How much is a unit of Colonial Penn life insurance?

Colonial Penn Life Insurance: Key Points

1. What amount is a unit from Colonial Penn?

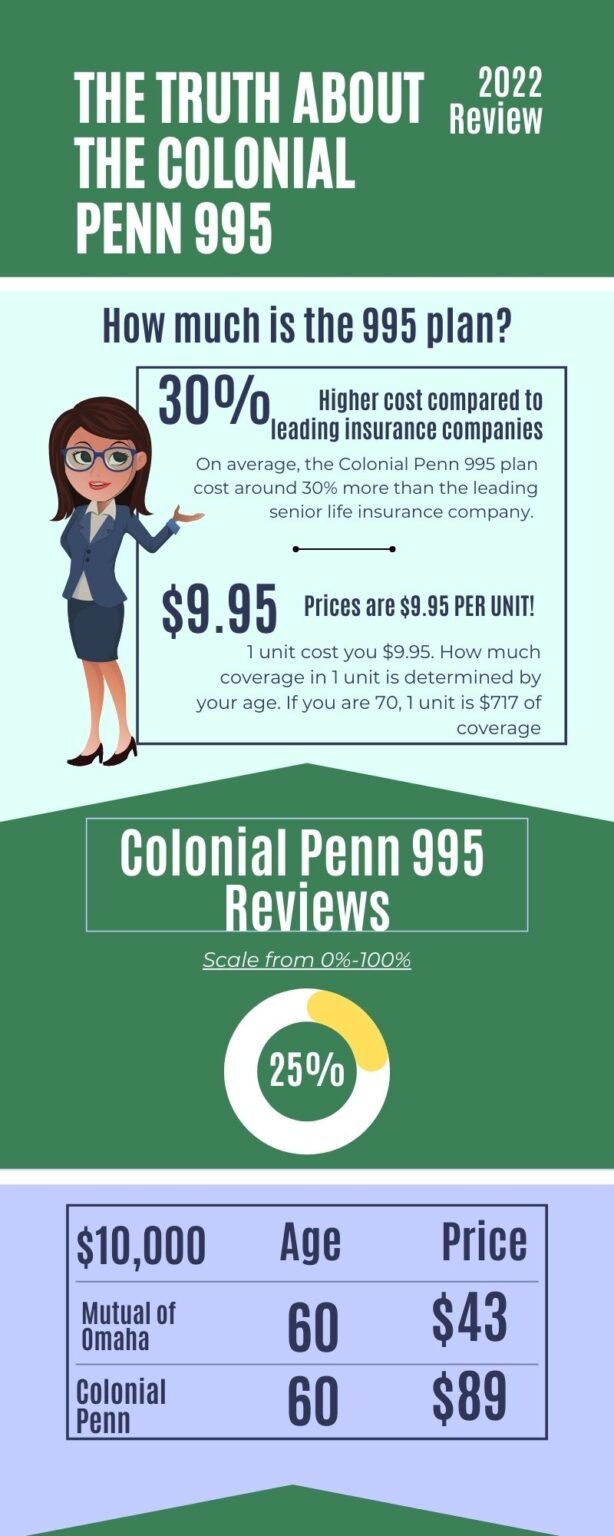

A unit of Colonial Penn coverage is the life insurance benefit amount you receive for $9.95 per month.

2. What is 1 unit of life insurance?

1 unit is determined based on your pay of the prior calendar year rounded up to the next higher $1,000.

3. Is Colonial Penn $9.95 a month?

Yes, Colonial Penn offers life insurance for $9.95 per month.

4. What is the death benefit of Colonial Penn $9.95 plan?

The death benefit of the $9.95 plan includes a two-year graded death benefit.

5. How much is a unit of life insurance?

A unit of life insurance is commonly priced in $1,000 increments.

6. How much is life insurance a month for a single person?

The average cost of life insurance for a healthy 35-year-old is around $25 a month for a woman and $30 for a man.

7. How many dollars is a unit in life insurance?

Each unit of coverage in life insurance is worth $1,000.

8. How much is a unit worth in life insurance?

Each unit of coverage in term life insurance is worth $1,000.

9. Does Colonial Penn pay after age 85?

Colonial Penn’s guaranteed acceptance life insurance is available to people ages 50 to 85, except in Minnesota, New Jersey, and Pennsylvania.

10. Is term 100 a permanent life insurance?

Term 100 is a permanent life insurance plan with guaranteed level premiums payable until age 100.

11. Will life insurance pay for a funeral?

Life insurance policies can be used to pay for funeral expenses and other financial needs.

What amount is a unit from Colonial Penn

$9.95 per month

A unit of Colonial Penn coverage is the life insurance benefit amount you receive for $9.95 per month. Your age and gender determine the exact amount of insurance coverage a single unit provides.

Cached

What is 1 unit of life insurance

Types of Life Insurance

| 1 unit = | your pay of the prior calendar year rounded up to the next higher $1,000. (For the first year of coverage your employer will estimate your pay.) |

|---|---|

| Example: | $43,500 pay = $44,000 coverage |

Is Colonial Penn $9.95 a month

Colonial Penn Life Insurance $9.95 Per Month Reviews

Colonial Penn's 995 plan is guaranteed the acceptance of life insurance products with limited underwriting and more minor death benefits that accumulate cash value. Unlike term life coverage.

