How do I dispute an Equifax collection?

What is the best way to dispute a collection on Equifax

A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. To file a dispute with Equifax, you can create a myEquifax account. Visit our dispute page to learn other ways you can submit a dispute.

Can Equifax remove a collection

The three major credit bureaus (Equifax, Experian and TransUnion) will remove collections information if you can prove that it’s inaccurate. Sometimes credit reports contain factual errors, and while some are more benign, having a significant error like a misreported collection account can really hurt your score.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what’s called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you’re about to apply for a mortgage.

How do I dispute a hard inquiry on Equifax

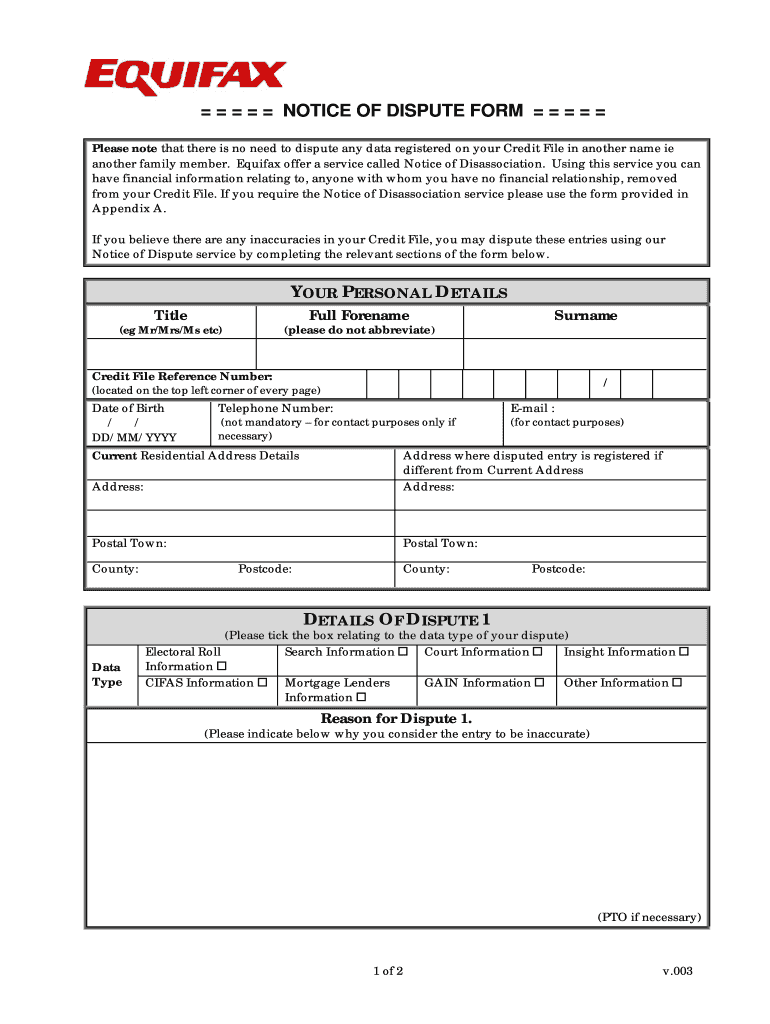

You can also submit disputes online at myequifax.com. Identification Information. Proof of Identity. Proof of Address. Complete, Print, and send (via U.S. mail) this form along with the requested documents to the following address: Equifax Information Services LLC. FRAUD/IDENTITY THEFT VICTIM.

Does disputing with Equifax drop your credit score

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

Does disputing collections work

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

How do I get my Equifax inquiry removed

Submit your dispute. So, submitting your credit dispute online or in writing is the best approach. Dispute hard inquiry errors by phone: Equifax: 886-349-5191. Experian: 888-397-3742.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

Can you still pay original creditor Instead collection agency

It’s possible in some cases to negotiate with a lender to repay a debt after it’s already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Is it worth disputing a hard inquiry

Should You Remove Hard Inquiries The idea of removing hard inquiries from your credit report to improve your credit score may sound appealing. But disputing a genuine hard inquiry on your credit report will likely not result in any change to your scores. You can, however, dispute ones that are a result of fraud.

What is the best way to dispute a collection on Equifax

A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. To file a dispute with Equifax, you can create a myEquifax account. Visit our dispute page to learn other ways you can submit a dispute.

Cached

Can Equifax remove a collection

The three major credit bureaus (Equifax, Experian and TransUnion) will remove collections information if you can prove that it's inaccurate. Sometimes credit reports contain factual errors, and while some are more benign, having a significant error like a misreported collection account can really hurt your score.

Cached

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

How do I dispute a hard inquiry on Equifax

You can also submit disputes online at myequifax.com.Identification Information.Proof of Identity.Proof of Address.Complete, Print, and send (via U.S. mail) this form along with the requested documents to the following address:Equifax Information Services LLC.FRAUD/IDENTITY THEFT VICTIM.

Cached

Does disputing with Equifax drop your credit score

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

Does disputing collections work

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

How do I get my Equifax inquiry removed

Submit your dispute

So, submitting your credit dispute online or in writing is the best approach. Dispute hard inquiry errors by phone: Equifax: 886-349-5191. Experian: 888-397-3742.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

Can you still pay original creditor Instead collection agency

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Is it worth disputing a hard inquiry

Should You Remove Hard Inquiries The idea of removing hard inquiries from your credit report to improve your credit score may sound appealing. But disputing a genuine hard inquiry on your credit report will likely not result in any change to your scores. You can, however, dispute ones that are a result of fraud.

Is there a downside to disputing credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

How long does an Equifax dispute take

within 30 days

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

How do I dispute a collection and win

How to Dispute a Debt and WinAssemble all documentation about the debt. Your first step is to assemble all evidence you have concerning the debt.Review the debt collection letter for mistakes.Determine your response to the debt collection agency.Wait for a response from the debt collection agency.

How do I get my Equifax inquiry removed in 24 hours

To get an inquiry removed within 24 hours, you need to physically call the companies that placed the inquiries on the telephone and demand their removal. This is all done over the phone, swiftly and without ever creating a letter or buying a stamp.

What do you say to a credit bureau to remove inquiries

What to do:Contact the creditor responsible for the hard inquiry.Explain that you believe there is an error on your credit report and request that they remove the inquiry.Share accurate details about the incorrect hard inquiry, such as the date of the credit check.

What is the 11 word phrase credit loophole

Summary: “Please cease and desist all calls and contact with me, immediately.” These are 11 words that can stop debt collectors in their tracks. If you're being sued by a debt collector, SoloSuit can help you respond and win in court. How does the 11-word credit loophole actually work

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is the 15 3 credit trick

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Why does the 15 3 credit hack work

The 15/3 hack can help struggling cardholders improve their credit because paying down part of a monthly balance—in a smaller increment—before the statement date reduces the reported amount owed. This means that credit utilization rate will be lower which can help boost the cardholder's credit score.

What should you not say to a debt collector

If you get an unexpected call from a debt collector, here are several things you should never tell them:Don't Admit the Debt. Even if you think you recognize the debt, don't say anything.Don't provide bank account information or other personal information.Document any agreements you reach with the debt collector.

How do I get my credit inquiry removed

How Do You Dispute (and Remove) Unauthorized InquiriesObtain free copies of your credit report.Flag any inaccurate hard inquiries.Contact the original lender.Start an official dispute.Include all essential information.Submit your dispute.Wait for a verdict.

What is the best reason to dispute a collection

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

What is the best option to choose when disputing credit report

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.