What do you put if you don’t have a Social Security number?

Summary

If you do not have a Social Security Number (SSN), you can enter your Individual Tax Identification Number (ITIN)

as an alternative. If you do not have an SSN or ITIN, you can leave the entry field blank.

We do not require you to have an SSN before you start work. However, the Internal Revenue Service (IRS) requires employers

to use your SSN to report your wages. While waiting for your SSN, your employer can use a letter from the Social Security Administration

stating that you have applied for a number.

With very few exceptions, all U.S. citizens, permanent residents, and temporary or working residents have a Social Security number.

You should receive your SSN card within 2 weeks after providing all necessary documents for your application, including verification

of your immigration document with the United States Citizenship and Immigration Services (USCIS). If immediate verification is not

possible, it may take an additional 2 weeks to receive your card.

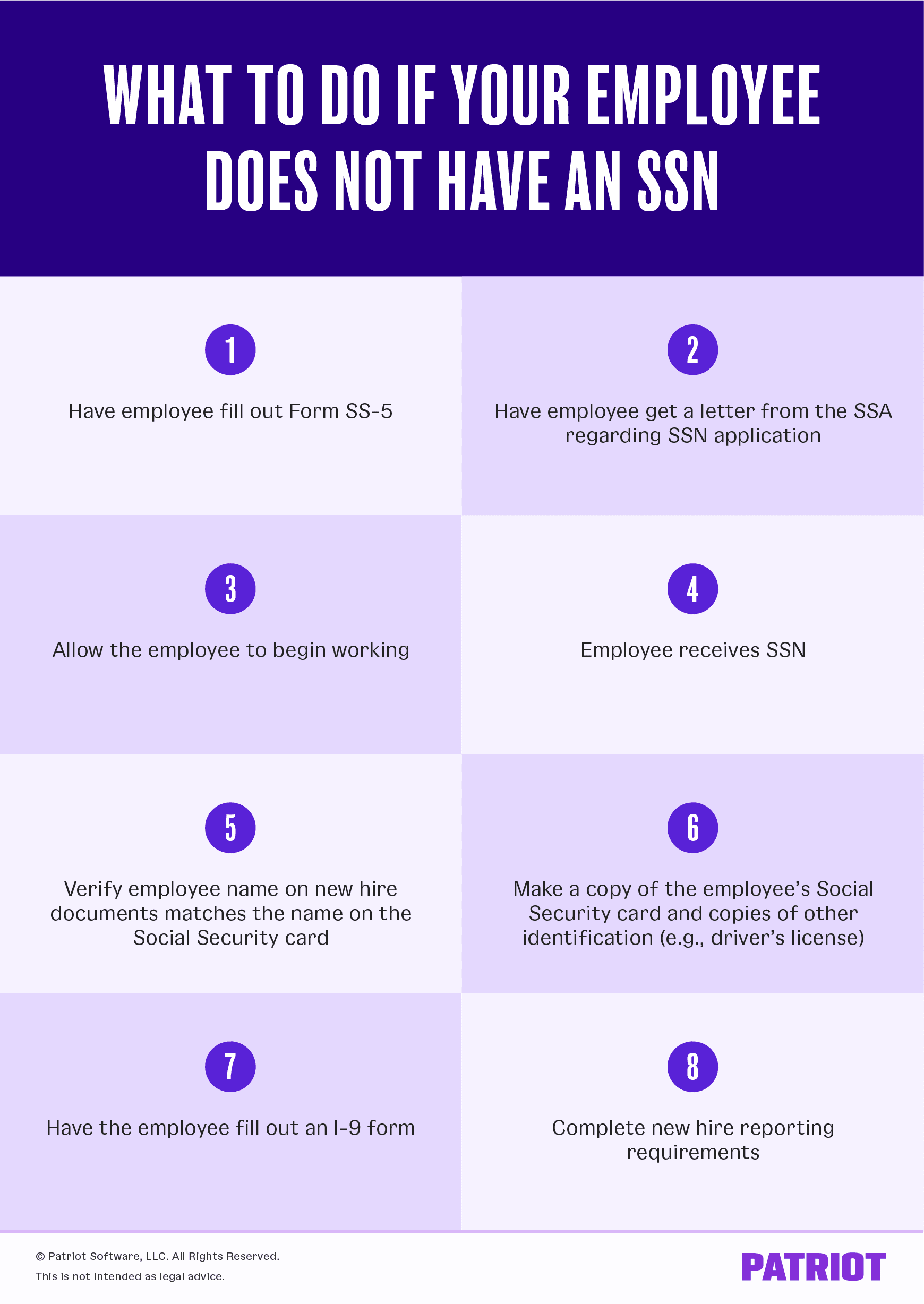

If an employee has applied for but has not yet received a Social Security number, employers should gather as much information as possible

about the employee, including their full name, address, date and place of birth, father’s full name, mother’s full maiden name, gender,

and the date they applied for a Social Security number.

