Is homeowners insurance going up in 2021?

Why did my homeowners insurance go up so much in 2021?

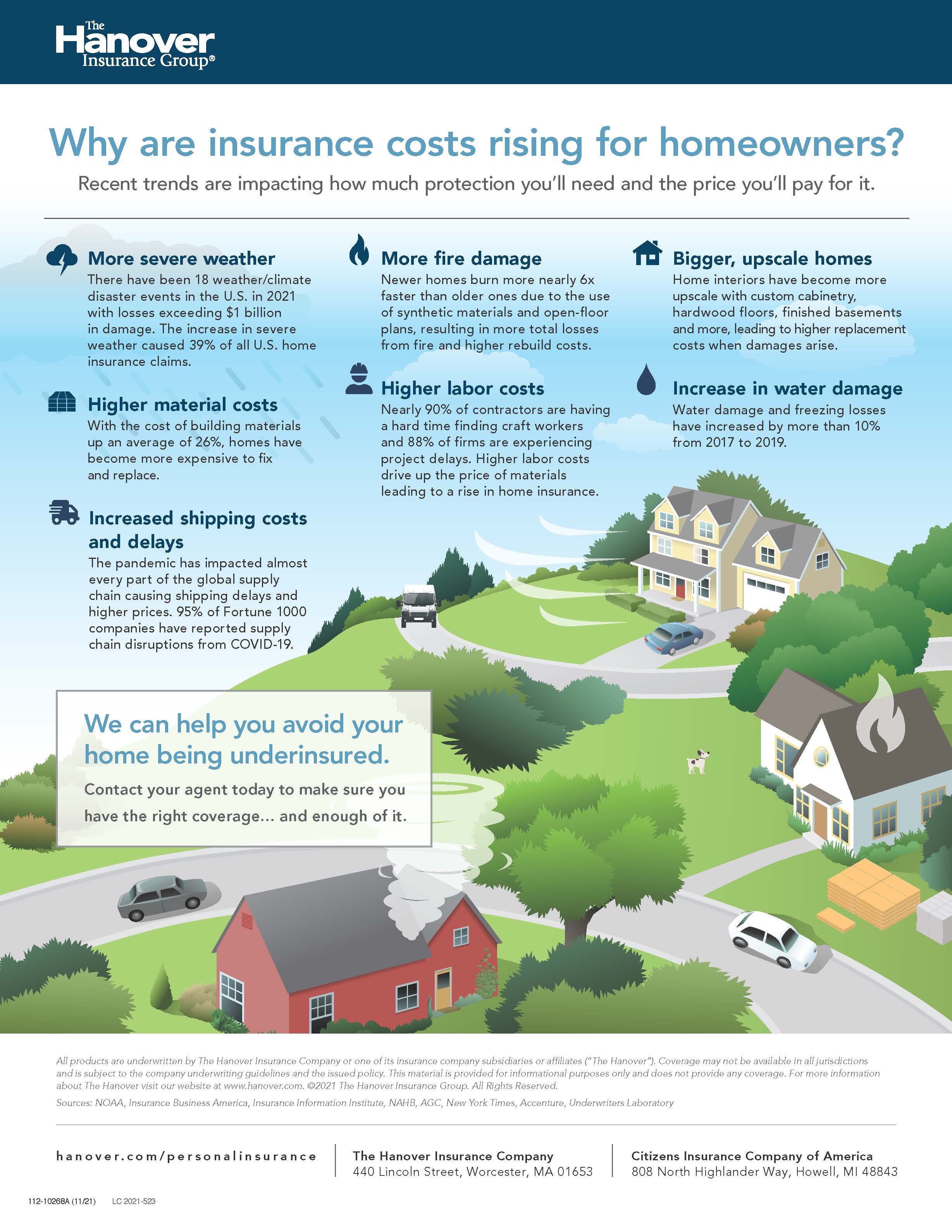

There are a laundry list of reasons your home insurance premiums went up in 2021, but the main culprits of last year’s rate hikes were rising labor and construction costs, supply chain issues, and the omnipresent threat of climate change.

How much will homeowners insurance increase in 2023?

