Is your tin your SSN?

Is your TIN your SSN?

Can I use my social security as my TIN

As the withholding agent, you must generally request that the payee provide you with its U.S. taxpayer identification number (TIN). You must include the payee’s TIN on forms, statements, and other tax documents. The payee’s TIN may be any of the following. An individual may have a Social Security number (SSN).

Cached

Do US citizens have a TIN number

Types of Tax Identification Numbers (TIN)

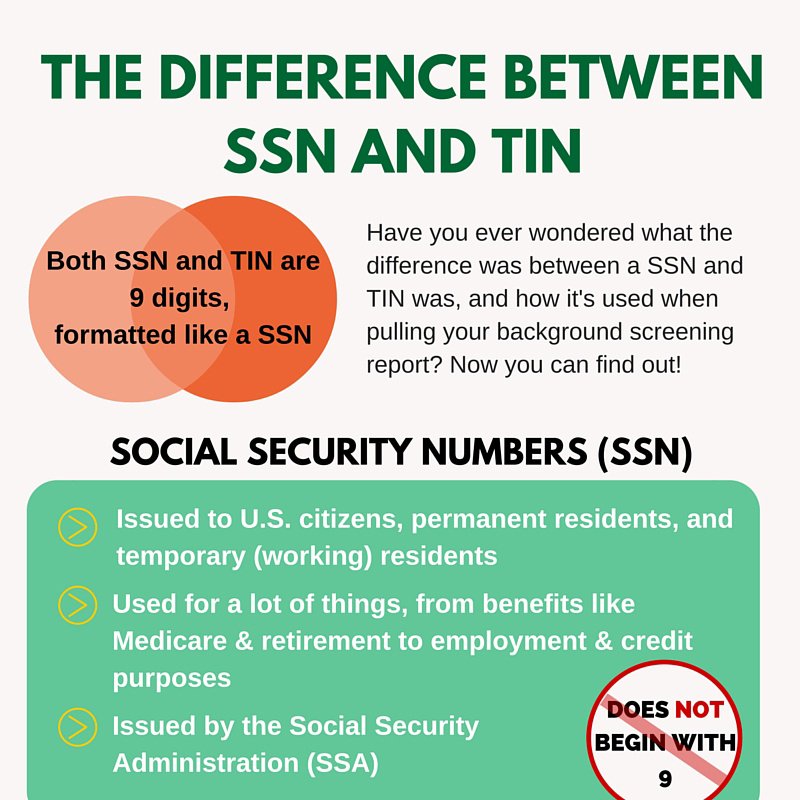

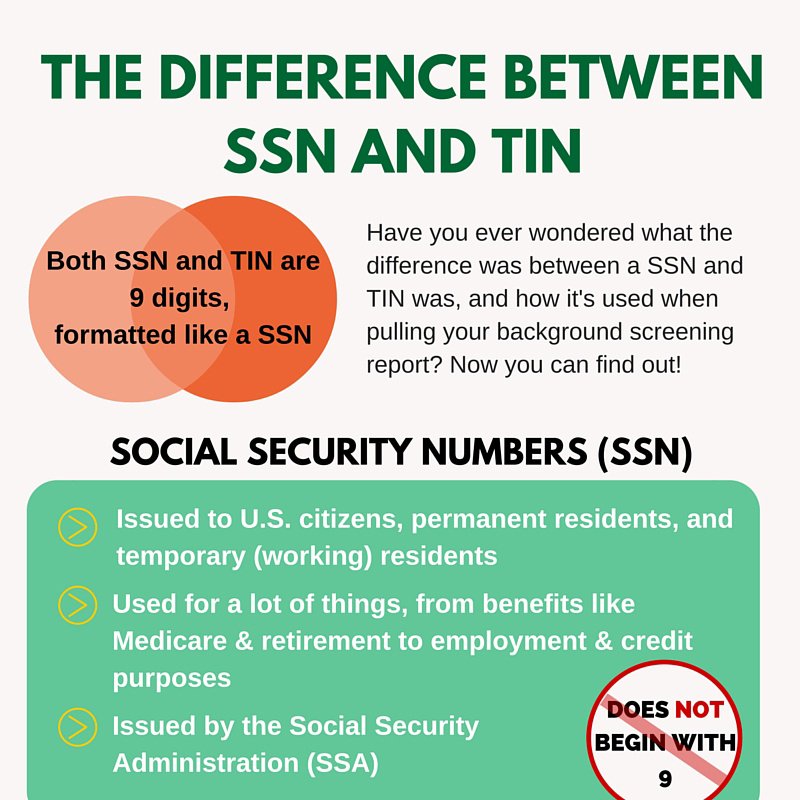

SSNs are issued to individuals—U.S. citizens, permanent residents, and certain temporary residents—by the Social Security Administration. These numbers are formatted as XXX-XX-XXXX.

Cached

Can an EIN and SSN be the same number

No, an EIN is not the same as a Social Security Number. An EIN is an Employer Identification Number and a Social Security Number is an individual’s Tax ID Number. Although the two numbers have similar tax reporting purposes, an EIN is strictly used for a business.

Is a TIN and EIN the same

Differences. The primary difference between these tax identification numbers and Employer Identification numbers is that a TIN is used to identify people who can be taxed within the United States, while the EIN is used to identify companies. Therefore, the difference is in the way the EIN and tax ID numbers can be used …

Is a tax ID the same as a social security number

A social security number (SSN) is a tax code used by an individual, while a tax ID is a nine-digit tax code for a business entity. For a business entity, a tax ID is usually called an EIN.

Can I use my ITIN as a social security number

The ITIN cannot be used in place of an SSN (if eligible for the latter) for tax and wage reporting. How do I apply for an ITIN Submit a completed IRS Form W-7 Application for IRS Individual Taxpayer Identification Number, along with documentation to substantiate your foreign status and true identity, to the IRS.

How do I find my US TIN number

Your TIN may be found on a variety of documents, including tax returns and also any forms filed with the IRS. Your SSN will be found on a social security card issued by the Social Security Administration.

