How do I get a tax ID number without SSN?

Can an undocumented person get a tax ID number?

They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code.

Can a non-US citizen get EIN number?

Applying for an Individual Taxpayer ID Number (ITIN)

Non-U.S. citizens who own businesses can still get a business EIN even if they do not have an SSN. Social Security numbers are for individual persons, whereas business EINs are for business entities; these two types of tax IDs are handled differently by the IRS.

How long does it take to get an EIN without a SSN?

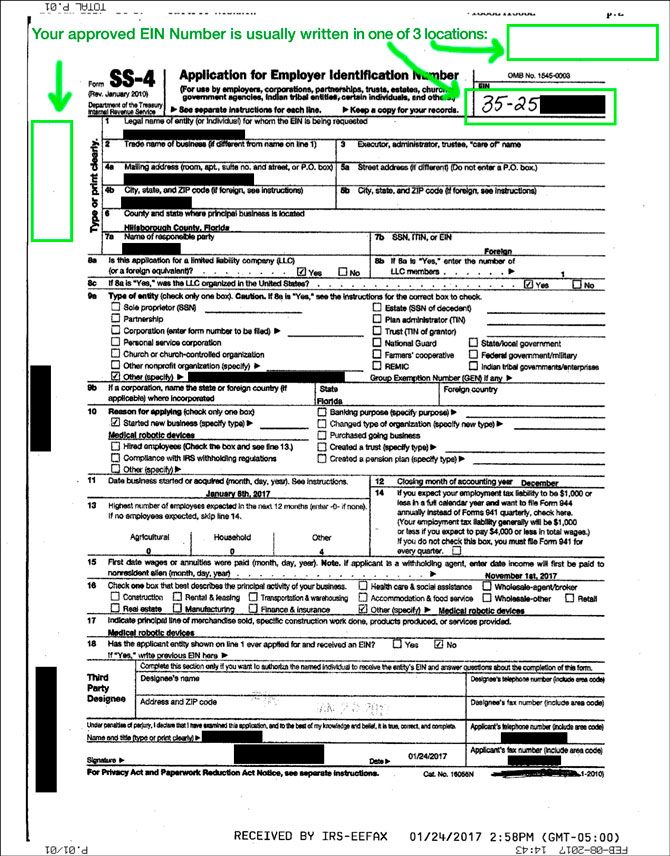

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

What do I put if I don’t have a tax ID number?

A tax ID number is not required if you operate a sole proprietorship or an LLC with no employees, in which case you would simply use your own Social Security Number as a tax ID.

Can you get deported if you have an ITIN number?

Can the ITIN be used to locate non-US citizens and deport them? No. Immigration Services may not use the ITIN to search for non-U.S. citizens who are in the country without permission.

What is the IRS number for illegal immigrants?

Who can I call for help? You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll-free number) if you are outside the United States.

How do I start a business in the US as a non-citizen?

How to Start a Business in the United States as a Foreigner

– Choose Your Business Structure.

– Choose the State for Formation.

– Obtain a Registered Agent.

– Obtain a Taxpayer Identification Number.

– Set Up a Business Bank Account.

– Maintain Business Compliance.

Can an immigrant have an EIN?

All immigrants regardless of legal status are able to earn a living as independent contractors or start a business using an ITIN, EIN, or SSN. Individuals may choose to apply for an EIN to identify a business entity and hire employees. An ITIN may be used to obtain an EIN.

Can I enter EIN instead of SSN?

Use EIN for your business’ tax filings and payroll

When filling out forms for your business, use its EIN wherever an individual would normally use an ITIN or SSN. For example, when applying for a business bank account or loan, you can apply with the business’ EIN instead of the business owner’s SSN or ITIN.

Can you start a business without a SSN?

If you are operating a sole proprietorship or a single-member LLC, no federal guidelines require the need for an SSN to operate in the United States legally. However, it may be necessary for some entities to have an SSN if: They wish to engage with other small business owners outside their entity. Hire employees.

Is a tax ID the same as an EIN?

Your Employer Identification Number (EIN) is your federal tax ID. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. It’s free to apply for an EIN, and you should do it right after you register you

Can an undocumented person get a tax ID number

They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code.

Can a non US citizen get EIN number

Applying for an Individual Taxpayer ID Number (ITIN)

Non-U.S. citizens who own businesses can still get a business EIN even if they do not have an SSN. Social Security numbers are for individual persons, whereas business EINs are for business entities; these two types of tax IDs are handled differently by the IRS.

Cached

How long does it take to get an EIN without a SSN

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

What do I put if I don’t have a tax ID number

A tax ID number is not required if you operate a sole proprietorship or an LLC with no employees, in which case you would simply use your own Social Security Number as a tax ID.

