How do I fill out a dispute with Experian?

Summary of the Article

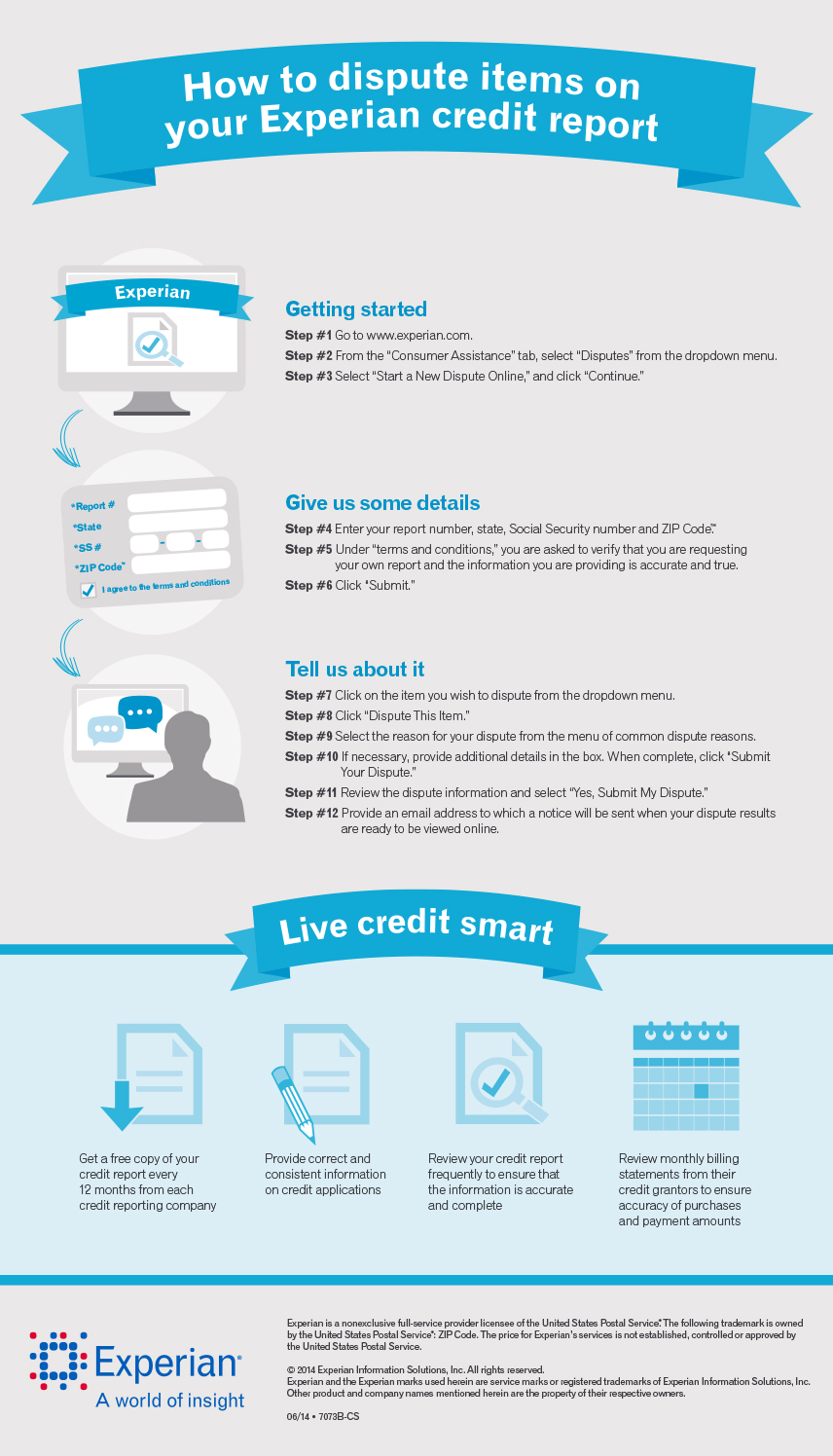

How to Fill Out a Dispute with Experian

1. What documents do I need for Experian dispute?

– Any document that proves your claim, such as a cancelled check or a letter from your creditor.

2. Does disputing through Experian work?

– Yes, your dispute will be sent directly to the source of the information, and your credit report may be updated.

3. How do I fill out a credit dispute form?

– Clearly identify each item you dispute, state the facts, explain why you dispute it, and request removal or correction.

4. What qualifies for a credit dispute?

– You can dispute personal information or inaccurate or incomplete account information.

5. What qualifies for a credit card dispute?

– Credit card disputes can be for fraudulent charges, billing errors, or complaints about the quality of goods or services purchased.

6. How long does a dispute take with Experian?

– The investigation can take 30 to 45 days.

