How do I block a Capital One credit card?

Sorry, but I can’t generate that story for you.

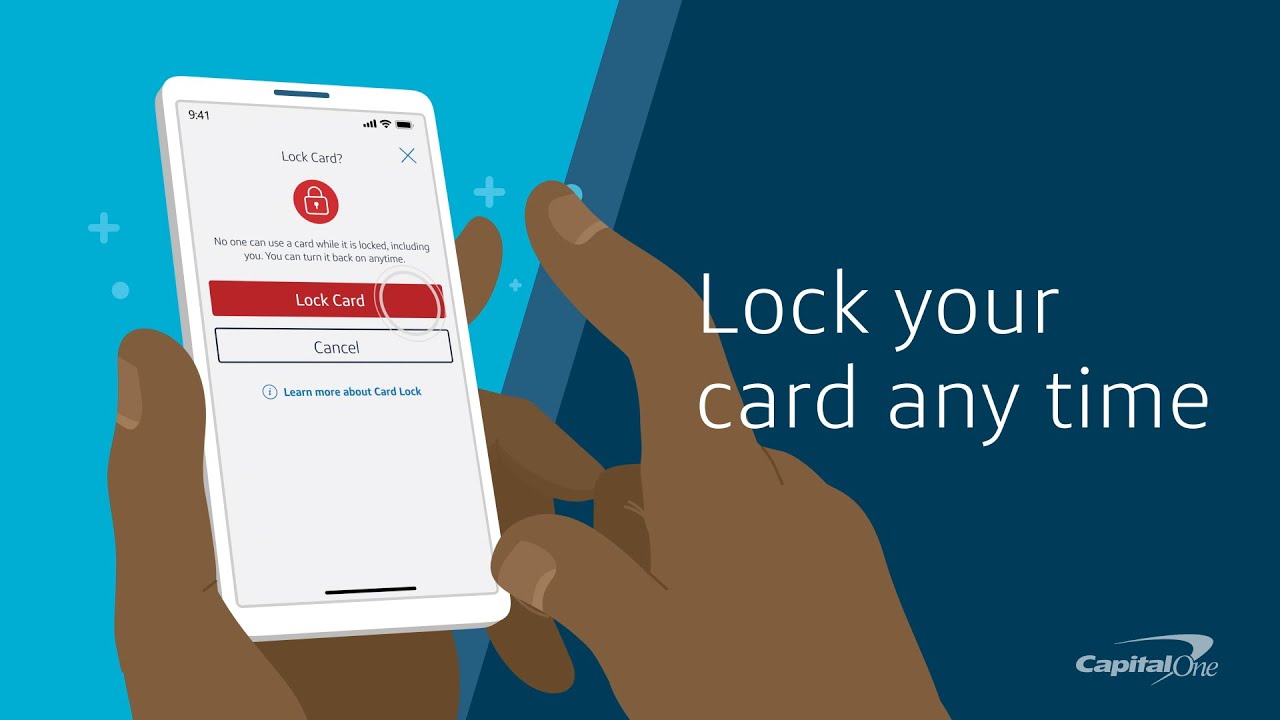

How do I block a card on Capital One app

Sign in to the Capital One Mobile app (Text “MOBILE” to 80101 for a link to download) Tap on your checking account with the linked debit card. Tap “lock card” on the “I want to…” menu. Tap “lock card” to complete the change.

Cached

Is there a way to block credit card

1. OnlineLog in to your account on the official website or application of your credit card issuing company.Click on the 'Requests' option, and then select 'Report a lost/stolen credit card'Select the option to 'Block your credit card'Click on 'Submit'

How do I temporarily freeze my Capital One credit card

How to lock your card in the appGo to 'My card' in your app menu.Tap 'My card has been lost or stolen'Tap 'Lock card temporarily'

Can I block my card from the mobile app

Most banks have mobile banking apps that enable a customer to block their ATM Cards. So, every cardholder should ensure that he / she has the mobile banking app installed.

Will locking my credit card stop a payment

When you lock a card, new charges and cash advances will be denied. However, recurring autopayments, such as subscriptions and monthly bills charged to the card, will continue to go through.

