What are the benefits of credit monitoring?

Summary of the Article: The Benefits of Credit Monitoring

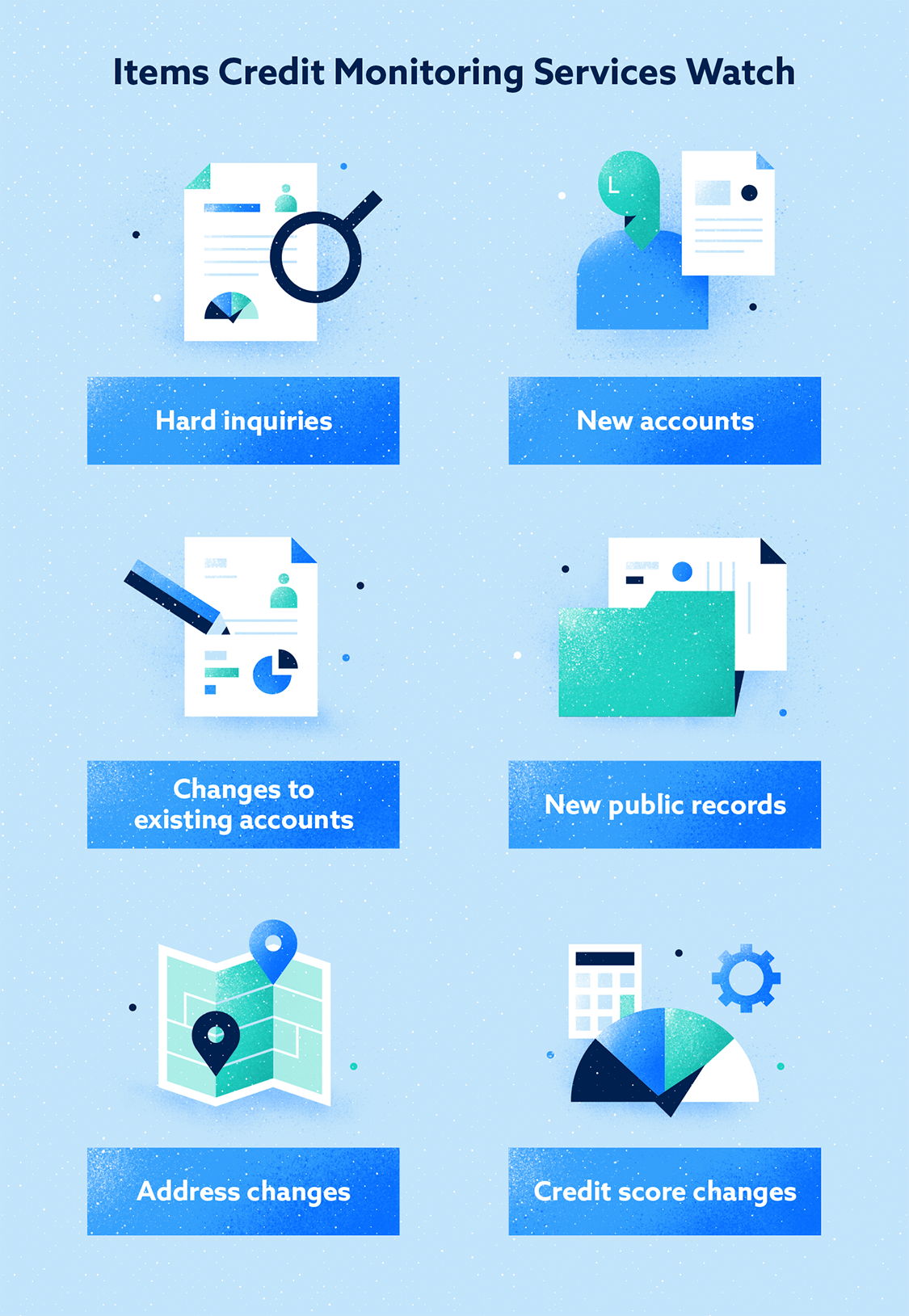

A credit monitoring system alerts you about your credit score changes, providing a clear idea of how your financial transactions affect your credit score. This helps you make better financial decisions in the future. It also tracks changes in borrower behavior to notify consumers of potential fraud and changes to their creditworthiness.