Cached

What is the death benefit of Colonial Penn $9.95 plan

Colonial Penn Guaranteed Acceptance Life has a two-year graded death benefit. If death occurs within the first two policy years, the death benefit payment equals a full refund of all premiums paid plus 7% interest on those payments. After two years, your beneficiaries will receive the full death benefit.

Cached

How much is a unit of life insurance

Your premium is what you pay collectively for all of those buckets of coins. The unit price is what you pay per bucket of coins. Life insurance will commonly price out their death benefit in $1,000 units. So when you're buying a policy with a $250,000 death benefit, what you're really buying is 250 buckets of coins.

How much is life insurance a month for a single person

The average cost of life insurance for a healthy 35-year-old is around $25 a month for a woman and $30 for a man for a $500,000 20-year term policy. If you're a smoker or suffer from major health conditions, expect to pay significantly higher premiums. Rates are provided by PolicyGenius and are valid as of June 2023.

How many dollars is a unit in life insurance

$1,000 units

The unit price is what you pay per bucket of coins. Life insurance will commonly price out their death benefit in $1,000 units. So when you're buying a policy with a $250,000 death benefit, what you're really buying is 250 buckets of coins.

How much is a unit worth in life insurance

Term life insurance companies sell life insurance “by the unit.” Each unit of coverage is worth $1,000.

Does Colonial Penn pay after age 85

In every state except Minnesota, New Jersey and Pennsylvania, Colonial Penn's guaranteed acceptance life insurance is available to people ages 50 to 85. The age range is 50 to 75 in Minnesota and 56 to 85 in Pennsylvania.

Is term 100 a permanent life insurance

What is Term 100 Term 100, is a permanent life insurance protection plan – that's insurance protection for as long as you live – with guaranteed level premiums payable until age 100.

Will life insurance pay for funeral

Does life insurance cover burial costs Yes, life insurance policies will pay a lump sum when you die to a beneficiary of your choice. That money can be used to pay for your funeral or for any other general financial needs of your survivors.

What does unit mean colonial life insurance

Guaranteed acceptance

A unit of coverage corresponds to the life insurance benefit amount that an individual can purchase. Coverage amounts are based on age, gender (in Montana, age only) and state of residence. The price per unit is a fixed amount. Multiple units can be purchased to help build a larger death benefit.

How much is $100000 life insurance a month

The average monthly cost of life insurance for a 10-year $100,000 policy is $11.02 or $12.59 for a 20-year policy.

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value.

What is price per unit of insurance

The rate is the price per unit of exposure. In fire insurance, for example, the rate may be expressed as $1 per $100 of exposed property; if an insured has $1,000 of exposed property, the premium will thus be $10.

What is the cut off age for Colonial Penn

Colonial Penn life insurance policies

Colonial Penn offers whole life insurance to those ages 40 to 75 (50 to 73 for men and 50 to 75 for women in New York).

What is the maximum age for Colonial Penn

Colonial Penn's whole life insurance policy is available to those between the ages of 40 and 75 in most states, with the maximum coverage amount being $50,000.

How much is a $100000 term life policy

How much does a $100,000 term life insurance policy cost The average monthly cost for $100,000 in life insurance for a 30-year-old is $11.02 for a 10-year policy and $12.59 for a 20-year policy.

What happens after 20-year term life insurance

What does a 20-year term life insurance policy mean This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

How long does it take for life insurance to pay out

within 60 days

Life insurance providers usually pay out within 60 days of receiving a death claim filing. Beneficiaries must file a death claim and verify their identity before receiving payment. The benefit could be delayed or denied due to policy lapses, fraud, or certain causes of death.

How much does life insurance pay out after death

This means that beneficiaries will receive 100% of the death benefit amount. In addition, life insurance payouts can be used for any purpose, so beneficiaries can use the money to cover expenses related to the death, such as funeral costs or outstanding debts.

How much does a $500000 whole life policy cost

The cost of a $500,000 term life insurance policy depends on several factors, such as your age, health profile and policy details. On average, a 40-year-old with excellent health buying a $500,000 life insurance policy will pay $18.44 a month for a 10-year term and $24.82 a month for a 20-year term.

What is the cash value of a $25 000 life insurance policy

Example of Cash Value Life Insurance

Consider a policy with a $25,000 death benefit. The policy has no outstanding loans or prior cash withdrawals and an accumulated cash value of $5,000. Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000.

How much does a $1 million dollar whole life insurance policy cost

The cost of a $1 million life insurance policy for a 10-year term is $32.05 per month on average. If you prefer a 20-year plan, you'll pay an average monthly premium of $46.65.

What is cost per 1 unit

What is cost per unit Cost per unit refers to both the variable costs and fixed costs associated with producing and delivering a single unit of any product to an end consumer. Monitoring your cost of goods sold helps create context to set pricing and ensure profit is generated.