Is it better to take a lump sum or monthly pension?

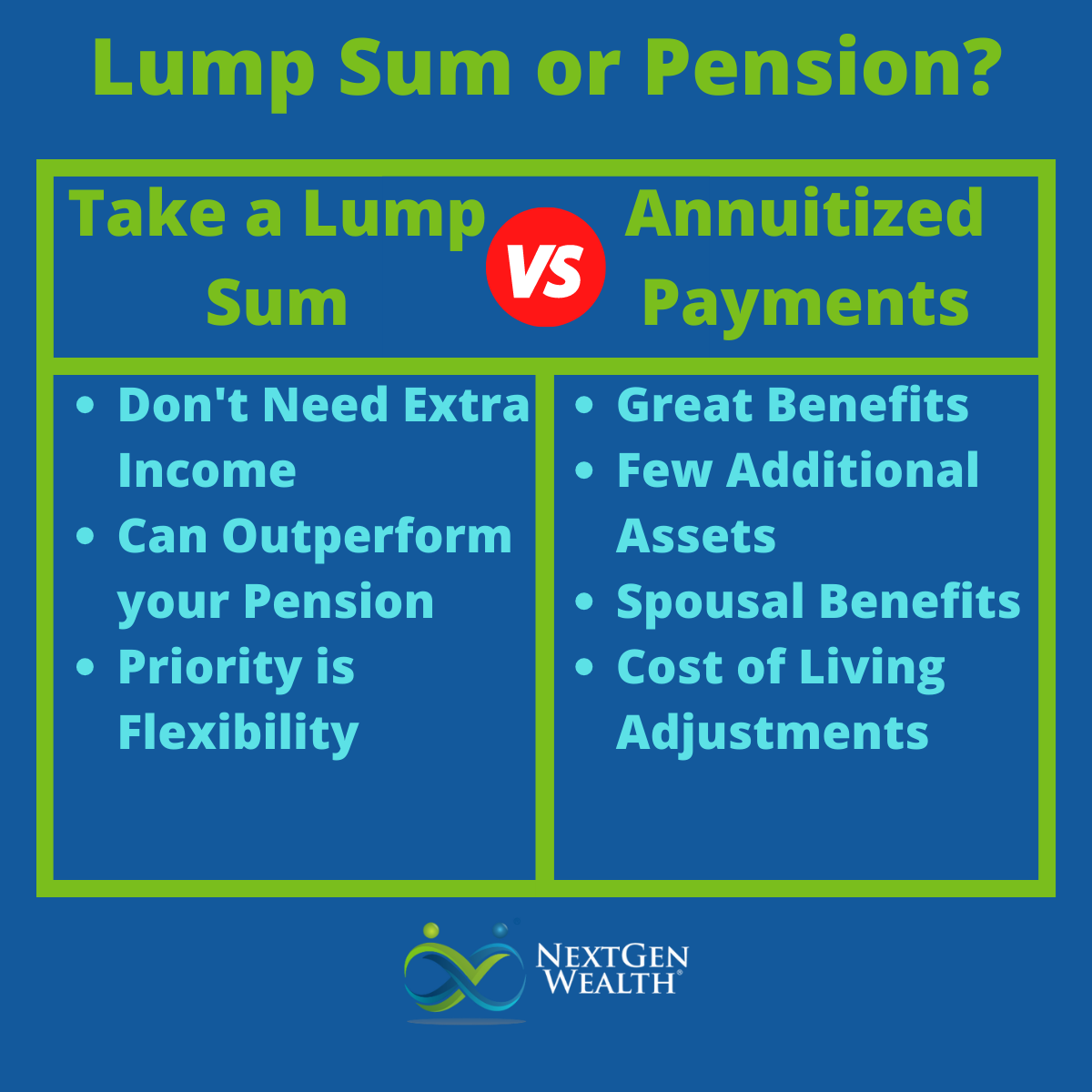

Key Points about Taking a Lump-Sum Pension

The disadvantages of taking a lump-sum pension include the potential decrease in pension value if the money is held in cash, affecting income for the rest of your life.

Question 1: What are the disadvantages of taking a lump-sum pension?

Single-life annuities can provide the highest monthly benefit but will cease to pay out upon your death, which makes it a good option for single individuals with no dependents.

Question 2: Which pension payout option is best?

If you are concerned about the financial situation of your pension provider, taking the lump-sum option may be more secure. Additionally, annuity payments without a cost-of-living adjustment will decrease in purchasing power over time due to inflation.

Question 3: Should I take my pension as an annuity or lump-sum?

The average pension payout per month is $4,989 for older households in 2021, according to data from the Bureau of Labor Statistics.

Question 4: What is the average pension payout per month?

To avoid paying taxes on a lump-sum pension payout, you can roll over the proceeds into an individual retirement account (IRA) or another eligible retirement account.

Question 5: How can I avoid paying tax on my pension lump sum?

The “50-70 rule” suggests aiming for an annual retirement income that is between 50% and 70% of your working income.

Question 6: What is a good pension lump sum?

Pensions are generally considered better than 401(k)s because they provide a guaranteed set income for life, with the investment and management risk on the employer.

Question 7: Is it better to cash out a pension or 401k?

Pensions offer greater stability than 401(k) plans since they guarantee a fixed monthly payment when you retire, allowing for better budgeting.

Question 8: Is a pension better than a retirement plan?

Investors can avoid taxes on a lump-sum pension payout by rolling over the proceeds into an individual retirement account (IRA) or another eligible retirement account.

Question 9: How do I avoid taxes on lump sum pension payout?