Average premiums for homeowners insurance are slated for yet another big increase in 2023, according to a new report. Nationwide, the average cost of homeowners insurance is projected to jump 9%, or by about $150, according to a recent report by online marketplace Insurify.

Why has my homeowners insurance doubled?

In most cases, the recent surge in homeowners insurance premiums can be attributed to the inflationary environment or recent natural disasters, but there are other factors that could be weighing on your insurance costs. The age of your home is one example.

Why is home insurance going up so fast?

Home insurance premiums are on the rise, and a key driver for the price increase is climate change. Yet, Americans are moving fastest to Florida, Texas and other states most at risk for climate-related natural disasters, according to a new study from LexisNexis Risk Solutions, a data and analytics provider.

Can you negotiate home insurance rates?

You cannot negotiate your homeowners insurance quote, but you can lower the amount you pay by taking a variety of steps—maintaining a good credit score, paying in full, installing protective devices, researching discounts, and more.

Does homeowners insurance increase with inflation?

How inflation is affecting homeowners insurance premium increases. Homeowners insurance premiums can increase for several reasons, but the higher-than-expected increases homeowners are currently seeing are primarily due to inflation.

What is the insurance forecast for 2023?

We forecast premiums to grow by 7.5% in 2023 and 5.5% in 2024. Slowing rate gains in commercial liability will likely be partly offset by acceleration in property and personal lines. Reserve adequacy poses a key downside risk if inflation causes losses to develop more than expected.

Which states have the highest homeowners insurance rates?

10 Most Expensive States for Homeowners Insurance

| # | State | Average Rate (for $300-399k insurance) |

|---|---|---|

| 1 | Oklahoma | $2,493 |

| 2 | Florida | $2,332 |

| 3 | Louisiana | $2,260 |

| 4 | Texas | $2,121 |

What are 3 things that could make home insurance go up?

Why Homeowners Insurance Rates Go Up

1: Filing Claims May Mean Higher Premiums.

2: Property Changes & Attractive Nuisances.

3: Inflation Strikes Again.

4: Construction Costs in Your Area Affect Your Rebuild Cost.

5: Your Insurance Score Dropped.

How much did insurance go up in 2023?

If you’re asking yourself why your car insurance rate went up, you are not alone. According to proprietary rate data from analytics company Quadrant Information Services, the average annual rate for a full coverage policy in 2022 was $1,771. In 2023, that same policy may cost you $2,014, an increase of 14 percent.

Why did my homeowners insurance go up so much in 2021

Why did my homeowners insurance go up in 2021 There are a laundry list of reasons your home insurance premiums went up in 2021, but the main culprits of last year's rate hikes were rising labor and construction costs, supply chain issues, and the omnipresent threat of climate change.

Cached

How much will homeowners insurance increase in 2023

9%

Average premiums for homeowners insurance are slated for yet another big increase in 2023, according to a new report. Nationwide, the average cost of homeowners insurance is projected to jump 9%, or by about $150, according to a recent report by online marketplace Insurify.

Why has my homeowners insurance doubled

In most cases, the recent surge in homeowners insurance premiums can be attributed to the inflationary environment or recent natural disasters, but there are other factors that could be weighing on your insurance costs. The age of your home is one example.

Why is home insurance going up so fast

Home insurance premiums are on the rise, and a key driver for the price increase is climate change. Yet, Americans are moving fastest to Florida, Texas and other states most at risk for climate-related natural disasters, according to a new study from LexisNexis Risk Solutions, a data and analytics provider.

Can you negotiate home insurance rates

Is homeowners insurance negotiable You cannot negotiate your homeowners insurance quote, but you can lower the amount you pay by taking a variety of steps—maintaining a good credit score, paying in full, installing protective devices, researching discounts, and more.

Does homeowners insurance increase with inflation

How inflation is affecting homeowners insurance premium increases. Homeowners insurance premiums can increase for several reasons, but the higher-than-expected increases homeowners are currently seeing are primarily due to inflation.

What is the insurance forecast for 2023

We forecast premiums to grow by 7.5% in 2023 and 5.5% in 2024. Slowing rate gains in commercial liability will likely be partly offset by acceleration in property and personal lines. Reserve adequacy poses a key downside risk if inflation causes losses to develop more than expected.

