How can I remove disputes from my credit report?

Summary of the Article:

Disputing credit report inaccuracies doesn’t affect your credit, but some changes made in response to disputes can help your credit scores. The removal of inaccurate late payments, new-credit inquiries, or bankruptcies could result in credit score increases. Consumer-reporting agencies must correct or delete information that is inaccurate, incomplete or unverifiable within 30 days. If you submit additional documentation while your dispute is being reviewed, the bureau can extend this deadline by up to 15 days. Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

While you will often have the results of your dispute much sooner, the Fair Credit Reporting Act (FCRA) requires that Experian allow 30 days for the dispute process to be completed. If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days. A chargeback reversal is the acknowledgment by an issuing bank that a transaction was valid, and that the cardholder’s chargeback claim was invalid. When a merchant wins a chargeback reversal, the bank will return the funds being disputed.

If an account is deleted as the result of a dispute and the lender later verifies the account as accurate, the account can be re-added to the credit report. A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. There’s no concrete answer to how much your credit score will increase if a negative item is removed because every credit report is unique. It will depend on how much the collection is currently affecting your credit score. If it has reduced your credit score by 100 points, removing it will likely boost your score by 100 points.

The quickest and easiest way to dispute your Experian credit report is to check your credit report online and submit corrections through the online Dispute Center. Most dispute investigations are completed within 30 days, and you will receive a notification once your investigation is complete. For more information on the dispute process, you can choose to dispute information via mail or phone. To learn more about how the dispute process works and what you need to do, you can visit the official website of the credit reporting agencies.

Questions and Answers:

1. Does removing disputes affect credit score?

Disputing credit report inaccuracies doesn’t affect your credit, but some changes made in response to disputes can help your credit scores. The removal of inaccurate late payments, new-credit inquiries, or bankruptcies could result in credit score increases.

2. How long does it take to remove off from credit report after disputing it?

Consumer-reporting agencies must correct or delete information that is inaccurate, incomplete, or unverifiable within 30 days. If you submit additional documentation while your dispute is being reviewed, the bureau can extend this deadline by up to 15 days.

3. How do I dispute and remove negative items on my credit report?

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

4. How long does it take Experian to remove a dispute?

While you will often have the results of your dispute much sooner, the Fair Credit Reporting Act (FCRA) requires that Experian allow 30 days for the dispute process to be completed.

5. How long does it take for your credit score to go up after a dispute?

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

6. Can a credit dispute be reversed?

A chargeback reversal is the acknowledgment by an issuing bank that a transaction was valid, and that the cardholder’s chargeback claim was invalid. When a merchant wins a chargeback reversal, the bank will return the funds being disputed.

7. Can a disputed debt be put back on a credit report?

If an account is deleted as the result of a dispute and the lender later verifies the account as accurate, the account can be re-added to the credit report.

8. What is the 609 loophole?

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

9. How much will my credit score increase if a negative item is removed?

There’s no concrete answer to this question because every credit report is unique, and it will depend on how much the collection is currently affecting your credit score. If it has reduced your credit score by 100 points, removing it will likely boost your score by 100 points.

10. What’s the fastest way to get a dispute taken off for credit from Experian?

The quickest and easiest way to dispute your Experian credit report is to check your credit report online and submit corrections through the online Dispute Center.

Does removing disputes affect credit score

Disputing credit report inaccuracies doesn't affect your credit, but some changes made in response to disputes can help your credit scores. The removal of inaccurate late payments, new-credit inquiries or bankruptcies could result in credit score increases.

How long does it take to remove off from credit report after disputing it

Consumer-reporting agencies must correct or delete information that is inaccurate, incomplete or unverifiable within 30 days. If you submit additional documentation while your dispute is being reviewed, the bureau can extend this deadline by up to 15 days.

How do I dispute and remove negative items on my credit report

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

How long does it take Experian to remove a dispute

While you will often have the results of your dispute much sooner, the Fair Credit Reporting Act (FCRA) requires that Experian allow 30 days for the dispute process to be completed.

How long does it take for your credit score to go up after a dispute

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

Can a credit dispute be reversed

A chargeback reversal is the acknowledgment by an issuing bank that a transaction was valid, and that the cardholder's chargeback claim was invalid. When a merchant wins a chargeback reversal, the bank will return the funds being disputed.

Can a disputed debt be put back on credit report

If an account is deleted as the result of a dispute and the lender later verifies the account as accurate, the account can be re-added to the credit report.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

How much will my credit score increase if negative item is removed

There's no concrete answer to this question because every credit report is unique, and it will depend on how much the collection is currently affecting your credit score. If it has reduced your credit score by 100 points, removing it will likely boost your score by 100 points.

What’s the fastest way to get a dispute taking off for credit from Experian

The quickest and easiest way to dispute your Experian credit report is to check your credit report online and submit corrections through the online Dispute Center.

How long does it take Equifax to remove dispute

Most dispute investigations are completed within 30 days, and you will receive a notification once your investigation is complete. Click here if you would prefer to dispute information via mail or phone. To learn more about how the dispute process works, please click here.

How can I raise my credit score 40 points fast

Here are six ways to quickly raise your credit score by 40 points:Check for errors on your credit report.Remove a late payment.Reduce your credit card debt.Become an authorized user on someone else's account.Pay twice a month.Build credit with a credit card.

