How do I set up a trust wallet?

Summary of the article: How do Trust Wallet work for beginners

Trust Wallet allows users to store and manage more than 9 million crypto assets, including NFTs, across 70 blockchains. As a multi-coin wallet, you can securely store all your assets under one roof.

Questions:

- How do I set up a trust wallet?

- Does Trust Wallet connect to your bank account?

- Do you have to pay to activate Trust Wallet?

- How do I put money in my Trust Wallet?

- Does Trust Wallet report to IRS?

- How will I withdraw money from Trust Wallet?

- How do I get my money out of my Trust Wallet?

- Is Trust Wallet tracked by IRS?

- What is the minimum deposit for Trust Wallet?

- Can I withdraw from Trust Wallet to my bank account?

- Is it safe to put money in Trust Wallet?

- Can the IRS take money from a trust account?

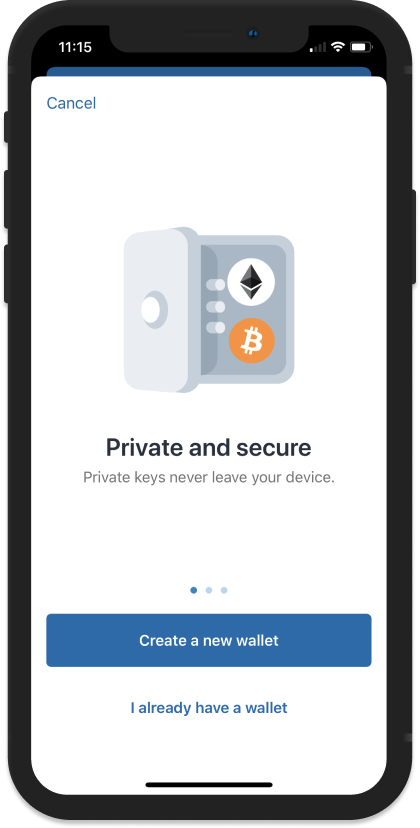

To set up a Trust Wallet, you need to download the app from the official website or app store. Once downloaded, follow the on-screen instructions to create an account and set up a secure password. Then, you can start adding your crypto assets to your wallet.

Withdrawing money is actually a very simple process. To do this, open the Trust Wallet app, select the “Wallets” tab, then select “Connect to Bank”. You will then be prompted to enter your bank account information.

No, Trust Wallet is free to use and does not require any subscription. However, users need to pay the network fee for in-app transactions or swaps. This fee is customizable.

To deposit money into your Trust Wallet, you can receive funds from other wallet addresses or purchase cryptocurrency from exchanges and transfer it to your Trust Wallet address.

No, Trust Wallet does not send any kind of tax report or form to the Internal Revenue Service (IRS). However, cryptocurrency exchanges are becoming more tax-compliant, and Trust Wallet might make it easier to file automatic taxes by creating a report for you.

To withdraw money from Trust Wallet, users need to swap their tokens for Bitcoin or Ethereum, send them to a cryptocurrency exchange like Binance, sell them for fiat currency, and then withdraw the fiat currency to their bank account.

To cash out your money from Trust Wallet, you need to convert your crypto assets into a fiat currency like USD or EUR. You can do this by selling your cryptocurrencies on a supported exchange and then withdrawing the funds to your bank account.

No, Trust Wallet does not currently report user information or activity to the IRS.

The minimum deposit amount for Trust Wallet depends on the cryptocurrency you want to deposit. For example, you can purchase a minimum of $50 worth of Ethereum with a credit card on Trust Wallet.

Yes, you can withdraw funds from Trust Wallet to your bank account. However, you need to convert your crypto assets into a fiat currency first and then transfer the funds to your bank account using a cryptocurrency exchange.

Yes, Trust Wallet is considered safe for storing crypto assets. As long as users protect their backup details and securely store their recovery phrase, their assets can be recovered even if the company becomes insolvent.

In certain cases, the IRS can initiate a trust fund recovery penalty investigation, which allows them to collect outstanding tax liabilities from a trust account.

How do Trust Wallet work for beginners

Trust Wallet allows users to store and manage more than 9 million crypto assets, including NFTs, across 70 blockchains. As a multi-coin wallet, you can securely store all your assets under one roof.

Cached

Does Trust Wallet connect to your bank account

Withdrawing money is actually a very simple process, and in this article, we will walk you through the steps involved. To do this, open the trust wallet app, select the "Wallets" tab, then select "Connect to Bank". You will then be prompted to enter your bank account information.

Do you have to pay to activate Trust Wallet

Like most software wallets, Trust Wallet is free to use and does not require any subscription. For in-app transactions or swaps, the wallet does not charge any fees, although users need to pay the network fee. This fee is customizable.