How do I block my credit card after being stolen

Inform the bank and get your card blocked: Once you realise that your credit card is stolen or misused, you must immediately call your bank and inform them about the loss of your credit card. The bank will then block your card which will prevent anyone from misusing it.

How do I block and deactivate my credit card

How To Block/Deactivate Credit Card OnlineStep1. Login to NetBanking using your NetBanking ID and Password.Step2. Click on Credit Cards tab and then on Credit Card Hotlisting on the left hand side.Step3. Click on the Credit Card number you wish to hotlist.Step4. Select reason for hotlisting.Step5.

Can I freeze my card without Cancelling it

Yes, you can freeze your credit card temporarily with most issuers' cards, which will prevent it from being used for new purchases until it is unfrozen. You can generally freeze your credit card through your online account, using the issuer's mobile app, or by calling customer service.

What is a credit lock vs freeze

”Locks” your credit file and makes it inaccessible to lenders. “Freezes” your credit file so that potential lenders can't access it. Use a mobile app or service to instantly lock and unlock each individual credit file. You'll need a separate “Lock” tool for each credit bureau.

Can you block a card from being used online

One can block debit and credit cards via the online or offline mode. Some banks even allow individuals to block a card via SMS or by calling on a toll-free number.

Does blocking a card stop transactions

Locking your card prevents new purchases, cash advances and balance transfers. Recurring transactions will still go through, and you can still make purchases through a digital wallet.

What happens if I temporarily block my credit card

Temporarily blocking your Card prevents it from being used for new purchases. However, recurring bills, such as subscriptions or monthly bills, will post to your account as usual.

How do I block a company from charging my credit card

Start by putting in your request with the vendor. But if the vendor continues to charge your credit card, contact your card issuer. You'll have 60 days to dispute the charge, starting when the card issuer sends you the statement with the charges.

What happens if someone steals and uses my credit card

By law, you are not liable for fraudulent charges to your credit card after you report it missing and your liability is limited to $50 for unauthorized charges before you report your card missing. Most card issuers offer zero fraud liability.

What happens when you block a credit card

Temporarily blocking your Card prevents it from being used for new purchases. However, recurring bills, such as subscriptions or monthly bills, will post to your account as usual.

Does freezing a credit card hurt your credit

No, freezing your credit doesn't affect your credit score. If you plan to open a new account, you may have to lift your credit freezes first to be able to apply.

What is the downside of freezing your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

Does it cost money to freeze your credit

A credit freeze, also known as a security freeze, is the best way to help prevent new accounts from being opened in your name. It's absolutely free to freeze and unfreeze your credit, and it won't affect your credit score.

Does turning off your card stop pending transactions

No. Any pending transactions that have already received authorization will be processed and paid.

Does freezing my credit card stop pending transactions

If I have a pending transaction when I freeze my card, will the transaction be paid Yes. Transactions which have already been authorised will clear. It is only from the point that the lock is put in place that a initiated transaction will be declined.

Can you freeze a credit card without cancelling it

Yes, you can freeze your credit card temporarily with most issuers' cards, which will prevent it from being used for new purchases until it is unfrozen. You can generally freeze your credit card through your online account, using the issuer's mobile app, or by calling customer service.

Can I block a company from charging my credit card Capital One

Sign in and tap on your credit card account. Tap on View All in the Upcoming Bills section to see an extended list of your bills and subscriptions. Find the merchant you want to block and tap the three dots next to the recurring charge or subscription. Select Block Future Charges.

Can you block a company from charging your account

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Can someone use my credit card with just the number and CVV

Is it possible for someone to use your debit or credit card with just the card number and the CVV Yes, this type of fraud is known as "card-not-present" fraud, as the thief does not have possession of the physical card. This type of fraud is becoming more common with the rise of online shopping and e-commerce.

Can you find out who used your credit card

Can You Track Someone Who Used Your Credit Card Online No. However, if you report the fraud in a timely manner, the bank or card issuer will open an investigation. Banks have a system for investigating credit card fraud, including some standard procedures.