Students can work without an SSN as long as they have the necessary authorization, such as on-campus work, Curricular Practical Training (CPT),

or Optional Practical Training (OPT). Employers should follow the correct instructions for allowing students to begin work without the SSN.

Since 1973, social security numbers have been issued by the Social Security Administration’s central office. The first three digits of a person’s

social security number are determined by the ZIP Code of the mailing address shown on the application for a social security number.

The nine-digit social security number is composed of three parts: The first three digits are called the Area Number, the second set of two digits

is called the Group Number, and the final set of four digits is the Serial Number.

You can find your SSN by checking your Social Security card, bank statements, or tax returns. If you have lost your card and need the number, you

will have to apply for a replacement. In the meantime, you can contact your employer for more information on your SSN.

To apply for a Social Security Number for the first time, individuals aged 12 or older must submit the following documents: Application for a Social

Security Card (Form SS-5), which can be obtained from the Social Security Administration’s website, and their original birth certificate.

An Individual Tax Identification Number (ITIN) should not be accepted as a substitute for an SSN for employee identification or work purposes. ITINs

are only available to resident and nonresident aliens who are not eligible for U.S. employment but need identification for tax purposes.

Questions and Answers

Q: What can I put if I don’t have a Social Security number?

A: If you do not have a Social Security Number (SSN), you can enter your Individual Tax Identification Number (ITIN) instead. If you do not have an SSN

or ITIN, you can leave the entry field blank.

Q: Can you work without a Social Security number?

A: We do not require you to have a Social Security Number (SSN) before you start work. However, the Internal Revenue Service (IRS) requires employers

to use your SSN to report your wages. While waiting for your SSN, your employer can use a letter from the Social Security Administration stating that

you have applied for a number.

Q: Do all U.S. citizens have a Social Security number?

A: With very few exceptions, all U.S. citizens, permanent residents, and temporary or working residents have a Social Security number.

Q: How long does it take to get a Social Security number?

A: You should receive your Social Security number (SSN) card within 2 weeks after providing all necessary documents for your application, including

verification of your immigration document with the United States Citizenship and Immigration Services (USCIS). If immediate verification is not possible,

it may take an additional 2 weeks to receive your card.

Q: What happens if an employee does not have a Social Security number?

A: If a worker has applied for but has not yet received a Social Security number, employers should gather as much information as possible about the employee,

including their full name, address, date and place of birth, father’s full name, mother’s full maiden name, gender, and the date they applied for a Social Security

number.

Q: Can students work without a Social Security number?

A: Students can work without a Social Security number (SSN) as long as they have the necessary authorization, such as on-campus work, Curricular Practical Training

(CPT), or Optional Practical Training (OPT). Employers should follow the correct instructions for allowing students to begin work without the SSN.

Q: What are the first 3 digits of a Social Security number?

A: Since 1973, social security numbers have been issued by the Social Security Administration’s central office. The first three digits of a person’s social security

number are determined by the ZIP Code of the mailing address shown on the application for a social security number.

Q: What is the last 4 digits of a Social Security number?

A: The nine-digit social security number is composed of three parts: The first three digits are called the Area Number, the second set of two digits is called the

Group Number, and the final set of four digits is the Serial Number.

Q: How do I find my Social Security number?

A: You can find your Social Security number (SSN) by checking your Social Security card, bank statements, or tax returns. If you have lost your card and need the number,

you will have to apply for a replacement. In the meantime, you can contact your employer for more information on your SSN.

Q: How do I apply for my Social Security number for the first time?

A: If you are applying for a Social Security number for the first time and you are 12 years of age or older, you must submit the following documents: Application for a

Social Security Card (Form SS-5), which can be obtained from the Social Security Administration (SSA) website, and your original birth certificate.

Q: Can you hire someone with an ITIN number?

A: An Individual Tax Identification Number (ITIN) should not be accepted as a substitute for a Social Security number (SSN) for employee identification or work purposes.

ITINs are only available to resident and nonresident aliens who are not eligible for U.S. employment but need identification for tax purposes.

