How can I tell if someone is stealing my identity?

How can I tell if someone is stealing my identity?

How can I check if my identity has been stolen

What you can do to detect identity theft

Track what bills you owe and when they’re due. If you stop getting a bill, that could be a sign that someone changed your billing address.

Review your bills.

Check your bank account statement.

Get and review your credit reports.

Cached

What are the first signs of identity theft

8 Warning Signs of Identity Theft

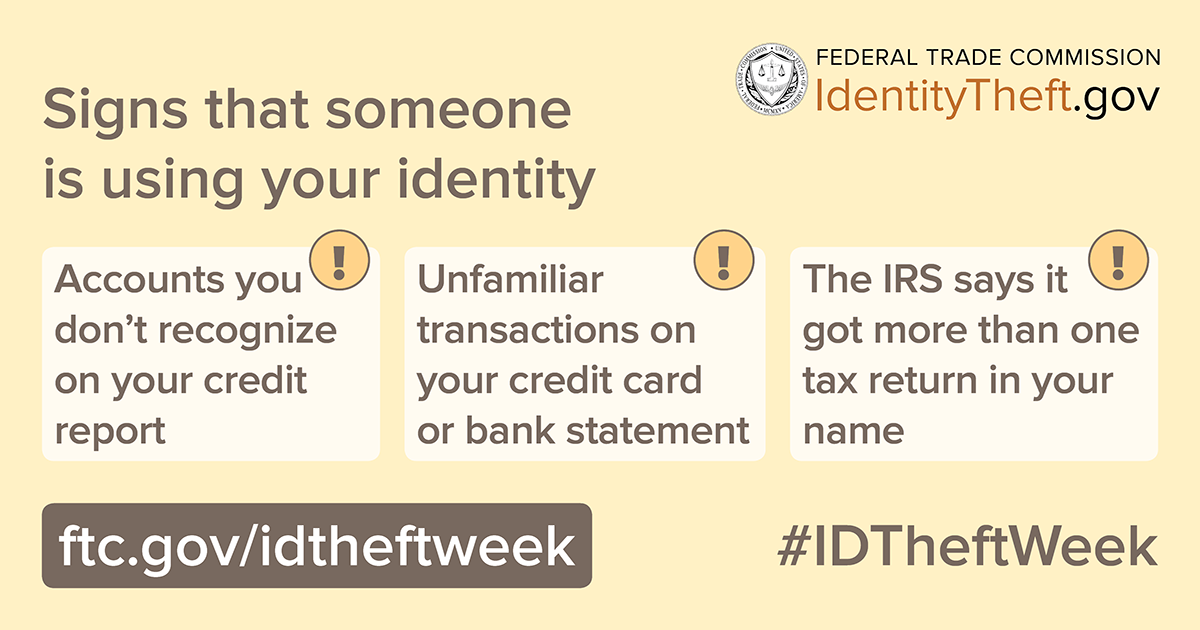

Unrecognized bank or credit card transactions.

Unfamiliar inquiries on your credit report.

Unexpected bills or statements.

Unexpected lack of bills or statements.

Surprise credit score drop.

Denial of loan or credit applications.

Calls from debt collectors.

How to check if someone is using your Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you’ll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I clear my stolen identity

5 Steps to Take Right Now

See if You Have Identity Theft Insurance.

Contact the Relevant Companies.

Report the Theft to the FTC and the Police.

Add a Fraud Alert to Your Credit Reports.

Freeze Your Credit Reports.

What are the 3 types of identity theft

The three most common types of identity theft are financial, medical and online.

What are the red flags of identity theft

appear to be forged or altered; Personal identifying information (i.e., photograph, physical description) on the identification does not match the individual presenting the information; Address or name does not match the information on the identification and/or insurance card(s), credit card(s), etc.

What is the most common way of identity theft

Financial identity theft.

Financial identity theft

This is the most common form of identity theft (including the credit card example described above). Financial identity theft can take multiple forms, including: Fraudsters may use your credit card information to buy things. We all love to shop online — even criminals.

Can someone access my bank account with my social security number

Can someone access my bank account with my Social Security number No, because you would have to provide even more personal details to authenticate your identity like physical evidence of your passport, ID, driver’s license, etc.

