How do I talk to a live person at Equifax?

How do I talk to a live person at Equifax?

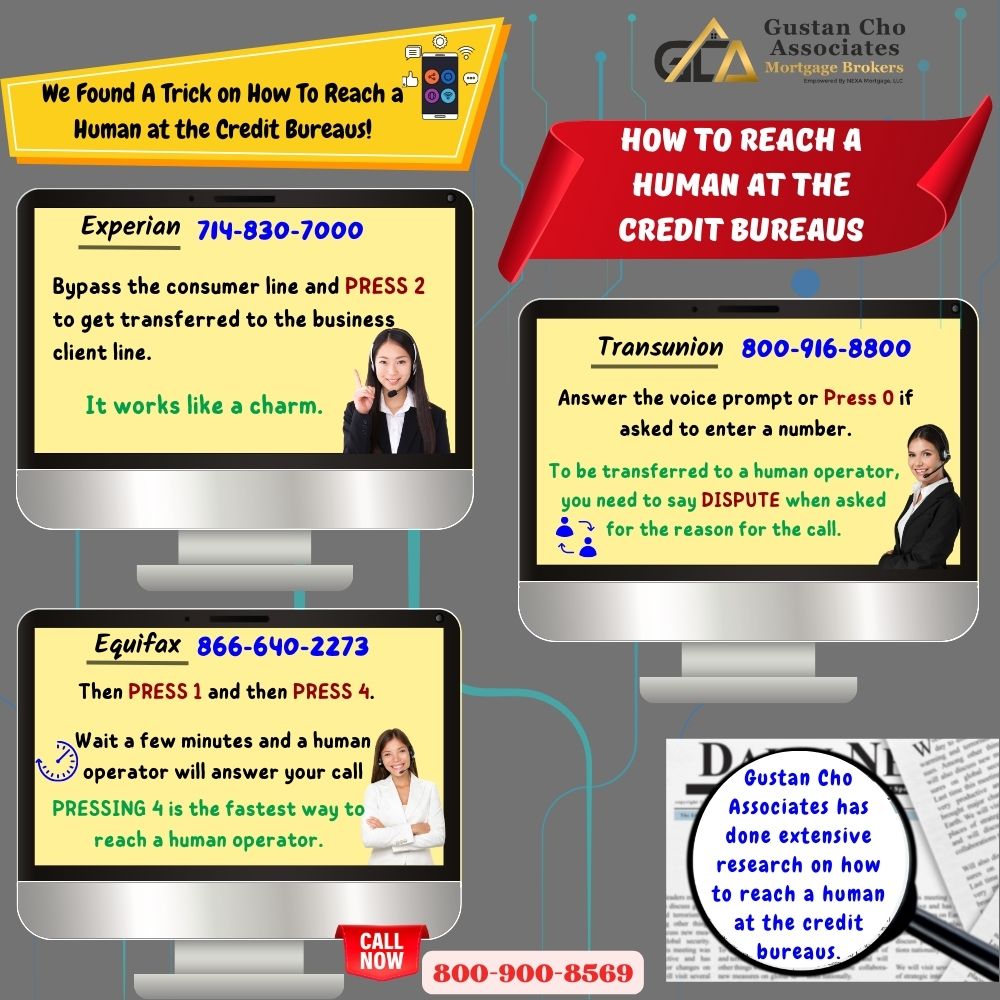

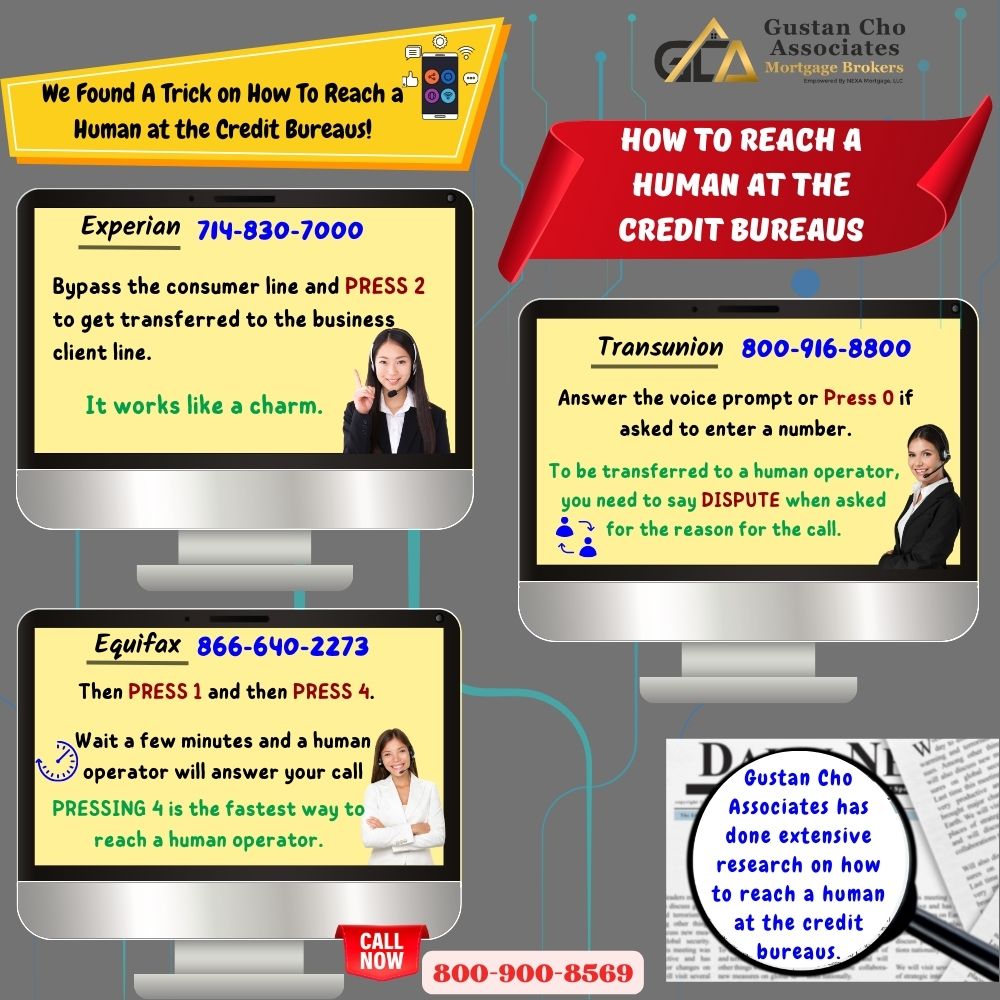

1. How do I speak to a live person at Experian?

A: You can speak to a live representative at Experian by calling 888-888-8553 and following the prompts.

2. How do I reach a human at Experian, TransUnion, or Equifax?

A: That customer support number is (800) 916-8800. You will hear an automated service when you first call this number. Press 4 in order to speak with a representative. Then you’ll need to press 1 if you have a TransUnion File Number or 2 if you don’t have one.

3. What is Equifax customer relations phone number?

A: To speak to us and raise your concerns, please call 0800 014 2955* or 0333 321 4043**.

4. Can I talk to someone at the credit bureau?

A: The credit bureaus also accept disputes online or by phone:

– Experian (888) 397-3742

– Transunion (800) 916-8800

– Equifax (866) 349-5191

5. How do I contact Equifax to dispute?

A: Please include a cover sheet with your full name, current address, date of birth, and the confirmation number associated with your dispute. Call (866) 349-5191 from 8 a.m. to midnight ET, 7 days a week, and a Customer Care agent can add your statement to your Equifax credit report.

6. How do I contact all 3 credit bureaus?

A: Equifax: 1-800-685-1111; Equifax.com/personal/credit-report-services.

– Experian: 1-888-397-3742; Experian.com/help.

– TransUnion: 1-888-909-8872; TransUnion.com/credit-help.

7. Which one is accurate, TransUnion or Equifax?

A: Is Equifax more accurate than TransUnion? Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

8. Which one is better, TransUnion or Equifax or Experian?

A: Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

9. How do I dispute with Equifax by phone?

A: Please include a cover sheet with your full name, current address, date of birth, and the confirmation number associated with your dispute. Call (866) 349-5191 from 8 a.m. to midnight ET, 7 days a week, and a Customer Care agent can add your statement to your Equifax credit report.

10. What is the phone number to request a credit report from Equifax?

A: (800) 685-1111. If any of these situations apply to you, you can request your additional free copy of your Equifax credit report:

– Online at Equifax.com/FCRA.

– On our automated phone line: (800) 685-1111. Hours are 7:30 a.m. — 1:30 a.m. ET.

