How do I cancel my homeowners insurance?

Summary of the Article: Can I Cancel My Homeowners Insurance?

1. Can I cancel home insurance policy at any time?

Your contract with the insurance company allows you to cancel your homeowners insurance at any time, for any reason, but you should really only cancel when doing so is in your best financial interest.

2. Can you just cancel homeowners insurance?

Yes, homeowners insurance can be canceled at any time, and you also have the right to a policy refund when you cancel. Most major insurance companies prorate refunds, meaning you can cancel at any time and get reimbursed for any unused policy premiums.

3. When should you cancel your homeowners insurance?

The home you sell is considered yours until the closing process is finalized. At closing, once the buyer officially owns the home, you can cancel your coverage. Until that time, your homeowners insurance policy should remain in place to provide protection should anything happen to the home.

4. Do you get a refund when you cancel home insurance?

You may receive a refund check from your prior homeowners insurance company if you cancel your policy before it expires, reimbursing you for the coverage you already paid for. You may also receive a refund in the event your lender makes a payment to your old insurer.

5. What happens if I stop paying my home insurance?

If you don’t make a payment within the grace period, your insurance carrier has the right to cancel your policy. If your coverage lapses, you won’t have any protection for your home and possessions – and you’ll have to shoulder the costs if the worst occurs.

6. Can you cancel an insurance policy before it expires?

Policyholders can cancel their auto insurance policy at any time, for any reason. And you never have to wait until the end of your policy period to cancel your policy. Even if your policy only started a few days ago, you may cancel it. Contact your insurer or agent to find the best way to cancel your policy.

7. What happens if you stop paying house insurance?

If you don’t make a payment within the grace period, your insurance carrier has the right to cancel your policy. If your coverage lapses, you won’t have any protection for your home and possessions – and you’ll have to shoulder the costs if the worst occurs.

8. Do insurance companies have to notify you of cancellation?

Yes. Your insurance company must give you at least 30 days notice before they can cancel your coverage for the reasons stated above. This gives you time to appeal the decision or find new coverage.

9. What happens to your mortgage if your insurance is canceled?

Technically, you could lose your mortgage if your home insurance is canceled and not replaced. Each mortgage has wording to the effect that if you fail to maintain insurance, you are in default and your mortgage lender could foreclose on the home.

10. Do I need to cancel my home insurance when I switch?

You can change your homeowners insurance company as often as you’d like, but your existing policy may include a penalty for canceling early. It’s a good idea to check with your current insurer before switching to understand if there’s a financial advantage to waiting until your renewal date to change companies.

11. Additional Question

Answer to the additional question goes here. (Up to 3000 characters)

12. Additional Question

Answer to the additional question goes here. (Up to 3000 characters)

13. Additional Question

Answer to the additional question goes here. (Up to 3000 characters)

14. Additional Question

Answer to the additional question goes here. (Up to 3000 characters)

15. Additional Question

Answer to the additional question goes here. (Up to 3000 characters)

Can I cancel home insurance policy at any time

Your contract with the insurance company allows you to cancel your homeowners insurance at any time, for any reason, but you should really only cancel when doing so is in your best financial interest.

Cached

Can you just cancel homeowners insurance

Yes, homeowners insurance can be canceled at any time, and you also have the right to a policy refund when you cancel. Most major insurance companies prorate refunds, meaning you can cancel at any time and get reimbursed for any unused policy premiums.

Cached

When should you cancel your homeowners insurance

The home you sell is considered yours until the closing process is finalized. At closing, once the buyer officially owns the home, you can cancel your coverage. Until that time, your homeowners insurance policy should remain in place to provide protection should anything happen to the home.

Cached

Do you get a refund when you cancel home insurance

You may receive a refund check from your prior homeowners insurance company if you cancel your policy before it expires, reimbursing you for the coverage you already paid for. You may also receive a refund in the event your lender makes a payment to your old insurer.

Cached

What happens if I stop paying my home insurance

Your Home Insurance Policy Could Be Cancelled

If you don't make a payment within the grace period, your insurance carrier has the right to cancel your policy. If your coverage lapses, you won't have any protection for your home and possessions – and you'll have to shoulder the costs if the worst occurs.

Can you cancel an insurance policy before it expires

Policyholders can cancel their auto insurance policy at any time, for any reason. And you never have to wait until the end of your policy period to cancel your policy. Even if your policy only started a few days ago, you may cancel it. Contact your insurer or agent to find the best way to cancel your policy.

