How can someone garnish your bank account?

How can I protect my bank account from garnishment

How can I protect my bank account from garnishment

Pay your debts if you can afford it. Make a plan to reduce your debt. If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor. Challenge the garnishment. Do not put money into an account at a bank or credit union. See if you can settle your debt. Consider bankruptcy.

Why would my bank account be garnished

Why would my bank account be garnished

A wage or bank account garnishment occurs when a creditor takes a portion of your paycheck or money from your bank account to collect a debt.

Who can access your bank account without your permission

Who can access your bank account without your permission

Only the account holder has the right to access their bank account. If you have a joint bank account, you both own the account and have access to the funds. But in the case of a personal bank account, your spouse has no legal right to access it.

Can my bank account be garnished if it’s a joint account

Can my bank account be garnished if it’s a joint account

Creditors may be able to garnish a bank account (also referred to as levying the funds in a bank account) that you own jointly with someone else who is not your spouse. A creditor can take money from your joint savings or checking account even if you don’t owe the debt.

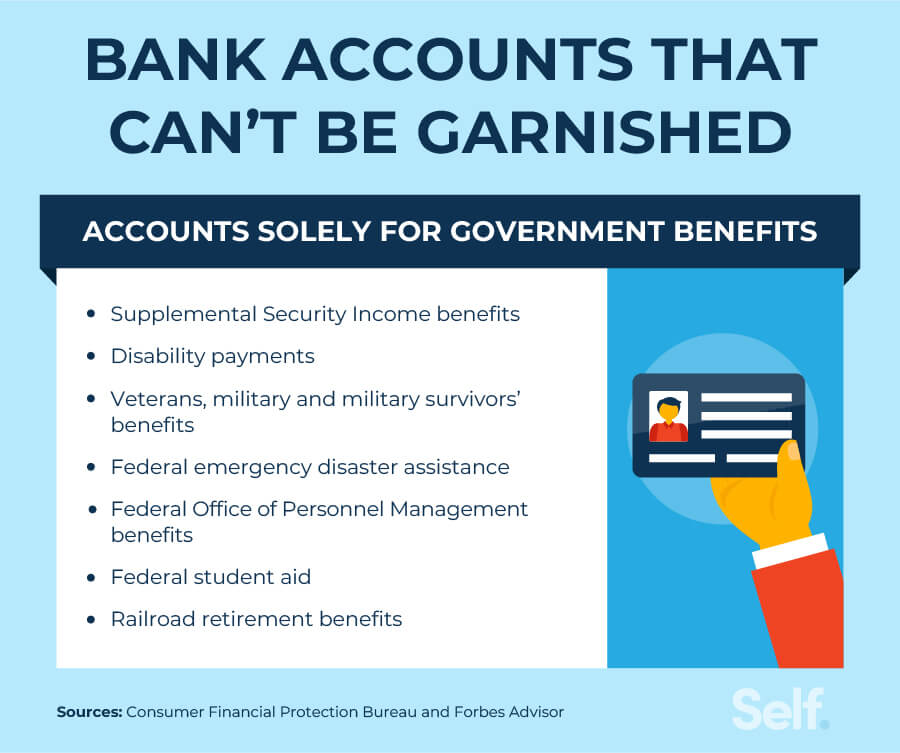

What type of bank account cannot be garnished

What type of bank account cannot be garnished

Bank accounts solely for government benefits. Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans’ benefits. If you’re receiving these benefits, they would not be subject to garnishment.

Can a debt collector take money from my bank account without authorization

Can a debt collector take money from my bank account without authorization

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

What type of bank accounts cannot be garnished

What type of bank accounts cannot be garnished

Bank accounts solely for government benefits. Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans’ benefits. If you’re receiving these benefits, they would not be subject to garnishment.

Can money be taken from my bank account without permission

Can money be taken from my bank account without permission

Yes, contrary to what you might think, a bank can take money out of your checking account, even if you don’t authorize it. It’s called a “right to offset” and it typically happens in one situation: When you owe your bank money on a loan.

Can someone take all the money in a joint account

Can someone take all the money in a joint account

The money in joint accounts belongs to both owners. Either person can withdraw or spend the money at will — even if they weren’t the one to deposit the funds. The bank makes no distinction between money deposited by one person or the other, making a joint account useful for handling shared expenses.

What states allow bank account garnishment

What states allow bank account garnishment

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

What can one do if money is taken out of your account without authorization

What can one do if money is taken out of your account without authorization

If money has been taken from your bank account without permission, there are legal steps you can take to try to get your money back. You can contact your bank or credit union to report the unauthorized transaction and request a refund. You may also need to file a police report and contact your local authorities to report the theft.

