Is there a charge to unfreeze your credit?

Is there a charge to unfreeze your credit?

There is no fee to add or remove a freeze. If you place a security freeze on your Experian credit file, it is not shared with the other two credit reporting agencies. You will need to contact Equifax and TransUnion separately if you wish to freeze your credit files with them.

What is the easiest way to unfreeze credit?

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

What happens when you unfreeze your credit?

The government stipulates that credit bureaus must unfreeze your account within a specified time — one hour if requested online or by phone, or within three business days if requested by mail. It prevents credit bureaus from selling your data.

Can you unfreeze your credit anytime?

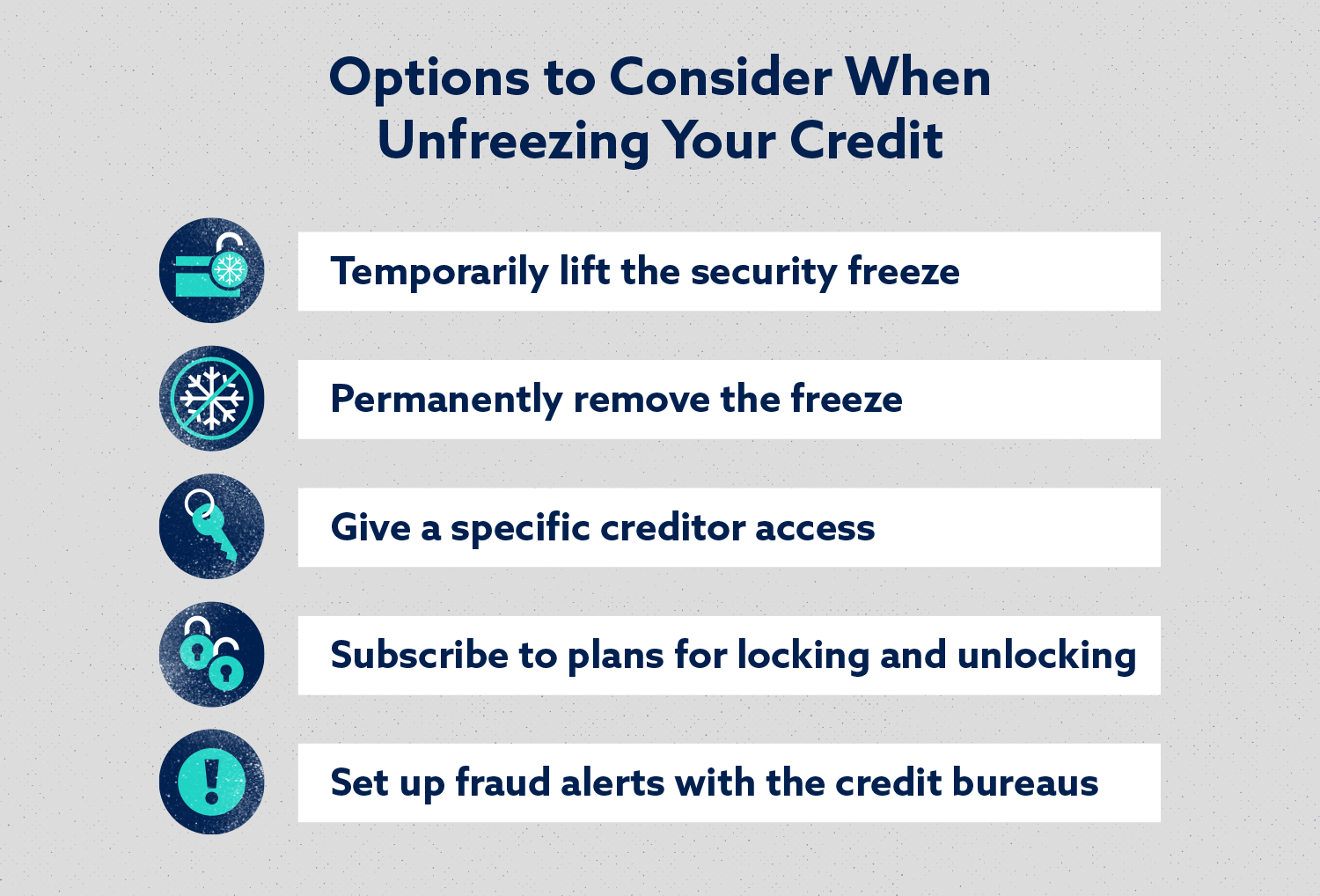

You can schedule an Experian credit freeze lift to occur during a specific time period or instantly with one click, if completing the process online. Unfreezing your Experian credit report can also be done permanently or temporarily.

Does Experian charge a fee?

Experian offers free access to credit scores and credit reports through various free product suites, as well as paid score and report options.

How long does it take to remove Experian freeze?

Updating your security freeze or unfreeze will take up to 3 days upon receiving your mailed request.

How do you unfreeze all 3 credit bureaus?

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus (Equifax, Experian, and TransUnion) individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks.

How long should I lift a credit freeze?

In most instances, a week is usually enough time for a business, credit card issuer, or potential employer to check your report. If you can find out which credit bureau they use, you only need to lift your freeze with that particular credit bureau.

What is the downside of freezing your credit?

