What company protects your credit?

Summary of the Article: Protecting Your Credit and Identity

1. Is LifeLock worth getting?

Yes, LifeLock is considered one of the top providers for identity theft protection. Their annual memberships come with a 60-day money-back guarantee.

2. What is the best bank after identity theft?

Chase is one of the most secure banks to keep your money safe.

3. How can I protect my credit?

– Review your credit reports regularly from each credit bureau.

– Use multi-factor authorization for your accounts.

– Keep your physical credit card safe and up to date.

– Set strong passwords for your online accounts.

– Consider enrolling in a credit monitoring service.

4. How do I get identity theft protection?

Contact the Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. You can also ask the three major credit reporting agencies to place fraud alerts and a credit freeze on your accounts.

5. What is the downside of LifeLock?

With the first three plans of LifeLock, only one credit bureau is monitored. You’ll need to pay for the most expensive plan to monitor all three credit bureaus. Additionally, not all companies report to all three bureaus, so there may be undetected fraud.

6. What is the monthly fee for LifeLock?

LifeLock Standard for a single adult costs $11.99 monthly or $124.99 if billed annually. For two adults, it is $23.99 monthly or $249.99 yearly. The family plan, which includes up to five children, is priced at $35.99 month-to-month or $359.99 with annual billing.

7. Will my bank protect me if I get scammed?

Contact your bank immediately if you’ve been scammed and ask if you can get a refund. Most banks should reimburse you if you’ve transferred money to someone because of a scam.

8. Are credit unions safer than banks?

Credit unions are just as safe as banks. Like banks, credit unions are insured by the National Credit Union Administration (NCUA), a US government agency that regulates and supervises credit unions.

9. Can you lock your credit score?

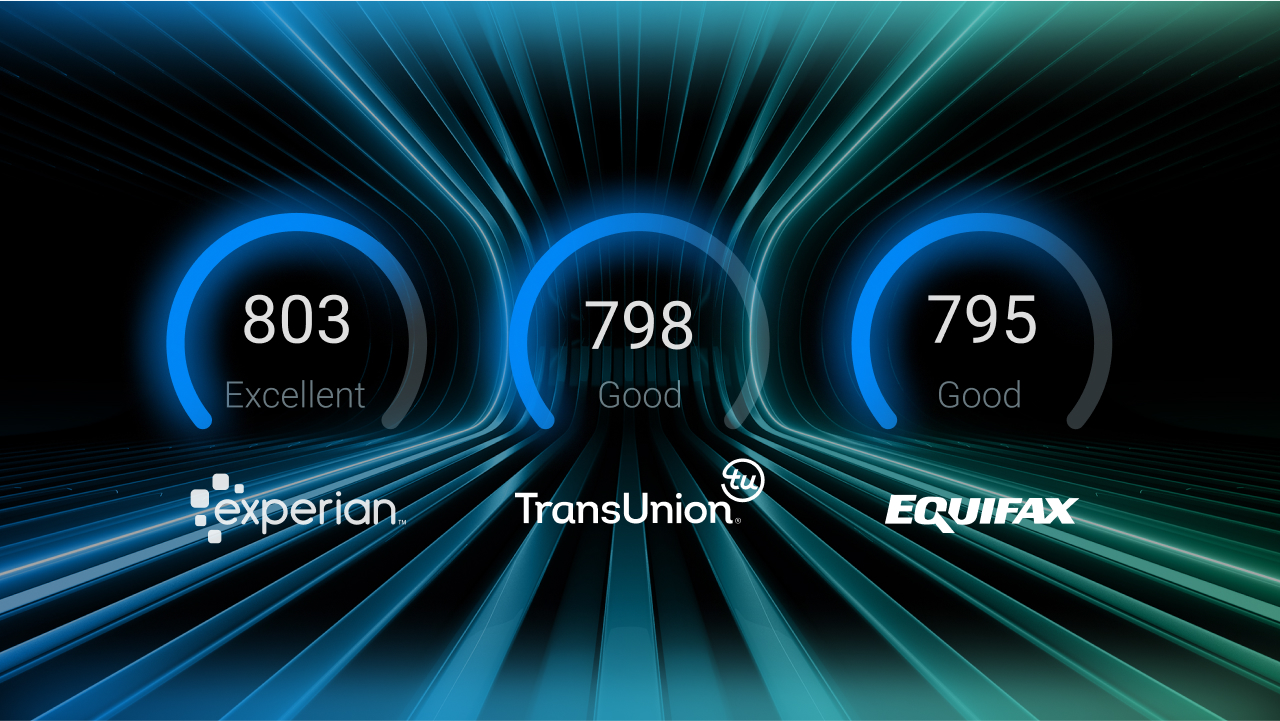

To lock your credit score, you need to enroll in a credit lock program offered by the major consumer credit bureaus, Equifax, Experian, and TransUnion.

