What Bureau does TransUnion use?

Summary of the Article

In this article, we will discuss various aspects of TransUnion, one of the major credit bureaus. We will explore questions related to credit scores, lenders’ preferences, and the accuracy of TransUnion compared to Equifax. Here are some key points:

Question 1: Does TransUnion follow Equifax?

The credit bureaus may have different information, and lenders may report updates to different bureaus at different times. Therefore, it’s possible for Equifax and TransUnion to have different credit information, leading to different credit scores.

Question 2: Which banks pull TransUnion only?

Some banks that may pull TransUnion only include Avianca, Apple Card (Goldman Sachs Bank), Barclays, Capital One, Synchrony Bank, and U.S Bank.

Question 3: Is TransUnion the lowest credit score?

TransUnion credit scores range from 300 to 850. Compared to other credit bureaus, TransUnion places more weight on payment history and the average age of credit accounts. This makes it less forgiving for individuals with limited credit history.

Question 4: Do lenders look at TransUnion or Equifax?

When applying for a mortgage, lenders typically consider credit history reports from all three major bureaus: Experian, Equifax, and TransUnion. In most cases, lenders also consider FICO scores, which have different scoring models.

Question 5: Which credit score is usually higher, TransUnion or Equifax?

Both TransUnion and Equifax scores are equally accurate, as they are calculated from slightly different sources. However, due to reporting differences, Equifax scores are more likely to appear lower than TransUnion scores. A “fair” score from TransUnion is generally considered “fair” across the board.

Question 6: Which credit score is more accurate, Equifax or TransUnion?

Both Equifax and TransUnion provide accurate scores as they use their own scoring systems. The accuracy of the score depends on the information provided by the individual lenders.

Question 7: Is TransUnion more strict than Equifax?

TransUnion is not necessarily stricter than Equifax. Both credit bureaus follow their own methodologies, resulting in slight score variations. A “fair” credit score from TransUnion is generally considered “fair” across all credit bureaus.

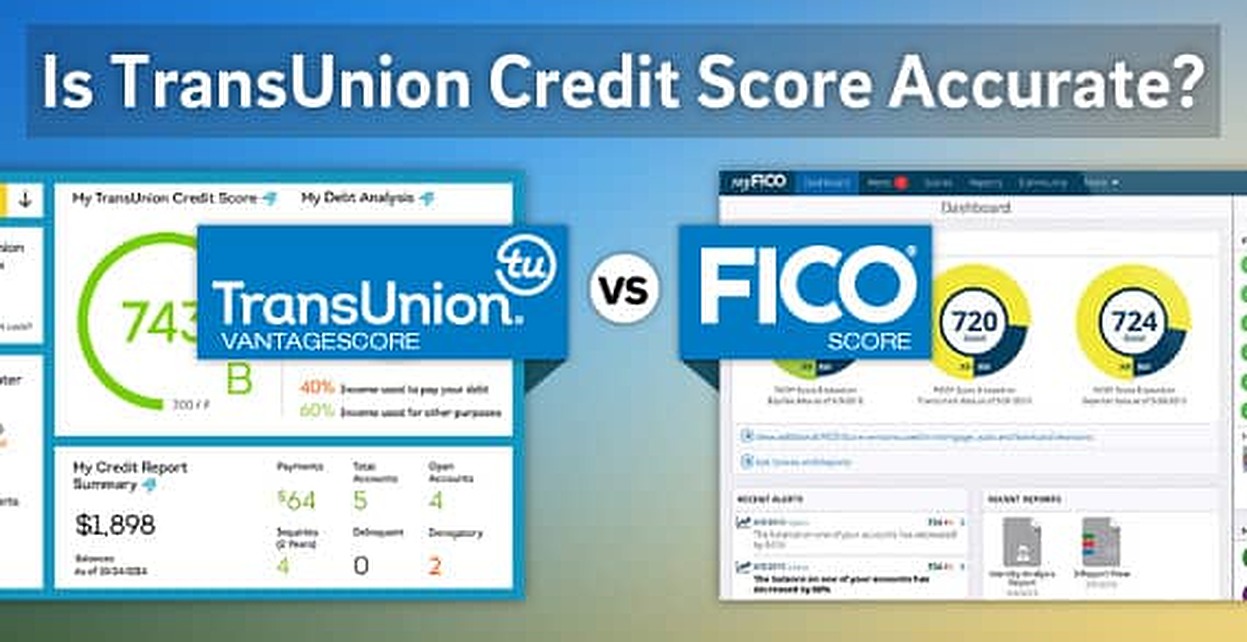

Question 8: Why is TransUnion higher than FICO?

Credit bureaus receive credit information from lenders at different times, leading to variations in reported data. Additionally, credit bureaus may interpret, display, or store information differently, resulting in discrepancies between TransUnion scores and FICO scores.

Question 9: Which score is usually higher, TransUnion or Equifax?

Neither score is inherently higher or lower than the other. The differences in scores are mainly due to reporting variations. However, a “fair” score from TransUnion is generally considered similar to a “fair” score from Equifax.

Question 10: Which one is more credible, TransUnion or Equifax?

Both TransUnion and Equifax are credible credit bureaus. They use their own scoring systems and provide accurate scores. The credibility of the information depends on the lender’s preference and the specific scoring model they choose.

Does TransUnion follow Equifax

The credit bureaus may have different information.

And a lender may report updates to different bureaus at different times. So, it's possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

Cached

Which banks pull TransUnion only

Which Banks Pull TransUnion OnlyAvianca.Apple Card – Goldman Sachs Bank.Barclays.Capital One.Synchrony Bank.U.S Bank.

Is TransUnion the lowest credit score

TransUnion ranges from a low of 300 to a high of 850. This is one of the least forgiving bureaus because much more weight is assigned to your payment history and the average age of your credit accounts. It's also the least friendly to those just starting out building credit. Equifax scores range from 280 to 850.

Cached

Do lenders look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Cached

Which credit score is usually higher TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which credit score is more accurate Equifax or TransUnion

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is TransUnion more strict than Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Why is TransUnion higher than FICO

Lenders report credit information to the credit bureaus at different times, often resulting in one agency having more up-to-date information than another. The credit bureaus may record, display or store the same information in different ways.

Which score is usually higher TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which is more accurate Equifax or TransUnion

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Which is more credible TransUnion or Equifax

4. Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is a TransUnion credit score of 650 good

A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850.

What is the most accurate credit bureau

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Why is TransUnion so much higher than Equifax

The biggest difference between your TransUnion credit report and Equifax credit score is that the TransUnion credit score reports your employment history and personal information. The other two credit reporting agencies or credit bureaus report only the name of your employer.

Which credit bureau is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is it better to have higher TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Is Equifax better than TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

How to go from 650 to 750 credit score

Here are some of the best ways.Pay on Time, Every Time.Reduce Your Credit Card Balances.Avoid Taking Out New Debt Frequently.Be Mindful of the Types of Credit You Use.Dispute Inaccurate Credit Report Information.Don't Close Old Credit Cards.

Does TransUnion or Equifax matter more

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Is Equifax or TransUnion more accurate

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How long does it take to build credit from 500 to 750

Average Recovery Time

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How long does it take to go from 650 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.