Is a tax ID the same as a Social Security number

A social security number (SSN) is a tax code used by an individual, while a tax ID is a nine-digit tax code for a business entity. For a business entity, a tax ID is usually called an EIN.

How do I find my TIN

Your TIN may be found on a variety of documents, including tax returns and also any forms filed with the IRS. Your SSN will be found on a social security card issued by the Social Security Administration.

What is the difference between EIN and TIN and SSN

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

What is my TIN number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. It’s required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too:

Can I use my social security as my TIN

As the withholding agent, you must generally request that the payee provide you with its U.S. taxpayer identification number (TIN). You must include the payee's TIN on forms, statements, and other tax documents. The payee's TIN may be any of the following. An individual may have a Social Security number (SSN).

Cached

Do US citizens have a TIN number

Types of Tax Identification Numbers (TIN)

SSNs are issued to individuals—U.S. citizens, permanent residents, and certain temporary residents—by the Social Security Administration. These numbers are formatted as XXX-XX-XXXX.

Cached

Can an EIN and SSN be the same number

No, an EIN is not the same as a Social Security Number. An EIN is an Employer Identification Number and a Social Security Number is an individual's Tax ID Number. Although the two numbers have similar tax reporting purposes, an EIN is strictly used for a business.

Is a TIN and EIN the same

Differences. The primary difference between these tax identification numbers and Employer Identification numbers is that a TIN is used to identify people who can be taxed within the United States, while the EIN is used to identify companies. Therefore, the difference is in the way the EIN and tax ID numbers can be used …

Is a tax ID the same as a social security number

A social security number (SSN) is a tax code used by an individual, while a tax ID is a nine-digit tax code for a business entity. For a business entity, a tax ID is usually called an EIN.