Monitoring has several advantages. Firstly, it helps determine if a project is performing as expected. Ongoing monitoring allows for the early identification of potential problems such as missed deadlines and overspending. It also helps assess whether the desired outcomes of a project are being achieved.

Monitoring your credit score does not negatively impact it. In fact, regularly checking your credit reports and scores helps ensure the accuracy of your personal and account information and may even help detect signs of potential identity theft.

However, there are some cons to credit monitoring services. Firstly, they come at a cost, usually ranging from $10 to $30 per month. Additionally, they do not stop fraud or identity theft, nor do they provide comprehensive information or fix mistakes.

The main purposes of monitoring are to assess stakeholders’ understanding of a project, minimize the risk of project failure, promote systematic and professional management, and assess progress in implementation.

Monitoring is important as it helps identify potential issues, track progress, and measure outcomes. It allows organizations to assess the effectiveness of their strategies, identify areas for improvement, and ensure that they are meeting their goals and objectives.

There are several ways to monitor your credit score, such as checking your credit card, financial institution, or loan statements, purchasing credit scores directly from credit bureaus or other providers, or using credit score services or free credit scoring sites.

Credit monitoring services do not hurt your credit score. Credit scoring systems ignore soft inquiries, such as those made for monitoring purposes.

In certain cases, the cost of credit monitoring services can be written off as a deductible expense for organizations providing identity theft protection and credit monitoring services.

The three main purposes of monitoring are to assess progress, ensure accountability, and facilitate learning and improvement.

Questions and Answers:

1. What are the advantages of credit monitoring?

A credit monitoring system alerts you about changes in your credit score, helping you make better financial decisions in the future.

2. What is the purpose of credit monitoring?

The purpose of credit monitoring is to track changes in borrower behavior, identify potential fraud, and notify consumers of changes to their creditworthiness.

3. Which one is the advantage of monitoring?

Monitoring helps determine if a project is performing as expected, identifying potential problems early on, such as missed deadlines and overspending.

4. Does monitoring your credit score affect it?

Monitoring your own credit reports and scores does not impact your credit score. In fact, it helps ensure the accuracy of your personal and account information and may detect signs of potential identity theft.

5. What are the cons of credit monitoring services?

Cons of paid credit monitoring include the cost, the inability to stop fraud or identity theft completely, limited information provided, and the inability to fix mistakes.

6. What are the four main purposes of monitoring?

The four main purposes of monitoring are to assess stakeholders’ understanding of a project, minimize the risk of project failure, promote systematic and professional management, and assess progress in implementation.

7. What is the importance of monitoring?

Monitoring helps identify potential issues, track progress, measure outcomes, assess effectiveness, and ensure goals and objectives are being met.

8. What is the best way to monitor my credit score?

You can monitor your credit score by checking your credit card, financial institution, or loan statements, purchasing credit scores directly from credit bureaus or other providers, or using credit score services or free credit scoring sites.

9. Does credit monitoring hurt your score?

Credit monitoring does not hurt your credit score, as credit scoring systems ignore soft inquiries made for monitoring purposes.

10. Can you write off credit monitoring services?

In certain cases, the cost of credit monitoring services can be written off as a deductible expense for organizations providing identity theft protection and credit monitoring services.

11. What are the three main purposes of monitoring?

The three main purposes of monitoring are to assess progress, ensure accountability, and facilitate learning and improvement.

What are the advantages of credit monitoring

A credit monitoring system alerts you about your credit score changes. Hence, this will help you to give a clear idea of how your financial transactions affect your credit score. This will help you to take better financial decisions in future.

What is the purpose of credit monitoring

A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness.

Cached

Which one is the advantage of monitoring

Monitoring helps you determine if the project is performing as expected. In addition, monitoring a project on an ongoing basis allows you to identify potential problems early on, including missed deadlines, overspending, and even determining if the outcomes that you have identified are actually changing as expected.

Does monitoring your credit score affect it

Good news: Credit scores aren't impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

What are the cons of credit monitoring services

Cons of paid credit monitoringIt costs money. Paid credit monitoring often costs between $10 and $30 a month—money that you'd probably prefer to save or spend on take-out or a streaming service subscription.It doesn't stop fraud or identity theft.It won't tell you everything.It can't fix mistakes.