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won’t affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

How long should I wait to unfreeze credit?

But to be safe, you may need to wait up to an hour for the request to be processed. The timing for unfreezing credit by phone is similar to doing it online. If you request to unfreeze your credit by mail, you may have to wait for up to three days after the credit bureau receives your request for the change to happen.

Do credit bureaus charge a fee?

You are entitled to get a free credit report annually from each of the nationwide credit reporting companies. It’s a good idea to review your credit reports for free every 12 months. Most or all of the information that goes into a credit score comes from your credit report.

How much does it cost to unfreeze Experian

There is no fee to add or remove a freeze. If you place a security freeze on your Experian credit file, it is not shared with the other two credit reporting agencies. You will need to contact Equifax and TransUnion separately if you wish to freeze your credit files with them.

What is the easiest way to unfreeze credit

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

Cached

What happens when you unfreeze your credit

The government stipulates that credit bureaus must unfreeze your account within a specified time — one hour if requested online or by phone, or within three business days if requested by mail. It prevents credit bureaus from selling your data.

Cached

Can you unfreeze your credit anytime

You can schedule an Experian credit freeze lift to occur during a specific time period or instantly with one click, if completing the process online. Unfreezing your Experian credit report can also be done permanently or temporarily.

Cached

Does Experian charge a fee

Experian offers free access to credit scores and credit reports through various free product suites, as well as paid score and report options.

How long does it take to remove Experian freeze

3 days

Updating your security freeze or unfreeze will take up to 3 days upon receiving your mailed request.

How do you unfreeze all 3 credit bureaus

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus (Equifax, Experian and TransUnion) individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks.

How long should I lift a credit freeze

In most instances a week is usually enough time for a business, credit card issuer, or potential employer to check your report. If you can find out which credit bureau they use, you only need to lift your freeze with that particular credit bureau.

What is the downside of freezing your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

How long should I wait to unfreeze credit

But to be safe, you may need to wait up to an hour for the request to be processed. The timing for unfreezing credit by phone is similar to doing it online. If you request to unfreeze your credit by mail, you may have to wait for up to three days after the credit bureau receives your request for the change to happen.

Do credit bureaus charge a fee

You are entitled to get a free credit report annually from each of the nationwide credit reporting companies. It's a good idea to review your credit reports for free every 12 months. Most or all of the information that goes into a credit score comes from your credit report.

Is Experian Basic free

The basic subscription is entirely free and features Experian credit report monitoring for new inquiries, new accounts, balance changes, credit utilization, dormant accounts or positive activity.

How do I cancel my Experian credit freeze

After you log in, you can navigate to the Help Center, where you can find quick actions to manage your freeze and toggle your freeze status to "Unfrozen." You can also call 888-EXPERIAN (888-397-3742), or send a request by mail to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Do I have to unfreeze all three credit bureaus to apply for credit card

If you're looking to apply for a loan or credit card, you will need to unfreeze your credit report. You'll have to unfreeze your credit report individually with each credit bureau. However, if you know which bureau a creditor is using, you can just unfreeze that one.

How long does freezing your credit last

Duration: A credit freeze lasts until you remove it. How to place: Contact each of the three credit bureaus — Equifax, Experian, and TransUnion.

Do I need to unfreeze all three bureaus

Each of the Major Credit Bureaus is Slightly Different

Here's a guide to unfreeze your credit with Equifax, Experian and TransUnion. The three major credit bureaus are all different. So, you have to unfreeze your credit with each bureau individually.

What is the fee for pulling credit report

Once you've received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $14.50 for a credit report. You may be able to view free credit reports more frequently online.

Is Experian free of charge

There is no charge for the Experian Account and you can cancel at any time. Your Experian Credit Score, updated monthly if you log in1. Compare credit cards, mortgages, loans †. See your eligibility for credit cards and loans.

How long does Experian freeze last

An initial fraud alert remains for one year, while an extended alert remains for seven. And while freezes must be removed before most access is granted, fraud alerts give lenders access to your credit reports and ask that they verify your identity before processing credit applications made under your name.

Do you have to unfreeze credit for a soft pull

Credit Monitoring Services

In order for them to access this information, they will request what is known as a “soft” pull on your credit. It's a type of inquiry that doesn't affect your credit score like a “hard” pull on your credit. Either way, your credit needs to be unfrozen for them to retrieve this information.

How do I lift a freeze from all credit bureaus

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus (Equifax, Experian and TransUnion) individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks.

Does freezing your account hurt your credit score

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

What are the requirements to unfreeze an account

How to Unfreeze an Account. Account freezes are not permanent but generally require the account holder to take certain actions before they can be lifted. The freeze is typically lifted once the person has made payment in full to clear an outstanding debt to a creditor or the government.

Do I have to go to the bank to unfreeze my account

If your account is frozen because of activity you know is legitimate, go to the bank with proof. If you prove there's no reason for the freeze, the bank can grant you full access to the account again. But do so promptly, as you may have limited time to make a claim.

Can you pay to clear your credit report

Pay for delete is an agreement with a creditor to pay all or part of an outstanding balance in exchange for that creditor removing negative information from your credit report. Credit reporting laws allow accurate information to remain on your credit history for up to seven years.