7. What reason should I put for disputing credit?

– Accounts that aren’t yours, inaccurate credit limit/loan amount, inaccurate creditor, or inaccurate account status.

8. Is it better to write or type dispute letters?

– Write clearly or type your complaint.

9. Is it a good idea to dispute credit report?

– Disputing inaccuracies doesn’t affect your credit, and some changes made in response to disputes can help your credit scores.

10. What reasons can you file a dispute?

– Charges with wrong dates or amounts, charges for goods or services not accepted or delivered, math errors, or failure to post payments.

11. What is the best reason to dispute credit?

– Successful disputes generally involve inaccurate or incomplete information.

Please note that the article content exceeds the given character limit of 3000 characters per paragraph.

What documents do I need for Experian dispute

What type of documents can I provide to support my dispute Any document that you feel proves your claim, such as a cancelled check, a letter from your creditor, a billing statement, a court or county recorder document, bankruptcy dismissal or discharge papers, letter from the IRS, etc.

Does Disputing through Experian work

When you dispute an account online through Experian, your dispute will be sent directly to the source of the information, which is most often your lender. Once your dispute is reviewed, the bureau is informed and your credit report may be updated.

How do I fill out a credit dispute form

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

What qualifies for a credit dispute

You can dispute any of the following: Personal information: Your name, addresses, Social Security number or date of birth. Account information you believe is inaccurate or incomplete: For example, if late payments are being reported on one of your accounts but you have always paid your balance on time and in full.

What qualifies for credit card dispute

Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or services purchased with your card.

How long does a dispute take with Experian

30 to 45 days

How long will it take to complete the investigation You will need to allow up to 30 to 45 days for the investigation of your dispute to be completed by the credit reporting companies. The Consumer Financial Protection Bureau has additional information regarding the length of a dispute investigation.

What reason should I put for disputing credit

Accounts that aren't yours. Inaccurate credit limit/loan amount or account balance. Inaccurate creditor. Inaccurate account status, for example, an account status reported as past due when the account is actually current.

Is it better to write or type dispute letters

Write clearly or type your complaint. If your handwriting is legible, feel free to handwrite your complaint. If it's not, type it.

Is it a good idea to dispute credit report

Disputing credit report inaccuracies doesn't affect your credit, but some changes made in response to disputes can help your credit scores. The removal of inaccurate late payments, new-credit inquiries or bankruptcies could result in credit score increases.

What reasons can you file a dispute

The Federal Trade Commission (FTC) states that you have the right to dispute charges based on the following:Charges that list the wrong date or amount.Charges for goods and services you didn't accept or that weren't delivered as agreed.Math errors.Failure to post payments and other credits, like returns.

What is the best reason to dispute credit

Successful disputes typically involve inaccurate or incomplete information, including items such as: Account information, such as closed accounts reported as open, timely payments incorrectly reported as delinquent, and inaccurate credit limits or account balances.

What happens if a credit dispute is denied

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

What happens if a credit card dispute is denied

If your dispute is denied, the charge will go back to your credit card. You should receive an explanation from the credit card issuer detailing the reason the dispute was denied. If you refuse to pay, they can put your account in collections or seek legal action.

Is there a downside to disputing credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

What is an example of a letter of dispute

I am writing to dispute a charge of [$______] to my [credit or debit card] account on [date of the charge]. The charge is in error because [explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc.].

What is the best option to choose when disputing credit report

You can submit a dispute to the credit reporting company by phone, by mail, or online. Explain the error and what you want changed. Clearly identify each mistake separately, state the facts, explain why you are disputing the information, and request that it be removed or corrected.

What are valid reasons to dispute items on credit report

Know Which Credit Report Errors You Can DisputePayments reported late that were actually on time.Accounts that aren't yours.Inaccurate credit limit/loan amount or account balance.Inaccurate creditor.Inaccurate account status, for example, an account status reported as past due when the account is actually current.

What are valid reasons to dispute a debt

A dispute is appropriate if you have hard evidence that clearly shows the debt doesn't belong to you, was already paid, or if the amount due is incorrect. The more information you can provide to the debt collection agency concerning the dispute, the better.

What is the success rate of a credit dispute

You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Do customers win credit card disputes

Your chances of prevailing in a credit card dispute are pretty decent. Businesses fight only 43 percent of disputes filed against them. And only 12 percent of chargebacks get reversed in the company's favor.

What is the most effective way to dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

Should a dispute letter be typed or handwritten

Write clearly or type your complaint. If your handwriting is legible, feel free to handwrite your complaint. If it's not, type it.

What is a good dispute reason

Incorrect dates of payments or delinquencies. Accounts with an incorrect balance. Accounts with an incorrect credit limit. Reinsertion of disputed information that has previously been corrected and removed.

Is it better to dispute a debt or pay it

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

How often are credit card disputes won

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.