Is Mint an accurate credit score?

Is it safe to check credit score through Mint?

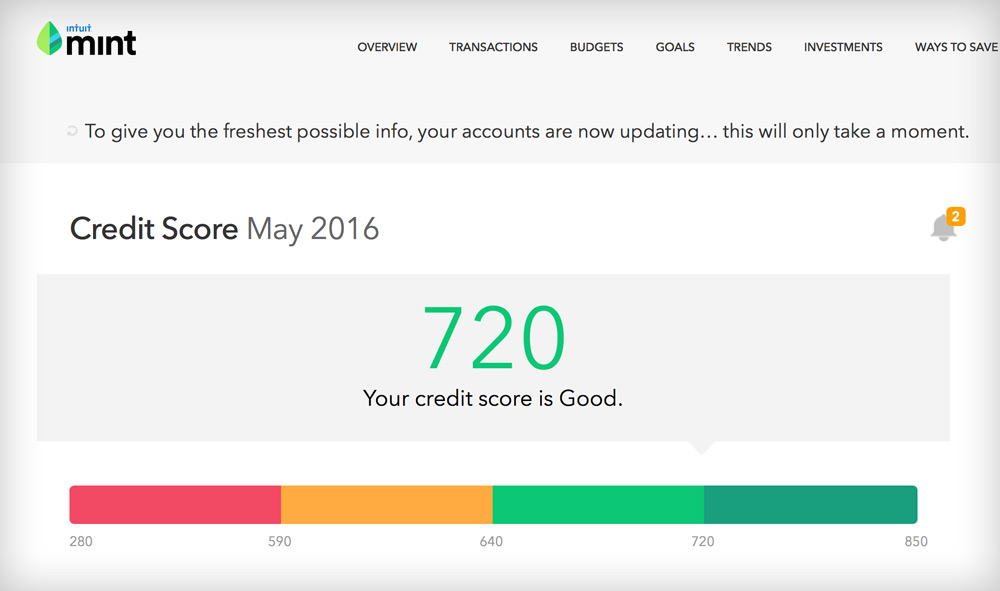

Checking your credit score through Mint doesn’t negatively affect your credit. Your score comes with a snapshot of your credit report, along with insights into how scores are calculated and steps you can take to improve your score. Mint also offers free credit monitoring through TransUnion.

Which credit score does Mint use?

Mint utilizes the VantageScore model, which measures credit on a scale ranging from 300 to 850. Your VantageScore is determined by six different factors: payment history, age and types of credit, credit utilization, total balances and debt, recent credit inquiries, and available credit.

Which credit score check is most accurate?

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Is the Mint app accurate?

Is Mint reliable Mint is a reliable software that lets you keep your finances organized. It supports 20,000+ local and international banks, including Bank of America, Chase, Discover, Citibank Credit Card, Apple Card, and more. It is definitely a reliable budgeting app that can be used free of charge.

Is Mint and Credit Karma the same thing?

Credit Karma acquires Mint financial management tool. Mint is a pioneer in the personal finance space, helping consumers make smart choices with their money.

What apps show the accurate credit score?

The 7 Best Credit Monitoring Apps in 2023Aura.Credit Karma.Credit Sesame.CreditWise by Capital One.myFICO.IdentityForce.Mint.

What is the difference between Mint and Credit Karma?

Credit Karma is focused on giving details about your credit scores and report, whereas Mint provides less in that area. Credit Karma pulls your full credit report and credit score from two sources, Equifax and TransUnion, as often as once a week.

Which credit score do lenders actually use?

The FICO credit score. Most lenders use the FICO credit score when assessing your creditworthiness for a loan. According to FICO, 90% of the top lenders use FICO credit scores.

How far off is Credit Karma?

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Why is my FICO score 100 points lower than Credit Karma?

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Does adding credit score to Mint affect credit score?

The good news is that checking your own credit is a soft inquiry and will not impact your score.

Is it safe to check credit score through Mint

Checking your credit score through Mint doesn't negatively affect your credit. Your score comes with a snapshot of your credit report, along with insights into how scores are calculated and steps you can take to improve your score. Mint also offers free credit monitoring through TransUnion.

Cached

Which credit score does Mint use

VantageScore model

Mint utilizes the VantageScore model, which measures credit on a scale ranging from 300 to 850. Your VantageScore is determined by six different factors: payment history, age and types of credit, credit utilization, total balances and debt, recent credit inquiries, and available credit.

Which credit score check is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Is the Mint app accurate

Is Mint reliable Mint is a reliable software that lets you keep your finances organized. It supports 20,000+ local and international banks, including Bank of America, Chase, Discover, Citibank Credit Card, Apple Card, and more. It is definitely a reliable budgeting app that can be used free of charge.

Cached

Is Mint and Credit Karma the same thing

Credit Karma acquires Mint financial management tool. Mint is a pioneer in the personal finance space, helping consumers make smart choices with their money.

What apps show the accurate credit score

The 7 Best Credit Monitoring Apps in 2023Aura.Credit Karma.Credit Sesame.CreditWise by Capital One.myFICO.IdentityForce.Mint.

What is the difference between Mint and Credit Karma

Credit Karma is focused on giving details about your credit scores and report, whereas Mint provides less in that area. Credit Karma pulls your full credit report and credit score from two sources, Equifax and TransUnion, as often as once a week.

Which credit score do lenders actually use

the FICO credit score

Which credit score do lenders actually use Most lenders use the FICO credit score when assessing your creditworthiness for a loan. According to FICO, 90% of the top lenders use FICO credit scores.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Why is my FICO score 100 points lower than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Does adding credit score to Mint affect credit score

The good news is that checking your own credit is a soft inquiry and will not impact your score.

Why is my Mint or Credit Karma score less than my actual

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

How close is Credit Karma to your actual score

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my Credit Karma score higher than FICO

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Which credit score is most accurate on Credit Karma

Credit Karma compiles its own accurate VantageScore based on that information. Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check.

Is Experian or Credit Karma more accurate

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Why is my FICO score 100 points higher than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Why is Credit Karma off by 100 points

The main reason why credit scores can vary is because they use different scoring models. A FICO® Score is calculated using a different formula than a VantageScore. And while most credit scores use a scale of 300 to 850, that isn't always the case.

How far off is Credit Karma from your actual credit score

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

How far off is Credit Karma from FICO

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

How many points is Credit Karma off

In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Why is my credit score 100 points different on Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Is a credit score of 650 good

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

How far off is Credit Karma from your actual score

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Why is my mint or Credit Karma score less than my actual

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.