What companies help rebuild credit?

Summary:

If you want help with fixing your credit, you can hire a credit repair company, but be cautious of scam offers. Some reputable credit repair companies include The Credit Pros, Credit Saint, Sky Blue Credit, The Credit People, CreditFirm.net, and CreditRepair.com. One of the quickest ways to repair your credit is to make small, regular payments and pay off outstanding credit card balances. Unfortunately, there is no quick way to clean your credit reports, as credit bureaus have a specific time frame for conducting investigations. While you can ask a debt collector to pay for delete, credit repair can cost around $100 a month and may take several months. Paying bills on time and reducing credit card balances are the most effective ways to build credit. While there are no shortcuts to developing a strong credit score, some individuals may see a quick boost of up to 200 points in just 30 days. Increasing your credit score by 100 points in a month is unlikely for most people, but maintaining good financial habits can lead to improvements over time. To raise your credit score overnight, get your free credit report, understand how your credit score is calculated, improve your debt-to-income ratio, keep your credit information up to date, avoid closing old credit accounts, make payments on time, monitor your credit report, and keep your credit balances low.

Questions and Answers:

1. Can you really pay someone to fix your credit?

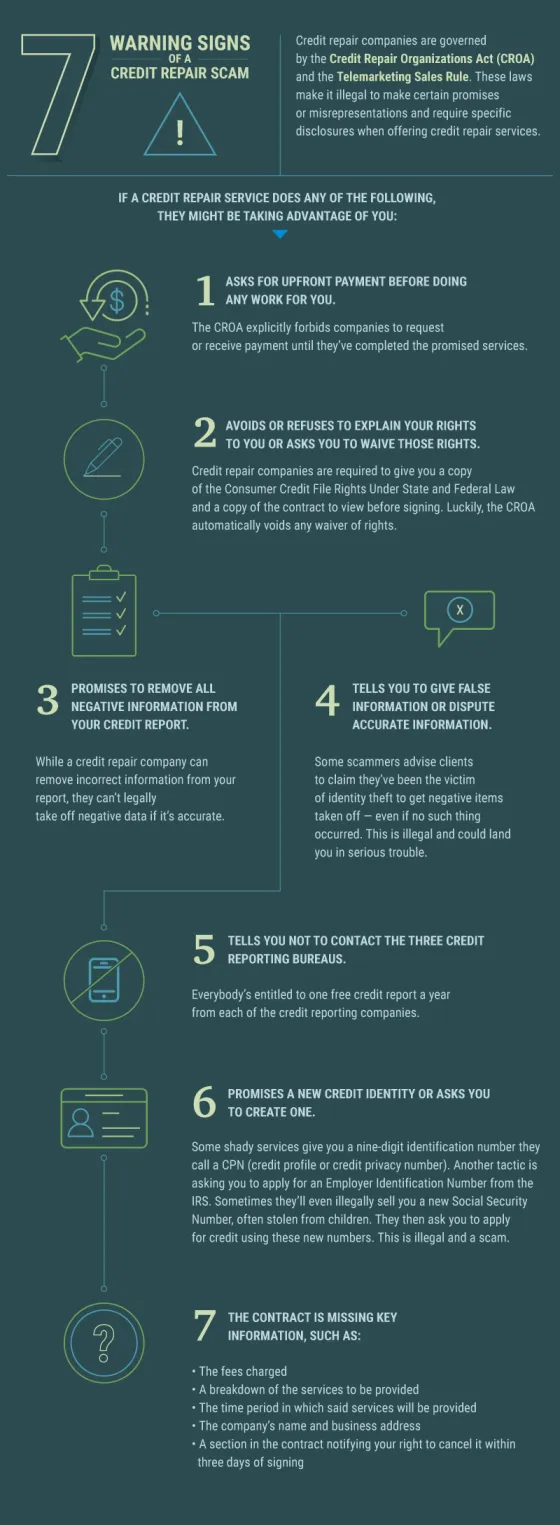

Yes, you can hire a credit repair company to assist you with fixing your credit, but beware of scam offers that may worsen your financial situation.

2. What companies help you build credit?

Some reputable credit repair companies that can help you build credit include The Credit Pros, Credit Saint, Sky Blue Credit, The Credit People, CreditFirm.net, and CreditRepair.com.

3. What is the quickest way to repair my credit?

One of the quickest ways to repair your credit is to make small, regular payments on all of your accounts and pay off outstanding credit card balances before they’re due.

4. Who can clean my credit report?

Unfortunately, there is no quick way to clean your credit reports. Credit bureaus have a specific time frame of 30-45 days to conduct investigations when you dispute information. If the credit bureaus can verify the information, it can remain on your credit reports for up to seven to ten years.