10. Does credit protection cost?

Yes, credit monitoring services usually charge users a monthly fee. However, there are also free credit monitoring services available with fewer features than their paid counterparts.

11. How do I check if someone is using my Social Security number?

Review your Social Security Statement to check for any inconsistencies in your earnings. If you believe someone is using your SSN for work or tax-related abuses, contact the Internal Revenue Service (IRS) or visit their website.

Is LifeLock worth getting

If you're in the market for identity theft protection, LifeLock is one of the top providers to consider—especially since annual memberships come with a 60-day money-back guarantee.

What is the best bank after identity theft

Chase. One of the biggest banks, Chase, is also one of the most secure banks to keep your money safe.

How can I protect my credit

5 ways to protect your creditReview credit reports. Everyone is entitled to a free credit report from each of the credit bureaus every year.Use multi-factor authorization.Keep your physical credit card safe and up to date.Set strong passwords.Enroll in a credit monitoring service.

Cached

How do I get identity theft protection

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

CachedSimilar

What is the downside of LifeLock

Downsides. Only one credit bureau is monitored with the first three plans. You have to pony up and pay for the most expensive plan to monitor all three credit bureaus. Since not all companies report to all three bureaus, there could be fraud that you're not made aware of.

What is the monthly fee for LifeLock

$11.99 monthly

How Much Does LifeLock Cost LifeLock Standard for a single adult costs $11.99 monthly or $124.99 if billed annually. For two adults the cost is $23.99 monthly or $249.99 yearly. A family plan which includes up to five children is priced at $35.99 month-to-month or $359.99 with annual billing.

Will my bank protect me if I get scammed

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam. This type of scam is known as an 'authorised push payment'.

Are credit unions safer than banks

Why are credit unions safer than banks Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. The National Credit Union Administration is a US government agency that regulates and supervises credit unions.

Can you lock your credit score

Unlike a credit freeze, which you can add and remove from your account as needed, a credit lock requires you to enroll in a program. To make a credit lock most effective, enroll in the programs at all three of the major consumer credit bureaus — Equifax, Experian and TransUnion.

Does credit protection cost

Credit monitoring services usually charge users a monthly fee. However, many provide a discount for customers who pay annually. There are also free credit monitoring services on the market, but these offer less comprehensive features than paid competitors. The number of credit bureaus monitored.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How much does LifeLock cost

How much is LifeLock LifeLock's plans start at $89.99 for the first year. If you pay monthly, their plans start at $7.99 per month for the first year. Rates increase for monthly and annual plans after the first year.

Is there a better service than LifeLock

The bottom line: Aura offers more features, better protection with included digital security tools, and more affordable pricing than LifeLock's comparable plan.

Is there a better alternative to LifeLock

Three Great LifeLock Alternatives, One Decision

In our experience, Identity Guard, IdentityForce, and ID Watchdog are all worth taking a hard look at when picking out identity theft protection. Identity Guard would be our pick, but that's based on a myriad of financial and personal factors.

How can I get my money back if I got scammed

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam.

Will the bank refund stolen money

Do banks reimburse stolen money Banks often reimburse stolen money, but there are some exceptions. Transactions not made by you or anyone authorized to use your account are fraudulent, and federal law protects your money.

Where is the safest place to keep your money

What are the safest types of investments U.S. Treasury securities, money market mutual funds and high-yield savings accounts are considered by most experts to be the safest types of investments available.

Are credit unions safe if banks crash

While credit unions don't receive FDIC protection, member funds are generally insured up to $250,000 by the National Credit Union Administration. (All federal credit unions and most state credit unions offer this coverage.)

How much does it cost to freeze your credit

free

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

What happens when you put a lock on your credit

A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won't offer you credit if they can't access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

Is credit protection program free

You may be able to find and use basic credit monitoring services for free, but expect to pay a monthly or annual fee for premium levels of this type of credit protection.

How much is Equifax protect

$14.95per month

Under Equifax Credit and Identity Protect – monitor 5 bank accounts, 8 credit/debit cards, 2 medicare cards, 3 email addresses, 3 phone numbers, 2 driver licences, 2 international bank accounts, 2 passports.

Can someone open a credit card in my name without my social security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

How can I find out if someone is using my identity for free

How To Check If Someone Is Using Your IdentityLook for unfamiliar activity on your credit report.Check your health insurance records.Review your tax return information.Make sure you're not locked out of sensitive online accounts.Scrutinize spam emails, texts, and mail.Check for missing physical mail or stolen trash.

How much does LifeLock cost per month

LifeLock's Subscription Options

| Pricing | LifeLock Standard | LifeLock Ultimate Plus |

|---|---|---|

| Monthly price | $8.99 | $23.99 |

| Can it be bundled with Norton 360 | No | Yes |

| Monthly price with Norton 360 | n/a | $29.99 |

| Yearly price with Norton 360 | n/a | $299.88 |

Apr 12, 2023