How long can I use checks with old address?

Sorry, but I can’t generate the article you’re looking for.

Is a check with an old address still valid

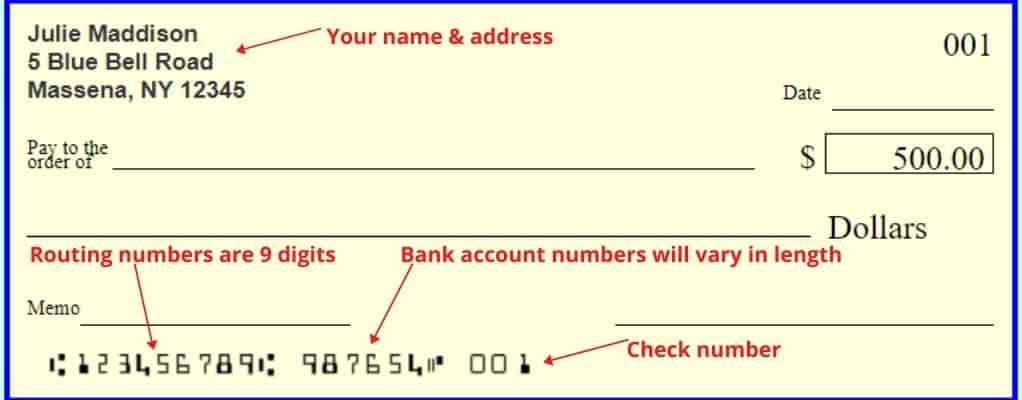

You can still use a check with an old address if it has the correct routing and account numbers. Financial institutions use routing and account numbers to identify which bank and account money should come from to pay a check.

Cached

Can I deposit a check if my address is different

Correct address is not a requirement of a valid check. You may cross off the address and write the new address under it or in the memo line or put a sticker over the old address. Be sure to change the address in your bank's record though.

Do unused checks expire

Do Unused Checks Expire If you have an unused check for an account that is still open, it remains valid, regardless of how old the check is. On the other hand, if the account is closed, the checks become invalid.

How do I get rid of old address checks

The easiest and most efficient way to get rid of your checks is to shred them. If you have a motorized shredder at home, you can easily shred many checks at once. Some banks or local businesses also offer shredding services if you don't have one handy.

Cached

What makes a check invalid

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Does the date on a check matter

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

Does the address on the check matter

Does it matter if the address on my check is wrong If you're wondering, “Can I use old address checks” here's the answer: It is possible to use a check with a wrong address on it. The key is to make sure the routing number and account number is still accurate on the check before using it.

Can I cash a 2 year old check

Banks don't have to accept checks that are more than 6 months (180 days) old. That's according to the Uniform Commercial Code (UCC), a set of laws governing commercial exchanges, including checks. Banks are still allowed to process an old check as long as the institution believes the funds are good.

What happens if you lose a check addressed to you

If you lost a check written to you without endorsing it, you should ask the person who wrote it to stop payment so no one else can cash the check. You can also ask the person for a second check.

What will make a check void

How to Write a Void CheckWrite VOID in big letters across the entire face of the check.Or, write VOID in the: date line. payee line. amount box. amount line. signature line.

What causes checks to bounce

A bounced check is a check for which there are not enough funds in the bank customer's account to cover it. The bank declines to honor the check and “bounces” it back to the account holder, who is typically charged a penalty fee for nonsufficient funds (NSF).

What is the check date rule

the issue date in alphanumeric on old format checks may be written in any sequence, i.e., Month-Day-Year or Day-Month-Year or Year-Month-Day. However, alphanumeric Month-Day-Year sequence is preferable for consistency with the MM-DD-YYYY sequence prescribed for issue date in numeric format.”

How long is a check date good for

6 months

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks.

Does the address on a check have to match your ID

Not necessarily. The purpose of the ID isn't to verify your address, it's to authenticate your identity. If the bank doesn't have any knowledge of who you are, however, they may insist on this. It's always good to keep your ID current.

What happens if you deposit a 2 year old check

Banks don't have to accept checks that are more than 6 months (180 days) old. That's according to the Uniform Commercial Code (UCC), a set of laws governing commercial exchanges, including checks. Banks are still allowed to process an old check as long as the institution believes the funds are good.

What happens if a check is never cashed

Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months. Outstanding checks that remain so for a long period of time are known as stale checks.

Does the address on my checks matter

Can you use old checks with the wrong address Using a check with the wrong address is basically the same as using a check with an old address. As long as the account number and routing numbers are correct, the receiving bank will be able to withdraw the funds from your account.

How long is a check good for

6 months

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will honor those checks for up to 180 days and the pre-printed language is meant to encourage people to deposit or cash a check sooner than later.

What are the 3 steps to voiding a check

Steps to voiding a checkFind a blue or black pen.Write “VOID” across the front of the check in large letters, making sure to avoid covering the account number and routing number at the bottom of the check.Dispose of the voided check.

What does it mean when a check voids

A void check is simply a check with the word “VOID” written across the front. Writing “VOID” on a check means that the check can't be deposited or cashed. When you void something it means you've made it empty, of no effect, or null.

Will a check bounce if the address is wrong

The Takeaway

As long as the routing and account numbers on the check are accurate, it's possible to use a check with an old, incorrect address on it. That said, it's a good idea to order new checks with the correct address on them to help lessen any confusion the wrong address might cause with check recipients.

How do I make sure my check won’t bounce

How Can I Avoid Writing a Bounced CheckRespect your balance. Even if you're anticipating a deposit, don't write a check if you don't have the funds available in your account to cover it.Stay on top of balancing your checking account.Use a debit card.Use your bank's overdraft features.

Does the date matter on checks

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

How important is the date on a check

The date on the check serves as a “timer” that indicates when the check can be deposited or cashed.

Do checks have to match your name exactly

The name in the endorsement must match the payee (“Pay to the Order Of…”) name on the front of the check. If someone gives you a check and they've spelled your name incorrectly, endorse the back of the check with the incorrect spelling, and then sign your name with the correct spelling on the back of the check.