How do I read my Equifax credit report Australia?

Summary of the Article: Understanding Credit Scores in Australia

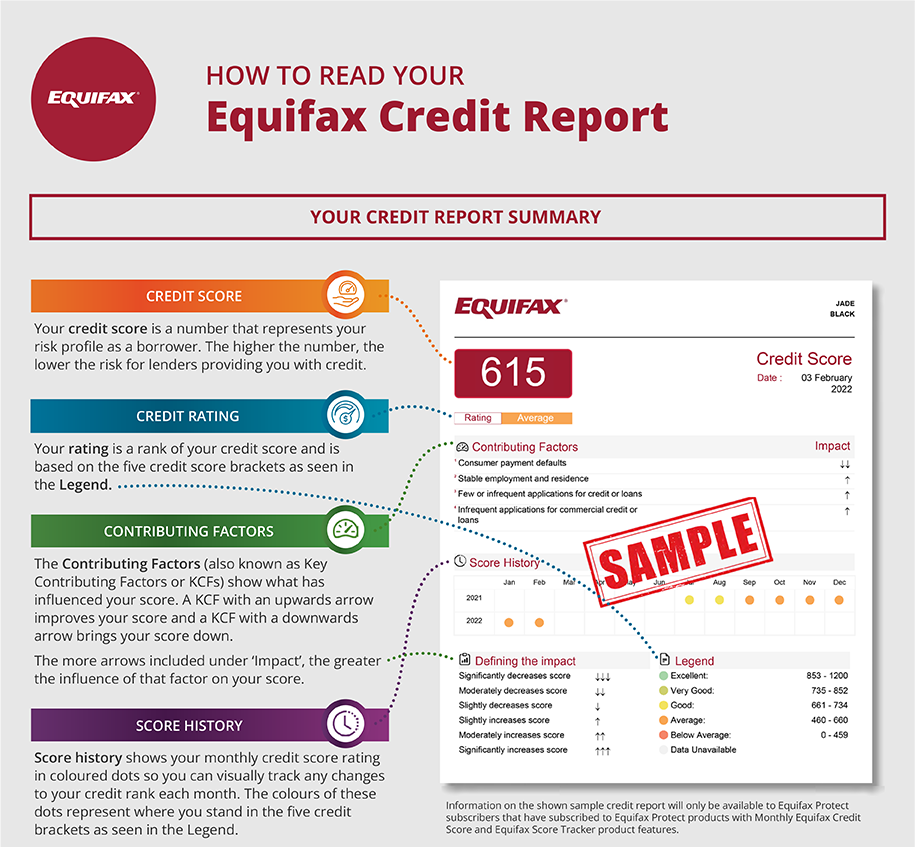

Credit scores are essential when it comes to financial matters. In Australia, credit scores are assigned by credit reporting agencies such as Illion and Equifax. These scores range from excellent to fair, with higher scores indicating lower credit risk. A good credit score is considered to be above 660.

Equifax Australia assigns credit scores ranging from 0 to 1200. The higher your score, the more attractive you are to lenders. To access your Equifax credit score, you can create a myEquifax account and enroll in Equifax Core Credit™.

The average credit score in Australia is 846, which is considered very good. Women tend to have a higher average credit score than men. As individuals establish more disciplined spending habits, their credit scores tend to improve.

Credit scoring systems differ across countries. While countries like Australia, the United Kingdom, Canada, and the United States have similar credit scoring systems, there are key differences between them.

A good credit score in Australia is generally considered to be above 661 (for scores out of 1200) and above 540 (for scores out of 1000). Different credit reporting agencies may use different scoring models.

Your Equifax credit score and FICO score may differ since the information on your credit reports at each bureau can vary. The numerical ranges used by Equifax and FICO differ slightly.

In conclusion, understanding credit scores is crucial in managing your financial health. A good credit score opens doors to better financial opportunities and loan terms. By monitoring your credit score and practicing responsible financial habits, you can improve your creditworthiness.

Questions:

- What do the numbers on your credit score mean in Australia?

- What is the Equifax credit score range in Australia?

- How can I view my Equifax FICO score?

- What is the summary of Equifax?

- What is the average credit score in Australia?

- What is the most common credit score in Australia?

- Do US credit scores work in Australia?

- What is considered a good credit score in Australia?

- Is my FICO score the same as my Equifax score?

- What is the difference between a FICO score and a credit score?

Answers:

- The numbers on your credit score in Australia indicate different credit ranges. An excellent score falls between 800 and 1000 (Illion) or 833 and 1200 (Equifax). Very good scores range from 700 to 799 (Illion) or 726 to 832 (Equifax). Average scores range from 500 to 699 (Illion) or 622 to 725 (Equifax). Fair scores range from 300 to 499 (Illion) or 510 to 621 (Equifax).

- The Equifax credit score range in Australia is from 0 to 1200. The higher the score, the lower the credit risk. A score above 660 is considered good.

- You can view your Equifax FICO score by logging into your account or creating a myEquifax account. Enroll in Equifax Core Credit™ to get your free monthly credit report and VantageScore credit score based on Equifax data.

- Equifax is a credit reporting company that offers various solutions such as consumer credit monitoring, identity theft prevention, business risk information, and financial marketing services.

- The average credit score in Australia is 846 according to Equifax. This is considered a very good credit score. Women tend to have a higher average credit score than men.