Can I use my ITIN as a social security number

The ITIN cannot be used in place of an SSN (if eligible for the latter) for tax and wage reporting. How do I apply for an ITIN Submit a completed IRS Form W-7 Application for IRS Individual Taxpayer Identification Number, along with documentation to substantiate your foreign status and true identity, to the IRS.

How do I find my US TIN number

Your TIN may be found on a variety of documents, including tax returns and also any forms filed with the IRS. Your SSN will be found on a social security card issued by the Social Security Administration.

Is a tax ID the same as a Social Security number

A social security number (SSN) is a tax code used by an individual, while a tax ID is a nine-digit tax code for a business entity. For a business entity, a tax ID is usually called an EIN.

How do I find my TIN

Your TIN may be found on a variety of documents, including tax returns and also any forms filed with the IRS. Your SSN will be found on a social security card issued by the Social Security Administration.

What is the difference between EIN and TIN and SSN

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

What is my TIN number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. It's required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too: the ITIN, EIN, ATIN and PTIN.

How do I find my TIN number

How do I determine my TINFor U.S.-based individuals: Your TIN is the same as your social security number.For U.S.-based entities (corporations, partnerships, LLCs, etc.): In general, your TIN is usually the entity's Federal Employer Identification Number (FEIN).

Can you look up a TIN number

The IRS is the ultimate resource for looking up a tax ID number. There is a business and specialty department reachable Monday-Friday from 7 am – 7 pm EST. Their number is 800-829-4933.

Is SSN and TIN the same

A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS.

Can I get a credit card with my ITIN number

Yes, the ITIN can be used in place of an SSN to obtain a credit card from many of the major issuers.

What is the difference between a TIN and a Social Security number

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

Where is the TIN number on a w2

Look at Box "a" on your W-2 form if you're employed. This required form includes your Social Security number. If you have a Social Security number, that number is also your federal tax ID number (TIN). If you don't have a Social Security number but you're employed, you have a TIN issued by the IRS.

Do I need an EIN or TIN

You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. It's free to apply for an EIN, and you should do it right after you register your business. Your business needs a federal tax ID number if it does any of the following: Pays employees.

Do I need an SSN if I have an EIN

Myth #3 – You need an SSN to get an EIN

You don't need an SSN (Social Security Number) to get an EIN. You only need an SSN (or ITIN) if you want to apply for an EIN online.

Can I look up my TIN

The IRS is the ultimate resource for looking up a tax ID number. There is a business and specialty department reachable Monday-Friday from 7 am – 7 pm EST. Their number is 800-829-4933. Keep in mind, you will need to answer a few authorization questions for security purposes before you get your TIN.

Can I find my ITIN number online

If you are wondering, 'Where can I find my ITIN number ' you might think the most obvious answer is, 'At the IRS. ' Generally, that is the correct answer. You can call the IRS helpline at 800-829-1040 to retrieve your ITIN.

How to convert TIN to SSN

If you had an ITIN number and your status changed from non-resident to resident alien, you are eligible to apply for a social security number. To secure a social security card, you may need to visit a local office for the Social Security Administration. Call 1-800-772-1213 to find the nearest office.

How do I check my TIN

Here are the steps to check your TIN number online using the BIR website:Go to https://ereg.bir.gov.ph/On the landing page, click on “Other eServices” where you can find the eReg TIN Query option.Enter your login credentials if you have an authorized user account.

What can I use my ITIN number for

What is an ITIN used forAuthorize work in the U.S.Provide eligibility for Social Security benefits.Qualify a dependent for Earned Income Tax Credit Purposes.

Does my credit score transfer from ITIN to SSN

The credit history you established with your ITIN number, if any, will need to be transferred to your new Social security number credit history. This will not happen automatically. Find out how to request a transfer from any of the 3 credit bureaus or any office of the IRS.