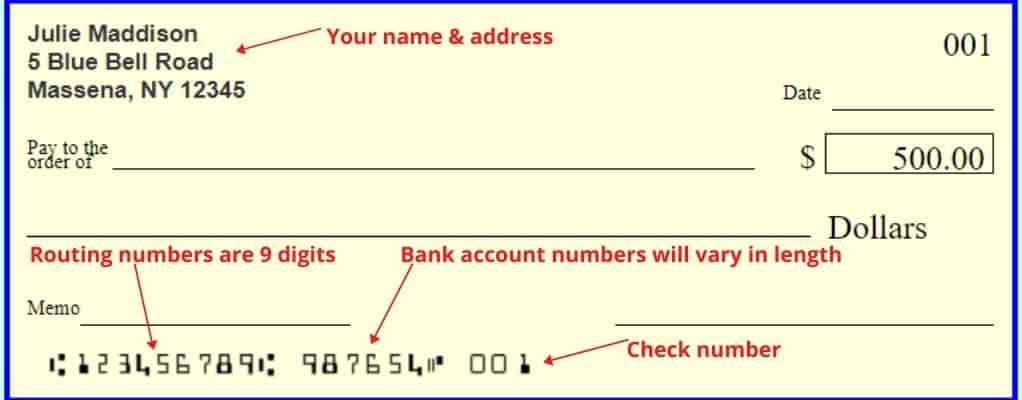

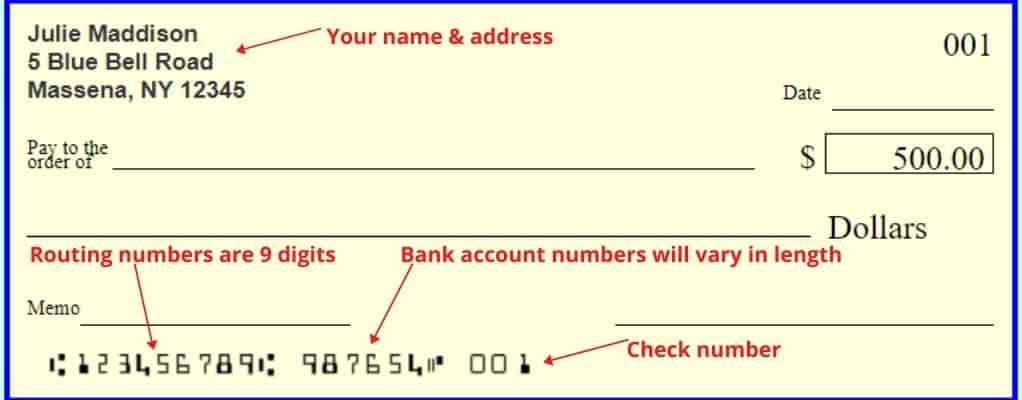

1. What information is required on a personal check?

A personal check is a piece of paper that shows the account number and routing number for your checking account. To write a check, you fill in the date, the recipient’s name and the amount of money. You also sign your name.

2. What makes a check invalid?

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

3. Can I deposit a check that has a different address?

Correct address is not a requirement of a valid check. You may cross off the address and write the new address under it or in the memo line or put a sticker over the old address. Be sure to change the address in your bank’s record though.

4. Should you put your full name on checks?

For an individual, be sure to include the first and last name, and for an organization or business, use its full name. Amount (numerical form). In the box to the right of the recipient’s name, fill in the amount in dollars and cents using numbers.

5. Do unused checks expire?

Blank checks, or unused checks, that are truly blank — no names, amounts or dates filled in — generally don’t expire, provided that the associated account is still active.

6. Is it OK to use a check with an old address?

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

7. What is the difference between check and personal check?

Sure, all checks can be used to pay bills or cover other expenses using funds in a linked checking account. But the main difference between a personal check and a business check is the source of funds. Personal checks are drawn on personal accounts; business checks are drawn on business checking accounts.

8. What will make a check void?

How to Write a Void Check

Write VOID in big letters across the entire face of the check.

Or, write VOID in the:

– date line

– payee line

– amount box

– amount line

– signature line.

9. What 6 reasons can a bank give for not accepting a check?

Review some of the top reasons why a bank won’t cash your check.

– You Don’t Have Proper ID. Banks have to protect themselves against check fraud.

– The Check Is Made to a Business Name.

– The Bank Branch Can’t Handle a Large Transaction Without Prior Notice.

– The Check is Too Old.

– Hold Payment Request on a Post-Dated Check.

10. Can I deposit check to someone else’s account?

A check can be deposited into another person’s account at a branch when you present it to the teller, along with the recipient’s name and account number. Unlike cash, the downside is that the check is not instantly available for use, because it takes time for financial institutions to verify and process checks. It’s always a good idea to keep a record of checks you’ve written, so you know how much money is in your account.

Does my address have to be on my checks

Do Checks Need an Address Checks do not need to have an address printed on them. However, if you choose to omit an address (say, because you know you'll likely be moving soon), some businesses may hesitate to accept the check. They might ask for a form of ID or a phone number in case they need to contact you.