What happens if you stop paying house insurance

Your Home Insurance Policy Could Be Cancelled

If you don't make a payment within the grace period, your insurance carrier has the right to cancel your policy. If your coverage lapses, you won't have any protection for your home and possessions – and you'll have to shoulder the costs if the worst occurs.

Do insurance companies have to notify you of cancellation

Will I be notified before my plan is canceled Yes. Your insurance company must give you at least 30 days notice before they can cancel your coverage for the reasons stated above. This gives you time to appeal the decision or find new coverage.

What happens to your mortgage if your insurance is Cancelled

Technically, you could lose your mortgage if your home insurance is canceled and not replaced. Each mortgage has wording to the effect that if you fail to maintain insurance, you are in default and your mortgage lender could foreclose on the home.

Do I need to cancel my home insurance when I switch

You can change your homeowners insurance company as often as you'd like, but your existing policy may include a penalty for canceling early. It's a good idea to check with your current insurer before switching to understand if there's a financial advantage to waiting until your renewal date to change companies.

Can you lose your mortgage without homeowners insurance

Legally, you can own a home without homeowners insurance. However, in most cases, those who have a financial interest in your home—such as a mortgage or home equity loan holder—will require that it be insured.

Do I need homeowners insurance after I pay off my mortgage

You need homeowners property and liability insurance even after your mortgage is paid off if you want protection for your home. Homeowners property coverage can help protect against the potentially devastating costs to rebuild or replace your property after damaging events like fire, lightening and windstorms.

What does it cost to cancel an insurance policy

Check whether you have to pay a cancellation fee.

Some insurance companies charge a fee for canceling your plan early. This fee could be a flat rate of $50 or a short rate fee, which is usually 10% of your remaining premium.

What is required to cancel an insurance policy

Cancellation typically requires a signed form or written notice of cancellation that includes the desired end date of the policy. You may have to pay a cancellation fee as well in rare cases. Be sure to notify your insurer of the cancellation, since nonpayment can result in additional costs.

Is there a cancellation fee to cancel insurance

Do insurers charge cancellation fees Most insurance companies will not charge a cancellation fee for cancelling a car insurance policy or a specific coverage. However, some may charge a flat fee, usually less than $100, or a short rate fee for cancelling auto insurance early.

What happens when you cancel your insurance policy

If you paid your premium in advance and cancel your policy before the end of the term, the insurance company might refund the remaining balance. Most auto insurers will prorate your refund based on the number of days your current policy was in effect.

Who is the only person who can cancel a mortgage insurance policy

The lender must automatically cancel the mortgage insurance policy either: On the date the mortgage loan balance is first scheduled to reach 78% of original value, based solely on the initial amortization schedule2, regardless of the outstanding balance of the loan AND.

How often should you change homeowners insurance

every one to two years

That's why personal finance experts recommend gathering new quotes every one to two years. And as long as you aren't filing claims with each new insurer, you shouldn't see any negative effects from switching insurance companies or looking into lower rates.

Is it smart not to have homeowners insurance

Without Homeowners Insurance, You Run The Risk of Serious Financial Loss. Most financial experts will say that you absolutely need to carry homeowners insurance, regardless of whether your home is fully paid for or not.

What happens if you stop paying home insurance

Your Home Insurance Policy Could Be Cancelled

If you don't make a payment within the grace period, your insurance carrier has the right to cancel your policy. If your coverage lapses, you won't have any protection for your home and possessions – and you'll have to shoulder the costs if the worst occurs.

How much will my taxes go up if I pay off my mortgage

Most mortgages get paid off because the owner has refinanced or has sold the property. Your real estate taxes should not change in any way due to paying off your loan – or taking on a new loan for that matter.

What happens after a mortgage is paid off

Paying off your mortgage is a major milestone — you now own your home free and clear. It's a moment to celebrate, but also to take specific steps to ensure you're the legal owner of the property, and to continue paying your homeowners insurance and property taxes on your own.

What are the disadvantages of canceling insurance

Drawbacks to canceling car insuranceIncreased premiums later on. If you cancel your car insurance and later decide to get coverage, your premiums will increase for the lapse in coverage during the time you were uninsured.Lack of coverage for events that can happen at home.State requirements.