- According to the Equifax 2022 Credit scorecard, the average credit score in Australia is 846. This score indicates that many Australians have established more disciplined spending habits.

- Credit scores do not work the same across all countries. While Australia, the United Kingdom, Canada, and the United States have similarities in their credit scoring systems, there are key differences between them.

- A good credit score in Australia depends on the scoring model used. If your credit report shows scores out of 1200, a score above 853 is considered excellent, while above 661 is considered good. If your credit report shows scores out of 1000, a score above 690 is excellent and above 540 is good.

- Your Equifax credit score and FICO score may not be the same since each credit bureau uses different information to calculate the scores. Equifax credit score models use a range between 280 and 850, while FICO score models use a range between 300 and 850.

- “Credit score” and “FICO® score” are often used interchangeably. They both refer to the same thing, which is a type of credit scoring model. While different credit reporting agencies may weigh factors slightly differently, they ultimately measure the same thing.

What do the numbers on your credit score mean Australia

Understanding Good Credit Score in Australia

| Credit Score Range* | Illion | Equifax |

|---|---|---|

| Excellent | 800 – 1000 | 833 – 1200 |

| Very good | 700 – 799 | 726 – 832 |

| Average | 500 – 699 | 622 – 725 |

| Fair | 300 – 499 | 510 – 621 |

What is Australia Equifax score

Equifax Australia credit score is assigned as a number between 0 to 1200. The higher your score is, the lower your credit risk and the more attractive you are to lenders. Ideally, a credit score above 660 is considered good.

How can I see my Equifax FICO score

It may be on your statement, or you may be able to log in to your account and access it online. Create a myEquifax account and click “Get my free credit score” to enroll in Equifax Core Credit™. You'll get a free monthly Equifax credit report and free monthly VantageScore credit score based on Equifax data.

What is the summary of Equifax

Providing U.S. consumers and businesses with a wide range of solutions — from consumer credit monitoring and identity theft prevention to business risk information, commercial identity & fraud solutions, financial marketing and analytical services.

What’s the average credit score in Australia

The average credit score among Australians is 846 according to credit reporting company Equifax. That means on average Australians have a 'very good' credit score. Women (858) have a higher average credit score than men (836), while the average credit score is higher for older Australians.

What is the most common credit score Australia

The Equifax 2022 Credit scorecard – combining survey data of 1,016 respondents with credit score information for more than two million individuals – found many Australians are establishing more disciplined spending habits. Average Australian's credit score is 846 according to Equifax.

Does US credit score work in Australia

Credit scores don't work the same across the world. Australia, the United Kingdom, Canada and the United States have similar credit scoring systems – but there are key differences between them.

What is a good credit score in Australia

If your credit report shows scores out of 1,200 then as a rule of thumb a score above 853 is excellent while above 661 is good. If your credit report shows scores out of 1,000, above 690 is excellent and above 540 is good.

Is my FICO score the same as Equifax

Since the information on your credit reports at each bureau can differ, your Equifax credit score and FICO score can differ depending on which credit report is used to calculate the score. The Equifax credit score model uses a numerical range between 280 and 850, and FICO score models use a range between 300 and 850.

What is FICO score vs credit score

Is "credit score" the same as "FICO® score" Basically, "credit score" and "FICO® score" are all referring to the same thing. A FICO® score is a type of credit scoring model. While different reporting agencies may weigh factors slightly differently, they are all essentially measuring the same thing.

What does your Equifax score mean

The Equifax credit score is an educational credit score developed by Equifax. Equifax credit scores are provided to consumers for their own use to help them estimate their general credit position. Equifax credit scores are not used by lenders and creditors to assess consumers' creditworthiness.

What is a good Equifax report

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Is there a credit score system in Australia

Your credit score is calculated by credit reporting agencies such as Veda, Australia's largest. Although these agencies score in different ways (Veda scores between zero and 1,200), in general the higher the number, the more likely you are to have your request for credit accepted.

Do Aussies have credit scores

Yes, credit scores are widely used in Australia. If you've ever applied for a loan or other form of credit, a credit file will have been created in your name, which is then used to calculate your credit score.

Does Australia use the FICO credit score

As we already highlighted, in the US, they mainly use the FICO system to calculate credit scores. In Australia, the bureaus do not use this system to calculate your credit scores.

Which credit score is used in Australia

As it's the largest of the credit reporting organisations, most Australian banks use Equifax credit scores in their assessments of credit worthiness.

Do credit scores exist in Australia

Yes, credit scores are widely used in Australia. If you've ever applied for a loan or other form of credit, a credit file will have been created in your name, which is then used to calculate your credit score.

Why is my Equifax score higher than FICO

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference.

Do lenders use Equifax or FICO

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Is FICO score higher than Equifax

The Equifax credit score model uses a numerical range between 280 and 850, and FICO score models use a range between 300 and 850.

What is a good FICO score

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Is Equifax usually the lowest score

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

What are the 5 levels of credit scores

Credit scores typically range from 300 to 850. Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and excellent.

What is the average Equifax score

The average credit score in the United States is 698, based on VantageScore® data from February 2021. It's a myth that you only have one credit score. In fact, you have many credit scores. It's a good idea to check your credit scores regularly.

Is FICO used in Australia

The Australian system is unique!

The most commonly used system is known as the FICO score (similar to our Equifax Score). A FICO score is between 300 and 850, the higher the score the better.