A $50,000 annuity with a lifetime income rider can result in monthly payments for life ranging from $284 to $646, depending on your age and when you start receiving the money.

Question 10: How much does a $50,000 annuity pay per month?

An earned pension income of $30,000 annually adds $2,500 per month to a person’s net worth, which is 25 times $100.

Question 11: How much is a $30,000 pension worth?

What are the disadvantages of taking lump-sum pension

The drawbacks of taking a lump sum

Taking a lump sum out of it early on could affect your income for the rest of your life considerably. Pension value can decrease: If you choose to withdraw and hold the money in cash, for example in a savings account, the value can decrease in real terms.

Which pension payout option is best

Single-Life Annuities

This option generally provides you with the highest monthly benefit; however, payouts will cease when you die since funds are only paid out to one person (you). This is often an excellent option if you're single with no dependents.

Should I take my pension as an annuity or lump-sum

If you're really concerned about losing your pension because of the pension provider's financial situation or inability to pay out, taking the lump sum may end up being the more secure option. If your annuity does not have a cost-of-living adjustment, its purchasing power will decrease over time due to inflation.

Cached

What is the average pension payout per month

Average Monthly Retirement Income

According to data from the BLS, average incomes in 2021 after taxes were as follows for older households: 65-74 years: $59,872 per year or $4,989 per month.

How can I avoid paying tax on my pension lump sum

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account (IRA) or other eligible retirement accounts.

What is a good pension lump sum

The 50 – 70 rule is a quick estimate of how much you could spend during your retirement. It suggests that you should aim for an annual income that is between 50% and 70% of your working income.

Is it better to cash out a pension or 401k

Though there are pros and cons to both plans, pensions are generally considered better than 401(k)s because all the investment and management risk is on your employer, while you are guaranteed a set income for life.

Is a pension better than a retirement plan

Pensions offer greater stability than 401(k) plans. With your pension, you are guaranteed a fixed monthly payment every month when you retire. Because it's a fixed amount, you'll be able to budget based on steady payments from your pension and Social Security benefits. A 401(k) is less stable.

How do I avoid taxes on lump sum pension payout

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account (IRA) or other eligible retirement accounts.

How much does a $50000 annuity pay per month

According to our data, if you purchase a $50,000 annuity with a lifetime income rider, you can expect to receive monthly payments for life between $284 and $646. Your age determines the payment amount when purchasing the annuity contract and how long you wait to receive the money.

How much is a $30000 pension worth

As an example, examine how much an earned pension income of $30,000 would add to a person's net worth. A defined benefit plan income of $30,000 annually is $2,500 per month, which is 25 times $100.

Is $6,000 a month a good pension

With $6,000 a month, you have more money than the average retiree—Americans aged 65 and older generally spend roughly $4,000 a month—and therefore more options on where to live. Below, we list five spectacular places where you might consider spending your golden years.

At what age are pensions not taxable

If you receive pension or annuity payments before age 59½, you may be subject to an additional 10% tax on early distributions, unless the distribution qualifies for an exception.

How much tax do I pay on a lump sum pension

The Internal Revenue Service (IRS) classifies pension distributions as ordinary income. This means that they are taxed at the highest income tax rates. The agency says that mandatory income tax withholding of 20% applies to the majority of lump sum distributions from employer retirement plans.

How much is a 50000 pension worth

Assuming you earn $50,000 and you're 61 years old now, Social Security's quick calculator says that you might expect roughly $19,260 per year at your Full Retirement Age of 67.

How long does it take to receive lump sum pension

around four to five weeks

How long does it take to receive a pension lump sum Usually it will take around four to five weeks from the date of your request for your pension provider to release your lump sum.

What is a good pension amount

The 50 – 70 rule is a quick estimate of how much you could spend during your retirement. It suggests that you should aim for an annual income that is between 50% and 70% of your working income.

What is the best age to retire with pension

67-70 – During this age range, your Social Security benefit, if you haven't already taken it, will increase by 8% for each year you delay taking it until you turn 70. So, if your benefit will be, say, $2,500/month if you start at your full retirement age, it would be more than $3,300/month if you can wait.

What is the tax rate on a lump sum pension payout

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account (IRA) or other eligible retirement accounts. Here are two things you need to know: 20% withholding.

How much does a $300000 annuity pay per month

How Much Does A $300,000 Annuity Pay Per Month A $300,000 annuity would pay you approximately $1,314 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

What monthly income can I get for $100000 annuity

A $100,000 annuity would pay you approximately $613 each month for the rest of your life if you purchased the annuity at age 70 and began taking payments immediately. This guide will answer the following questions: What is the monthly payout for a $100,000 annuity

Is $3 000 a month a good pension

If you have a low living cost and can supplement your income with a part-time job or a generous pension, then retiring on $3,000 a month is certainly possible. However, if you have a high living cost or rely solely on Social Security benefits, retiring on $3,000 a month may be more difficult.

Is $4000 a month a good pension

First, let's look at some statistics to establish a baseline for what a solid retirement looks like: Average monthly retirement income in 2021 for retirees 65 and older was about $4,000 a month, or $48,000 a year; this is a slight decrease from 2020, when it was about $49,000.

How much will my Social Security be reduced if I have a pension

How much will my Social Security benefits be reduced We'll reduce your Social Security benefits by two-thirds of your government pension. In other words, if you get a monthly civil service pension of $600, two-thirds of that, or $400, must be deducted from your Social Security benefits.

Does a lump sum pension affect Social Security

Receiving a lump sum pension payment won't affect your Social Security benefit amount assuming that you didn't work for an employer that was exempt from withholding U.S. Social Security taxes.