Which states have the highest homeowners insurance rates

10 Most Expensive States for Homeowners Insurance

| # | State | Average Rate (for $300-399k insurance) |

|---|---|---|

| 1 | Oklahoma | $2,493 |

| 2 | Florida | $2,332 |

| 3 | Louisiana | $2,260 |

| 4 | Texas | $2,121 |

What are 3 things that could make home insurance go up

Why Homeowners Insurance Rates Go Up1: Filing Claims May Mean Higher Premiums.2: Property Changes & Attractive Nuisances.3: Inflation Strikes Again.4: Construction Costs in Your Area Affect Your Rebuild Cost.5: Your Insurance Score Dropped.

How much did insurance go up in 2023

If you're asking yourself why your car insurance rate went up, you are not alone. According to proprietary rate data from analytics company Quadrant Information Services, the average annual rate for a full coverage policy in 2022 was $1,771. In 2023, that same policy may cost you $2,014, an increase of 14 percent.

What is one way to reduce the cost of a homeowners insurance policy

Increase your deductible

A quick way to reduce your premium is to raise your homeowners insurance deductible, the amount you pay if you have to make a claim. If you have a $1,000 deductible, you could save an average of 11% a year by increasing it to $2,500, according to NerdWallet's rate analysis.

Is a $2500 deductible good home insurance

Is a $2,500 deductible good for home insurance Yes, if the insured can easily come up with $2,500 at the time of a claim. If it's too much, they're better off with a lower deductible, even if it raises the amount they pay in premiums.

What will 2023 look like financially

In 2023, economic activity is projected to stagnate, with rising unemployment and falling inflation. Interest rates are projected to remain high initially and then gradually decrease in the next few years as inflation continues to slow.

How are insurance companies doing in 2023

Insurance firms face multiple headwinds in 2023 as the economy takes a downward turn and industry conditions become more uncertain. Inflation has been one of the biggest economic challenges for insurers over the past year.

What state has the cheapest homeowners insurance

Across the country, the average annual cost for $300-399k total insurance is around $1,307. In Utah – the state with the cheapest rate for homeowners insurance – annual premiums cost just over half of that. What other states have lower than average premiums

How much does the average American pay for home insurance

The average cost of homeowners insurance in the U.S. is $1,428 per year for $250,000 in dwelling coverage. However, your actual rates may vary depending on a variety of factors.

What are the 3 biggest factors in determining the cost for homeowners insurance

Factors like where you live, your home's replacement cost, and your policy deductible generally affect your home insurance premiums the most.

What are 2 things not covered in homeowners insurance

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won't be covered.

Why are insurance rates going up 2023

Even with inflation cooling a bit, the cost of car insurance keeps going up due to increased repair costs. Stubborn supply chain problems are also making things difficult and much pricier. Add in a labor shortage in the auto repair market and it's no surprise that big rate increases are expected as 2023 progresses.

Does credit score affect insurance rate

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states. Getting a quote, however, does not affect your credit.

What is the most common deductible on homeowners insurance

What Is the Standard Homeowners Insurance Deductible Typically, homeowners choose a $1,000 deductible (for flat deductibles), with $500 and $2,000 also being common amounts. Though those are the most standard deductible amounts selected, you can opt for even higher deductibles to save more on your premium.

Can I deduct home insurance on my taxes

You may look for ways to reduce costs including turning to your tax return. Some taxpayers have asked if homeowner's insurance is tax deductible. Here's the skinny: You can only deduct homeowner's insurance premiums paid on rental properties. Homeowner's insurance is never tax deductible your main home.

How long will the recession last in 2023

That's the prediction of The Conference Board. But some economists project the U.S. will avoid a contraction in GDP altogether.

Is a recession coming in 2023

Halfway through 2023, "The market has told us: no recession, no correction, no more rate hikes," Amanda Agati, chief investment officer for PNC Financial Services Asset Management Group, said in a report.

What is the outlook for property insurance in 2023

We forecast premiums to grow by 7.5% in 2023 and 5.5% in 2024. Slowing rate gains in commercial liability will likely be partly offset by acceleration in property and personal lines.