Can someone open a credit card in my name without my social security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

Can someone use my name and address fraudulently

Can thieves steal identities with only

How can I check if my identity has been stolen

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

Cached

What are the first signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

How to check if someone is using your Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I clear my stolen identity

5 Steps to Take Right NowSee if You Have Identity Theft Insurance.Contact the Relevant Companies.Report the Theft to the FTC and the Police.Add a Fraud Alert to Your Credit Reports.Freeze Your Credit Reports.

What are the 3 types of identity theft

The three most common types of identity theft are financial, medical and online.

What are the red flags of identity theft

appear to be forged or altered; Personal identifying information (i.e., photograph, physical description) on the identification does not match the individual presenting the information; Address or name does not match the information on the identification and/or insurance card(s), credit card(s), etc.

What is the most common way of identity theft

Financial identity theft

Financial identity theft

This is the most common form of identity theft (including the credit card example described above). Financial identity theft can take multiple forms, including: Fraudsters may use your credit card information to buy things. We all love to shop online — even criminals.

Can someone access my bank account with my social security number

Can someone access my bank account with my Social Security number No, because you would have to provide even more personal details to authenticate your identity like physical evidence of your passport, ID, driver's license, etc.

Can someone open a credit card in my name without my social security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

Can someone use my name and address fraudulently

Can thieves steal identities with only a name and address In short, the answer is “no.” Which is a good thing, as your name and address are in fact part of the public record. Anyone can get a hold of them. However, because they are public information, they are still tools that identity thieves can use.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

What is the most common method used to steal your identity

Physical Theft: examples of this would be dumpster diving, mail theft, skimming, change of address, reshipping, government records, identity consolidation. Technology-Based: examples of this are phishing, pharming, DNS Cache Poisoning, wardriving, spyware, malware and viruses.

What are 3 steps to take after identity has been stolen

If you suspect you may be a victim of identity theft, complete these tasks as soon as possible and document everything you do.Call your bank and other companies where fraud occurred.Contact a credit agency to place a fraud alert.Create an Identity Theft Affidavit.File a report with your local police department.

What is the most common form of identity theft

Financial identity theft

Financial identity theft.

This is the most common form of identity theft — when someone uses another person's information for financial gain.

What is the most serious threat from identity theft

Here are the most common dangers of identity theft: Fraudsters can open new accounts, credit cards, and loans in your name. You can lose your health care benefits (i.e., medical identity theft). Hackers can “own” your email and other accounts (account takeovers).

What are the 4 steps to take if your identity is stolen

There are five steps you should take right away if someone steals your identity:See if you have identity theft insurance.Contact the relevant companies.Report the theft to the FTC and the police.Add a fraud alert to your credit reports.Freeze your consumer reports.

What are the four 4 types of identity theft

The four types of identity theft include medical, criminal, financial and child identity theft.

How do I lock my Social Security number

If you know your Social Security information has been compromised, you can request to Block Electronic Access. This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778).

Can someone take out a loan in my name without me knowing

If anyone, including a spouse, family member, or intimate partner, uses your personal information to open up an account in your name without your permission, this could be considered identify theft.

How do you put an alert on your Social Security number for free

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

How can I stop someone from using my address

If you become aware of someone using your address for insurance, proof of residence, or driver's license, go straight to the police station to file a report. In case you are mailed any renewal notices or statements in someone else's name at your address, keep them and contact the respective companies.

What are the 4 steps you should take when your identity has been stolen

Quick AnswerSee if you have identity theft insurance.Contact the relevant companies.Report the theft to the FTC and the police.Add a fraud alert to your credit reports.Freeze your consumer reports.

Who is at higher risk for identity theft

Do you know the biggest targets of identity theft The answer may surprise you – while everyone should be aware of identity theft, children and the elderly are at an especially high risk of becoming victims.

What are the 3 most common causes of identity theft

Identity theft usually begins when your personal data is exposed through hacking, phishing, data breaches, or other means. Next, a criminal makes use of your exposed information to do something illegal, such as opening an account in your name.