Cached

How do I put money in my Trust Wallet

By hitting that subscribe button press the notification Bell. So that you'll never miss another upcoming upload from us when it comes to depositing money on your trust wallet either you can receive

Does Trust Wallet report to IRS

Trust Wallet does not send any kind of tax report or form to the Internal Revenue Service (IRS). But since there is more pressure on cryptocurrency exchanges to be tax-compliant, Trust Wallet might make it easier to file automatic taxes by creating a report for you.

How will I withdraw money from Trust Wallet

To withdraw money from Trust Wallet, users need to swap their tokens for Bitcoin or Ethereum, send them to a cryptocurrency exchange like Binance, sell them for fiat currency, and then withdraw the fiat currency to their bank account.

How do I get my money out of my Trust Wallet

To withdraw money from Trust Wallet, users need to swap their tokens for Bitcoin or Ethereum, send them to a cryptocurrency exchange like Binance, sell them for fiat currency, and then withdraw the fiat currency to their bank account.

Is Trust Wallet tracked by IRS

The simple answer is that Trust Wallet does not currently report user information or activity to the IRS.

What is the minimum deposit for Trust Wallet

You can purchase a minimum $50 and up to $20,000 (USD) worth of Ethereum with a credit card on Trust Wallet.

Can I withdraw from Trust Wallet to my bank account

You can withdraw the cash using the exchanges withdrawal process. The withdrawal could take a couple of days to process, so keep that in mind. Each exchange has its own procedure for withdrawing funds, which can be found in their terms and conditions or FAQ.

Is it safe to put money in Trust Wallet

Trust Wallet is safe to use for crypto asset storage once users protect their backup details. In the event that the company became insolvent, it's still possible to recover assets with your 12-seed recovery phrase.

Can the IRS take money from a trust account

This is called a trust fund recovery penalty investigation, and it permits the IRS to collect unpaid trust fund taxes. They will not only from the business but from the assets of the individuals responsible for not paying withheld taxes.

Can the IRS seize money in a trust

The IRS and Irrevocable Trusts

When you put your assets into an irrevocable trust, they no longer belong to you, the taxpayer (this is different from a revocable trust, where they do still belong to you). This means that generally, the IRS cannot touch your assets in an irrevocable trust.

Why can’t i withdraw from Trust Wallet

While you can't withdraw money to your bank account in Trust Wallet, you can send the tokens to a centralized exchange and sell it there. Once you exchange your tokens for your local currency, you can withdraw the funds to your bank account.

What are the fees for Trust Wallet

Pricing: Trust Wallet is free to use. There may be fees for some optional features, however, such as integrated purchases from the Binance exchange or other third-party sellers. And cryptocurrencies' underlying blockchain networks often charge transaction fees, regardless of which wallet you use.

Can I transfer from Trust Wallet to bank account

While you can't withdraw money to your bank account in Trust Wallet, you can send the tokens to a centralized exchange and sell it there. Once you exchange your tokens for your local currency, you can withdraw the funds to your bank account.

Will trust wallet send me a 1099

No. Trust Wallet does not send 1099 forms to users.

How does IRS know if you own crypto

Yes, the IRS can track cryptocurrency, including Bitcoin, Ether and a huge variety of other cryptocurrencies. The IRS does this by collecting KYC data from centralized exchanges.

How much is $50 in Trust Wallet

NGN to TWT

| Amount | Today at 8:50 pm |

|---|---|

| 10 NGN | 0.0294 TWT |

| 50 NGN | 0.15 TWT |

| 100 NGN | 0.29 TWT |

| 500 NGN | 1.47 TWT |

Is it easy to withdraw money from Trust Wallet

To withdraw money from Trust Wallet, users need to swap their tokens for Bitcoin or Ethereum, send them to a cryptocurrency exchange like Binance, sell them for fiat currency, and then withdraw the fiat currency to their bank account.

How do I cash out my Trust Wallet to USD

Unfortunately, Trust Wallet does not allow you to trade from crypto to FIAT or traditional currencies such as USD, EUR and GBP. When withdrawing money from Trust Wallet, you will need access to a crypto exchange like Binance or Coinbase, which supports FIAT markets.

Can you actually take out money in cash out of a Trust Wallet

To withdraw money from Trust Wallet, users need to swap their tokens for Bitcoin or Ethereum, send them to a cryptocurrency exchange like Binance, sell them for fiat currency, and then withdraw the fiat currency to their bank account.

Can the IRS see my trust wallet

Click on the Cryptocurrency of your choice in the token section. View the transactions using that currency. If you want to see more, click on a transaction of your choice. The short answer is yes, Trust Wallet does report to the IRS.

Does putting money in trust avoid taxes

Truth – The transfer of assets to a trust will give the donor no additional tax benefit. Taxes must be paid on the income or assets held in trust, including the income generated by property held in trust. The responsibility to pay taxes may fall to the trust, the beneficiary, or the transferor.

How do I transfer money from my Trust Wallet to my bank account

To withdraw money from Trust Wallet, users need to swap their tokens for Bitcoin or Ethereum, send them to a cryptocurrency exchange like Binance, sell them for fiat currency, and then withdraw the fiat currency to their bank account.