5. Can you pay someone to wipe your credit clean?

Under the Fair Credit Reporting Act (FCRA), you can ask a debt collector to pay for a delete, which is legal. However, it’s important to get the agreement in writing to enforce it afterwards.

6. How much does it cost to pay someone to fix your credit?

Credit repair can cost around $100 a month and may take several months. There is no guarantee that your credit score will be higher at the end. It’s worth noting that credit repair cannot do anything that you can’t do on your own, and it cannot remove accurate, timely, and verifiable negative marks from your credit reports.

7. What builds credit the fastest?

Paying bills on time and reducing balances on credit cards are the most powerful steps you can take to raise your credit score. Credit card issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

8. Can my credit score go up 200 points in a month?

While there are no shortcuts to building a strong credit history and score, there are actions you can take that may provide a quick boost to your credit score. Some individuals’ credit scores may increase by as much as 200 points in just 30 days.

9. How can I get my credit score up 100 points in 30 days?

Increasing your credit score by 100 points in a month is unlikely for most people. However, paying bills on time, eliminating consumer debt, avoiding high credit card balances, and maintaining a mix of both consumer and secured borrowing can lead to an increase in your credit score within months.

10. How can I raise my credit score 100 points overnight?

To raise your credit score by 100 points overnight, you can start by getting your free credit report, understanding how your credit score is calculated, improving your debt-to-income ratio, keeping your credit information up to date, not closing old credit accounts, making payments on time, monitoring your credit report, and keeping your credit balances low.

Can you really pay someone to fix your credit

If you want help, you can hire a credit repair company to assist you. They generally charge anywhere from $19 to $149 a month for their services. But beware of scam credit repair offers, which may leave you in worse financial shape than before. Consumer Financial Protection Bureau.

What companies help you build credit

Best Credit Repair Companies of 2023Best for Credit-Building Tools: The Credit Pros.Best Simple Credit Repair Options: Credit Saint.Most Experienced: Sky Blue Credit.Most Aggressive Timeline: The Credit People.Best for Dispute Services: CreditFirm.net.Best Customer Experience: CreditRepair.com.

Cached

What is the quickest way to repair my credit

Focus On Small, Regular Payments

This means that one of the quickest ways you can raise your score is to make minimum payments on all of your accounts every month. Ideally, you should also pay off each of your outstanding credit card balances before they're due.

Who can clean my credit report

Unfortunately, there's no way to quickly clean your credit reports. Under federal law, the credit bureaus have 30 – 45 days to conduct their investigations when you dispute information. If the credit bureaus can verify the information on your credit reports, it can remain for up to seven to 10 years.

Can you pay someone to wipe your credit clean

"As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact."

How much is it to pay someone to fix your credit

Credit repair can cost around $100 a month and take several months — with no guarantee that your credit score will be higher at the end. Note that credit repair can't do anything that you can't do on your own, and it can't remove negative marks from your credit reports if they're accurate, timely and verifiable.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

How to get your credit score up 100 points in 30 days

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

Can you legally erase bad credit

Can debt collectors remove negative information from my reports Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years.

Can I pay someone to wipe my credit history

"As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact."

How do people illegally fix credit

A. Illegal ways to change a credit score include: Employer Identification Numbers – Are social security numbers that are obtained by companies. Credit Privacy Numbers – A CPN, or credit privacy number, is a nine-digit number that's formatted just like a Social Security number (SSN).

Can you fix ruined credit

The most important step to fix your bad credit is to start paying all of your bills on time. If you have delinquent accounts, bring them up to date, then put them on autopay so you never miss another payment. Paying down the amount you owe on credit cards and loans will also help improve your bad credit.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get a 700 credit score in 2 months

Here's what you need to do.Make every payment on time.Keep your credit utilization low.Don't close old accounts.Pay off credit card balances.Ask your card issuer to increase your limit.Use the authorized user strategy.Put your bill payments to work.Use a rent reporting company.

How to get credit score from 580 to 700

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get my credit score from 500 to 700

Average Recovery Time for Negative Marks on Your Credit ReportHow You Can Improve Your Credit Score From 500 to 700.Pay All of Your Bills on Time.Reduce Your Debt.Use a Secured Card Responsibly.Bring Your Utilization Below 30%

Is it true that after 7 years your credit is clear

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

How do I clear my credit history clean

How to clean up your credit reportRequest your credit reports.Review your credit reports.Dispute credit report errors.Pay off any debts.

How do I get my credit wiped clean

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Is pay for delete worth it

Do 'pay for delete' letters actually work While you may not be successful in convincing a debt collection agency to comply with a pay for delete request, it can't hurt to try. However, it's important to wait for written confirmation that a collection agency has accepted your offer before you proceed with payment.

How do I rebuild my worst credit

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month.Think About Your Credit Utilization Ratio.Consider a Secured Account.Ask for Help from Family and Friends.Be Careful with New Credit.Get Help with Debt.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.