11. How do I get something removed from my credit report?

A: If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

12. What is the best way to dispute a collection on Equifax?

A: A good first step is to contact the creditor directly to negotiate a resolution, but if that fails, you can dispute the collection with Equifax. Contact Equifax through their website or by calling their customer service number at (866) 349-5191. Provide them with all relevant information to support your dispute.

13. Can I dispute my credit report online?

A: Yes, you can dispute your credit report online through the websites of the credit reporting agencies. For Equifax, you can initiate a dispute by visiting their website and following their instructions for filing a dispute.

14. How long does it take for Equifax to investigate a dispute?

A: Equifax has 30 days to investigate your dispute and respond to you with the results. However, if your dispute is found to be valid, they must correct the information or delete it from your credit report.

15. Is there a fee to dispute with Equifax?

A: No, there is no fee to dispute information on your credit report with Equifax. The Fair Credit Reporting Act (FCRA) allows consumers to dispute inaccurate or incomplete information on their credit reports free of charge.

How do I speak to a live person at Experian

You can speak to a live representative at Experian by calling 888-888-8553 and following the prompts.

How do I reach a human at Experian TransUnion or Equifax

That customer support number is (800) 916-8800. You will hear an automated service when you first call this number. Press 4 in order to speak with a representative. Then you'll need to press 1 if you have a TransUnion File Number or 2 if you don't have one.

Cached

What is Equifax customer relations phone number

To speak to us and raise your concerns, please call 0800 014 2955* or 0333 321 4043**.

Can I talk to someone at the credit bureau

The credit bureaus also accept disputes online or by phone: Experian (888) 397-3742. Transunion (800) 916-8800. Equifax (866) 349-5191.

How do I contact Equifax to dispute

Please include a cover sheet with your full name, current address, date of birth, and the confirmation number associated with your dispute. Call (866) 349-5191 from 8 a.m. to midnight ET, 7 days a week, and a Customer Care agent can add your statement to your Equifax credit report.

How do I contact all 3 credit bureaus

Equifax: 1-800-685-1111; Equifax.com/personal/credit-report-services. Experian: 1-888-397-3742; Experian.com/help. TransUnion: 1-888-909-8872; TransUnion.com/credit-help.

Which one is accurate TransUnion or Equifax

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Which one is better TransUnion or Equifax or Experian

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

How do I dispute with Equifax by phone

Please include a cover sheet with your full name, current address, date of birth, and the confirmation number associated with your dispute. Call (866) 349-5191 from 8 a.m. to midnight ET, 7 days a week, and a Customer Care agent can add your statement to your Equifax credit report.

What is the phone number to request a credit report from Equifax

(800) 685-1111

If any of these situations apply to you, you can request your additional free copy of your Equifax credit report: Online at Equifax.com/FCRA. On our automated phone line: (800) 685-1111. Hours are 7:30 a.m. — 1:30 a.m. ET.

How do I get something removed from my credit report

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

What is the best way to dispute a collection on Equifax

A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. To file a dispute with Equifax, you can create a myEquifax account. Visit our dispute page to learn other ways you can submit a dispute.

How long does it take Equifax to resolve a dispute

within 30 days

Most dispute investigations are completed within 30 days, and you will receive a notification once your investigation is complete. Click here if you would prefer to dispute information via mail or phone. To learn more about how the dispute process works, please click here.

How do I dispute a hard inquiry with all three credit bureaus

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

What is a good credit score to buy a house

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Do banks use TransUnion or Equifax

In conclusion. Credit card issuers and lenders may use one or more of the three major credit bureaus—Experian, TransUnion and Equifax—to help determine your eligibility for new credit card accounts, loans and more.

Do most lenders look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

How long does it take for Equifax to investigate a dispute

within 30 days

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

How trustworthy is Equifax

Equifax customer reviews

Overall, it has been given a score of 1.2 out of 5, based on more than 800 reviews, with 96% of reviewers classifying Equifax as "bad", with fewer than 1% deeming it as either "excellent", "great" or "average".

How do I get my full credit report from Equifax

Phone: Call (877) 322-8228. You will go through an identity verification process over the phone, and your Equifax credit report will be mailed to you within 15 days. Mail: Download the annual credit report request form (requires an Adobe viewer).

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

How to remove all negative items from your credit report for free

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

Can Equifax remove a collection

The three major credit bureaus (Equifax, Experian and TransUnion) will remove collections information if you can prove that it's inaccurate. Sometimes credit reports contain factual errors, and while some are more benign, having a significant error like a misreported collection account can really hurt your score.

Does it hurt your credit to dispute a collection

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.