Can disputed collections come back

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

Does disputing a charge remove it

Your credit card company will likely remove the charge from your statement during the dispute process. You won't need to pay it until a decision is reached regarding the dispute, and if you win, you won't need to pay it at all.

Can a collection be removed and then added back

As long as the item is accurate and verifiable, a furnishing party can re-report the entry and have the credit reporting agency can reinsert the entry on your credit reports.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is the 11 word phrase credit loophole

Summary: “Please cease and desist all calls and contact with me, immediately.” These are 11 words that can stop debt collectors in their tracks. If you're being sued by a debt collector, SoloSuit can help you respond and win in court. How does the 11-word credit loophole actually work

Do derogatory marks go away once paid

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

How bad is a 600 credit score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

How can I clean up my credit report myself

How To Fix Your Credit In 7 Easy StepsCheck Your Credit Score & Report.Fix or Dispute Any Errors.Always Pay Your Bills On Time.Keep Your Credit Utilization Ratio Below 30%Pay Down Other Debts.Keep Old Credit Cards Open.Don't Take Out Credit Unless You Need It.

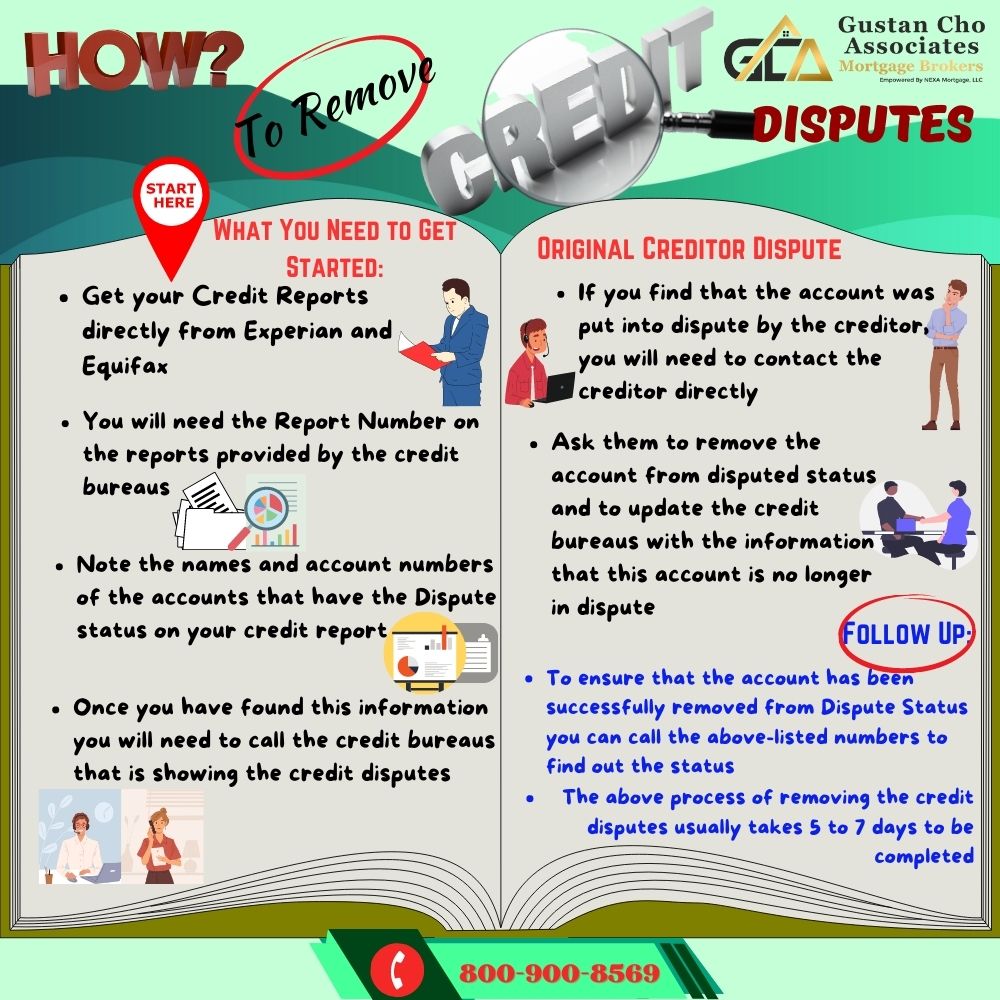

How do I get a dispute removed from Equifax

Just tell them you need the National Consumer Assistance Center to end the dispute(s). Their hours are from 8AM-5PM PST. They then have up to 72 hours to remove dispute(s) and you will receive an e-mail confirmation once completed. Equifax's phone number is 404-885-8300 and it too is answered by a person.

How do I contact Equifax to remove a dispute

Please include a cover sheet with your full name, current address, date of birth, and the confirmation number associated with your dispute. Call (866) 349-5191 from 8 a.m. to midnight ET, 7 days a week, and a Customer Care agent can add your statement to your Equifax credit report.

How to increase credit score 100 points in 1 month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

How do you dispute a collection and get it removed

Write a dispute letter to credit bureaus

The Consumer Financial Protection Bureau (CFPB) suggests that you include your contact information, clear identification of each mistake, including account numbers or dates, explanations for why you're disputing the information and a request to remove or correct the error.