What information is required on a personal check

A personal check is a piece of paper that shows the account number and routing number for your checking account. To write a check, you fill in the date, the recipient's name and the amount of money. You also sign your name.

What makes a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Can I deposit a check that has a different address

Correct address is not a requirement of a valid check. You may cross off the address and write the new address under it or in the memo line or put a sticker over the old address. Be sure to change the address in your bank's record though.

Should you put your full name on checks

For an individual, be sure to include the first and last name, and for an organization or business, use its full name. Amount (numerical form). In the box to the right of the recipient's name, fill in the amount in dollars and cents using numbers.

Do unused checks expire

Blank checks, or unused checks, that are truly blank — no names, amounts or dates filled in — generally don't expire, provided that the associated account is still active.

Is it OK to use a check with an old address

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

What is the difference between check and personal check

Sure, all checks can be used to pay bills or cover other expenses using funds in a linked checking account. But the main difference between a personal check and a business check is the source of funds. Personal checks are drawn on personal accounts; business checks are drawn on business checking accounts.

What will make a check void

How to Write a Void CheckWrite VOID in big letters across the entire face of the check.Or, write VOID in the: date line. payee line. amount box. amount line. signature line.

What 6 reasons can a bank give for not accepting a check

Review some of the top reasons why a bank won't cash your check.You Don't Have Proper ID. Banks have to protect themselves against check fraud.The Check Is Made to a Business Name.The Bank Branch Can't Handle a Large Transaction Without Prior Notice.The Check is Too Old.Hold Payment Request on a Post-Dated Check.

Can I deposit check to someone else’s account

A check can be deposited into another person's account at a branch when you present it to the teller, along with the recipient's name and account number. Unlike cash, the downside is your bank won't always make the funds available immediately.

What happens if a paycheck is sent to the wrong address

If you're at fault – you wrote the wrong address or stuck the check in the wrong envelope – your employee is entitled to a replacement check. If the employee is wrong, for example because she gave you the wrong mailing address, there's a good chance you're legally off the hook.

Does it matter how you write on a check

Make sure you write the amount as close to the left-hand border as possible to prevent someone from committing fraud by writing additional digits to the left (for example, changing 100.00 to 2,100.00). Check amount (written out). Below the “Pay to the Order of” line, write out the check amount in words.

Do banks verify names on checks

Typically one bank will call another, provide the name, account number and amount of the check to “verify funds.” The bank the check is written on could decline to provide any information, which happens with large banks, or they could state “that check is good right now” which is a way to say I'm not guaranteeing the …

Can I cash a 3 year old check

The Uniform Commercial Code (UCC) is a collection of laws and regulations meant to harmonize the laws of sales and regulations across the U.S. The UCC tells banks that they are under no obligation to accept personal or business checks that are older than 180 days (6 months).

What happens to checks never cashed

Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months. Outstanding checks that remain so for a long period of time are known as stale checks.

What happens if a check is sent to the wrong address

The check writer should contact their bank and while awaiting that resolution, should send you another check.

Does the name on a check matter

Legally, there is no requirement that a check have the name of the maker, as long as the bank can identify the account. You may run into problems trying to use checks with merchants, when the name does not match that on your ID.

What is the disadvantage of a personal check

The first thing to note is that personal checks are not cost-effective. Their processing takes longer, and the recipient has to cash the check before they can spend it. The recipient must also have a checking account to cash the check, which is not always required when using a debit card.

How do you address a personal check

You'd fill out the:Date. Write the date you're mailing the check in the upper right-hand corner of the check.Payee. Write the payee's name on the line that says “Pay to the Order of,” unless your statement lists another name to use.Check amount (numerical).Check amount (written out).Memo.Signature.

What are the 3 steps to voiding a check

Steps to voiding a checkFind a blue or black pen.Write “VOID” across the front of the check in large letters, making sure to avoid covering the account number and routing number at the bottom of the check.Dispose of the voided check.

What does it mean when a check voids

A void check is simply a check with the word “VOID” written across the front. Writing “VOID” on a check means that the check can't be deposited or cashed. When you void something it means you've made it empty, of no effect, or null.

What are 5 reasons why a bank may dishonor a check

Below are six common reasons for dishonour.Account Concerns. If you have insufficient funds in your account to pay someone, don't write a cheque.Your Signature Doesn't Match.Check Date.Unclear Value.Damage.Excess Writing.

What would cause a bank to not cash a check you bring into the bank

Some reasons why a bank won't cash a check include not having a proper ID, not having an account with that bank, the check is filled out incorrectly, or the check being too old. Ensure you comply with all the required criteria before attempting to deposit a check.

Can I deposit my boyfriends check into my account

The answer is yes, generally speaking. It's possible to deposit checks on behalf of another person into their bank account or in some cases, your own bank account. Banks and credit unions may allow you to deposit checks for someone else when certain conditions are met.