What are the four main purposes of monitoring

assess the stakeholders' understanding of the project; • minimise the risk of project failure; • promote systematic and professional management; and • assess progress in implementation. One needs to recognize the role played by the various stakeholders in monitoring.

What is the importance of monitoring

4 days ago

It helps to identify any potential issues, track progress, and measure outcomes. Through Monitoring and Evaluation, organizations can assess the effectiveness of their strategies, identify areas of improvement, and ensure that they are meeting their goals and objectives.

What is the best way to monitor my credit score

Here are a few ways:Check your credit card, financial institution or loan statement.Purchase credit scores directly from one of the three major credit bureaus or other provider, such as FICO.Use a credit score service or free credit scoring site.

Does credit monitoring hurt your score

Credit Monitoring Doesn't Affect Credit Scores

Credit scoring systems such as the FICO® Score☉ and VantageScore® use credit report data for their calculations but ignore soft inquiries, which means they have no effect on your scores.

Can you write off credit monitoring services

Offering free identity theft protection and credit-monitoring services is a standard part of breach responses from compromised organizations, but some organizations have been providing such benefits on their own. The IRS now says the cost of those services is a deductible one for these companies.

What are the three main purposes of monitoring

What are the three main purpose of monitoringTo measure performance against established targets and standards.To identify deviations from expected results and to make necessary adjustments.To provide feedback to process owners and stakeholders on the effectiveness of processes and on areas for improvement.

What are the 4 key reasons for monitoring and evaluation

There are typically four primary purposes of M&E, including:Learning from experiences to help improve activities, initiatives or practices in the future.Making informed decisions on the future of the activity or initiative.Ensuring accountability of the resources of the project or initiative and the results.

Does credit monitoring lower your credit score

Credit monitoring will not affect your credit scores because you won't incur hard inquiries. When you access your own credit report, it's considered a soft inquiry which doesn't lower your credit score as it's not a scoring factor.

Should I monitor my credit score

Checking your credit history and credit scores can help you better understand your current credit position. Regularly checking your credit reports can help you be more aware of what lenders may see. Checking your credit reports can also help you detect any inaccurate or incomplete information.

How do credit monitoring services make money

Credit bureaus make money by selling information like consumer credit reports and data analytics to other companies. Your credit report also includes personal information like your name, birthdate, address, Social Security Number (SSN).

What are the 3 most important points about progress monitoring

Important components of progress monitoring are:Selecting evidence-based tools.Implementing the assessment well.Considering students' language barriers and special needs.Recognizing students' strengths.

What are the 5 pillars of monitoring

5 Pillars of Data Observability: How Recency, Distribution, Volume, Schema, and Lineage Maintain Healthy DataRecency. Also referred to as “freshness,” recency looks at the timeliness of your data.Distribution.Volume.Schema.Lineage.

What brings your credit score down the most

5 Things That May Hurt Your Credit ScoresHighlights: Even one late payment can cause credit scores to drop.Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

How often should you monitor your credit score

once a year

Experts suggest you check your credit score and report at least once a year – and sometimes more often – to spot errors or fraud and to get a sense of your credit health.

What are the three main purpose of monitoring

The three main purposes of monitoring are: To measure performance against established targets and standards. To identify deviations from expected results and to make necessary adjustments. To provide feedback to process owners and stakeholders on the effectiveness of processes and on areas for improvement.

Why is monitoring progress good

Why you want to monitor Keeping records and monitoring activities helps people see progress and builds a sense of achievement. Records can be useful and even essential when promoting the group or applying for funding. Monitoring also has significance for the wider field of conservation.

What are the 4 golden rules of monitoring

The answer is with the four Golden Signals: latency, traffic, error rate, and resource saturation. In this blog, we explain what the Golden Signals are, how they work, and how they can make monitoring complex distributed systems easier.

What are the 4 golden signals of monitoring

The four Golden Signals of MonitoringErrors – rate of requests that fail.Saturation – consumption of your system resources.Traffic – amount of use of your service per time unit.Latency – the time it takes to serve a request.

What is the #1 way to improve your credit score

One of the best things you can do to improve your credit score is to pay your debts on time and in full whenever possible. Payment history makes up a significant chunk of your credit score, so it's important to avoid late payments.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.