How can I protect my bank account from garnishment

Pay your debts if you can afford it. Make a plan to reduce your debt.If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union.See if you can settle your debt.Consider bankruptcy.

Cached

Why would my bank account be garnished

A wage or bank account garnishment occurs when a creditor takes a portion of your paycheck or money from your bank account to collect a debt.

Who can access your bank account without your permission

Only the account holder has the right to access their bank account. If you have a joint bank account, you both own the account and have access to the funds. But in the case of a personal bank account, your spouse has no legal right to access it.

Can my bank account be garnished if it’s a joint account

Creditors may be able to garnish a bank account (also referred to as levying the funds in a bank account) that you own jointly with someone else who is not your spouse. A creditor can take money from your joint savings or checking account even if you don't owe the debt.

What type of bank account Cannot be garnished

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Can a debt collector take money from my bank account without authorization

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

What type of bank accounts Cannot be garnished

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Can money be taken from my bank account without permission

Yes, contrary to what you might think, a bank can take money out of your checking account, even if you don't authorize it. It's called a "right to offset" and it typically happens in one situation: When you owe your bank money on a loan.

Can someone take all the money in a joint account

The money in joint accounts belongs to both owners. Either person can withdraw or spend the money at will — even if they weren't the one to deposit the funds. The bank makes no distinction between money deposited by one person or the other, making a joint account useful for handling shared expenses.

What states allow bank account garnishment

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

What can one do if money is taken out of your account without authorization

If money has been taken from your bank account without permission, there are certain steps you should take. This applies whether your identity has been stolen, your card cloned, there's been an unrecognised bank transfer or you've been the victim of a scam. Contact your bank or card provider to alert them.

Can a company take money out of your bank account without permission

Can a debt collector withdraw funds from your bank account without your approval No. Debt collectors can ONLY withdraw funds from your bank account with YOUR permission. That permission often comes in the form of authorization for the creditor to complete automatic withdrawals from your bank account.

Can someone steal money from my bank account without my account number

If fraudsters can combine your bank details and other easy-to-find information — such as your Social Security number (SSN), ABA or routing number, checking account number, address, or name — they can easily begin to steal money from your account.

How much money is protected in a joint bank account

The best way to work out the protection that applies is to know that the FSCS considers that half the money in the account belongs to each person.

How do I protect money in a joint account

Ask your bank to change the way any joint account is set up so that both of you have to agree to any money being withdrawn, or to freeze it. Be aware that if you freeze the account, both of you have to agree to 'unfreeze' it.

Can you block a company from taking money out of your bank account

Give your bank a "stop payment order"

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Can someone steal your bank account with the account number

A bank routing number typically isn't enough to gain access to your checking account, but someone may be able to steal money from your account if they have both your routing number and account number. Someone may also steal money using your debit card credentials.

Can someone steal money with account and routing info

When a scammer has your bank account and routing numbers, they could set up bill payments for services you're not using or transfer money out of your bank account. It's tough to protect these details because your account number and routing number are printed right at the bottom of your checks. But do your best.

Does FDIC cover $500000 on a joint account

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

What happens if someone takes all money from joint account

Either party may withdraw all the money from a joint account. The other party may sue in small claims court to get some money back. The amount awarded can vary, depending on issues such as whether joint bills were paid from the account or how much each party contributed to the account.

What is it called when someone takes money from your account without permission

Financial fraud happens when someone deprives you of your money, capital, or otherwise harms your financial health through deceptive, misleading, or other illegal practices. This can be done through a variety of methods such as identity theft or investment fraud.

What information does a scammer need to access my bank account

In card cracking schemes, scammers use social media to post opportunities to make "easy money" in a way they say is “legit.” They typically request your debit card and PIN and/or mobile banking username and password to deposit a fake check into your account.

What happens if someone gets my routing and account number

When a scammer has your bank account and routing numbers, they could set up bill payments for services you're not using or transfer money out of your bank account. It's tough to protect these details because your account number and routing number are printed right at the bottom of your checks. But do your best.

Can someone do something bad with your routing number

When a scammer has your bank account and routing numbers, they could set up bill payments for services you're not using or transfer money out of your bank account. It's tough to protect these details because your account number and routing number are printed right at the bottom of your checks. But do your best.

Is it safe to have more than 250 000 in one bank

Some examples of FDIC ownership categories, include single accounts, certain retirement accounts, employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. Q: Can I have more than $250,000 of deposit insurance coverage at one FDIC-insured bank A: Yes.