Cached

Can you get deported if you have an ITIN number

Can the ITIN be used to locate non-us citizens and deport them No. Immigration Services may not use the ITIN to search for non-U.S. citizens who are in the country without permission.

What is the IRS number for illegal immigrants

Who can I call for help You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll- free number) if you are outside the United States.

How do I start a business in the US as a non citizen

How to Start a Business in the United States as a ForeignerChoose Your Business Structure.Choose the State for Formation.Obtain a Registered Agent.Obtain a Taxpayer Identification Number.Set Up a Business Bank Account.Maintain Business Compliance.

Can an immigrant have an EIN

All immigrants regardless of legal status are able to earn a living as independent contractors, or start a business using an ITIN, EIN, or SSN. Individuals may choose to apply for an EIN to identify a business entity and hire employees. An ITIN may be used to obtain an EIN.

Can I enter EIN instead of SSN

Use EIN for your business' tax filings and payroll

When filling out forms for your business, use its EIN wherever an individual would normally use an ITIN or SSN. For example, when applying for a business bank account or loan, you can apply with the business' EIN instead of the business owner's SSN or ITIN.

Can you start a business without a SSN

If you are operating a sole proprietorship or a single-member LLC, no federal guidelines require the need for an SSN to operate in the United States legally. However, it may be necessary for some entities to have an SSN if: They wish to engage with other small business owners outside their entity. Hire employees.

Is a tax ID the same as an EIN

Your Employer Identification Number (EIN) is your federal tax ID. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. It's free to apply for an EIN, and you should do it right after you register your business.

How long does it take to get the ITIN number

within seven weeks

Q11: How long does it take to get an ITIN A11: If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number usually within seven weeks (up to 11 weeks if requested during peak tax time (January 15 through April 30) or from abroad).

Can you legally work in the U.S. with an ITIN number

Filing with an ITIN

The IRS issues ITINs for federal tax purposes, and ITINs should be used for tax reporting only. ITINs do not authorize a person to work in the U.S. or provide eligibility for Social Security benefits.

What does an itin number do for illegal immigrants

While undocumented individuals may not qualify to file and pay taxes with a social security number, they can obtain an Individual Taxpayer Identification Number (ITIN). An ITIN works like a social security number for the purpose of filing taxes only.

Can an undocumented person work in the US

The IRCA prohibits employers from knowingly hiring undocumented workers and requires them to verify the work-authorization status of all employees at the time of hire. To verify work-authorization status, the employer uses a form called the I-9 Employment Eligibility and Verification Form (“I-9”).

Can a non-US citizen own an LLC

There's no requirement for citizenship to operate a business in the U.S., so long as it's the right form of business. This means that a noncitizen can operate a limited liability company (LLC) or a C corporation, but not an S corporation.

Can I get a Green Card if I open a business

USCIS administers the EB-5 Program. Under this program, investors (and their spouses and unmarried children under 21) are eligible to apply for lawful permanent residence (become a Green Card holder) if they: Make the necessary investment in a commercial enterprise in the United States; and.

What is the tax number for undocumented immigrants

While undocumented individuals may not qualify to file and pay taxes with a social security number, they can obtain an Individual Taxpayer Identification Number (ITIN). An ITIN works like a social security number for the purpose of filing taxes only.

What is the tax number for illegal immigrants

An ITIN is a tax processing number issued by the Internal Revenue Service (IRS) to people who do not have U.S. Social Security Numbers, including undocumented immigrants. An ITIN allows the holder to pay U.S. income taxes regardless of their immigration status.

What can I use instead of SSN

individual taxpayer identification number (ITIN)

An individual taxpayer identification number (ITIN) is issued by the U.S. government, and can be issued to people who are not eligible for a Social Security number (SSN)—including non-citizens and spouses.

Is EIN the same as tax ID

Your Employer Identification Number (EIN) is your federal tax ID.

What business card does not require SSN

Some additional credit card options that don't require an SSN and only ask for an EIN are corporate cards, corporate store cards, corporate gas cards and prepaid business credit cards.

Can I use EIN instead of SSN

Instead of using the SSN as your Federal Tax Identification Number (TIN), you can use an Employer Identification Number (EIN). This better protects you, your business, and your commercial dealings with others.

Is my SSN my tax ID number

A Social Security number (SSN) is a taxpayer identification number issued by the Social Security Administration. Individuals who are employed in the U.S. must have a Social Security number to file an income tax return.

How long does it take to get an EIN

The processing timeframe for an EIN application received by mail is four weeks. Ensure that the Form SS-4PDF contains all of the required information. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.