Does it cost money to cancel a policy

Do insurers charge cancellation fees Most insurance companies will not charge a cancellation fee for cancelling a car insurance policy or a specific coverage. However, some may charge a flat fee, usually less than $100, or a short rate fee for cancelling auto insurance early.

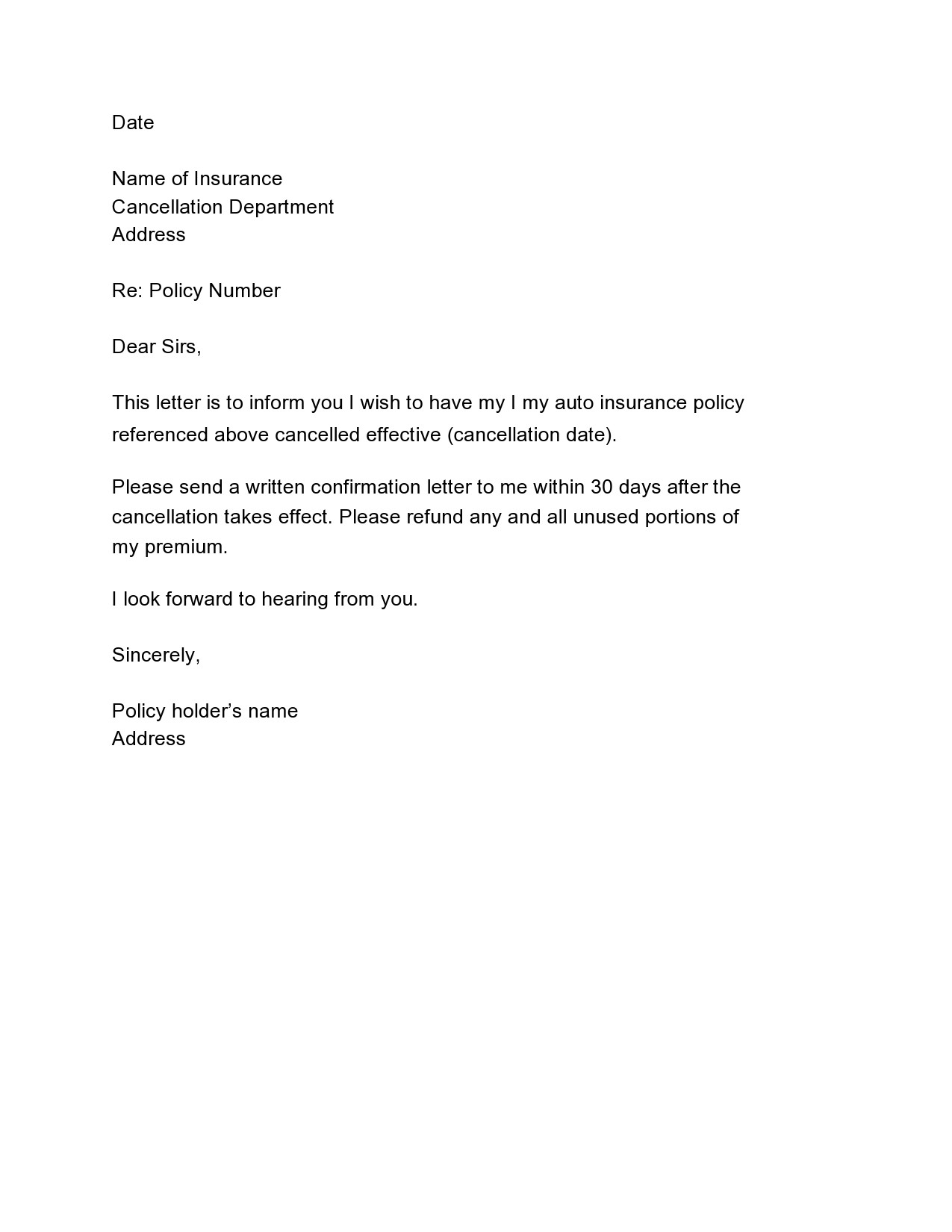

How do I notify my insurance company of cancellation

Mail or fax a signed cancellation request: Writing a signed letter to your insurer with your full name, policy number and the effective date you would like your coverage to end should be sufficient to initiate a cancellation. Confirm with your carrier if any cancellation fee is required.