What can I put if I don’t have a Social Security number

If you do not have a Social Security Number (SSN) enter your Individual Tax Identification Number (ITIN). If you do not have an SSN or ITIN leave the entry field blank.

Cached

Can you work without a SSN

We don't require you to have an SSN before you start work. However, the Internal Revenue Service requires employers to use your SSN to report your wages. While you wait for your SSN, your employer can use a letter from us stating you applied for a number.

Do all U.S. citizens have a Social Security number

With very few exceptions, all U.S. citizens, permanent residents, and temporary or working residents have a Social Security number.

How long does it take to get SSN

You should receive your SSN card within 2 weeks after we have everything we need to process your application, including verification of your immigration document with the USCIS. If we are unable to immediately verify your immigration document with the USCIS, it may take 2 additional weeks to receive your card.

What happens if an employee does not have SSN

If a worker applied for but has not yet received a Social Security number, you should get the following information as complete as possible: The worker's full name, address, date of birth, place of birth, father's full name, mother's full maiden name, gender and the date he or she applied for a Social Security number.

Can students work without SSN

As long as you have authorization (on-campus work, CPT, or OPT), yes: you can start working without an SSN. Be sure your employer follows the correct instructions for allowing you to begin work without the SSN.

What are the first 3 digits of SSN

Since 1973, social security numbers have been issued by our central office. The first three (3) digits of a person's social security number are determined by the ZIP Code of the mailing address shown on the application for a social security number.

What is the last 4 digits of SSN

The SSN Numbering Scheme

The nine-digit SSN is composed of three parts: The first set of three digits is called the Area Number. The second set of two digits is called the Group Number. The final set of four digits is the Serial Number.

How do I find my SSN number

Finding your SSN is possible by checking your Social Security card, but you can also find it on bank statements or tax returns. If you lost your card and need the number, you will have to apply for a replacement, and in the meantime, you can ask your employer for more information on it.

How do I ask for my SSN for the first time

If you are applying for a Social Security Number for the first time and you are 12 years of age or older, you must submit the following documents: Application for a Social Security Card, Form SS-5. You can print the form from the SSA's webpage to ensure you are using the latest version. Your original birth certificate.

Can you hire someone with a ITIN number

Do not accept an ITIN in place of an SSN for employee identification or for work. An ITIN is only available to resident and nonresident aliens who are not eligible for U.S. employment and need identification for other tax purposes.

How do I get a SSN

Apply for a Social Security number

If you're in the U.S., you can apply online, then go to a local Social Security office to provide your documentation. Once your application is approved, you'll receive a Social Security card with your number on it by mail within 14 days.

What are the last 4 digits of SSN for

The last four digits of the SSN are the serial number. The serial number represents a straight numerical series of numbers from 0001–9999 within each group. Serial number 0000 is not assigned.

What are the last 4 digits of a real SSN

The nine-digit SSN is composed of three parts: The first set of three digits is called the Area Number. The second set of two digits is called the Group Number. The final set of four digits is the Serial Number.

What happens when we run out of Social Security numbers

So we're not in danger of running out of them anytime soon, and your number is yours to keep. Forever. An FAQ on the agency's website says it will not reassign your number even after you die.

Can I look up my SSN online

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

How do I find my social security number by name for free

So while you can't find another individual's social security number by name for free or at all, employers or companies can sometimes request this information as part of an employment application.

How do I get a SSN if I never had one

NOTE: If you are age 12 or older and have never received a Social Security number, you must apply in person. To apply for a replacement card, you must provide one document to prove your identity.

Can I use ITIN instead of SSN

The ITIN cannot be used in place of an SSN (if eligible for the latter) for tax and wage reporting. How do I apply for an ITIN Submit a completed IRS Form W-7 Application for IRS Individual Taxpayer Identification Number, along with documentation to substantiate your foreign status and true identity, to the IRS.

Can an undocumented immigrant apply for ITIN

Frequently Asked Questions. Can undocumented individuals apply for an ITIN Yes. Any individual not eligible for a SSN may apply and file for an ITIN.

How do I get my SSN for the first time

Apply for a Social Security number

If you're in the U.S., you can apply online, then go to a local Social Security office to provide your documentation. Once your application is approved, you'll receive a Social Security card with your number on it by mail within 14 days.

How do I get my SSN online

You can go to www.ssa.gov/ssnumber and answer a few questions to find out the best way to apply. If you aren't able to use a personal my Social Security account to request a replacement card, you can still begin the process online and complete it in a local Social Security office or card center, usually in less time.

Do the last 4 digits of SSN matter

The last 4 digits of an SSN are important because if they're in the wrong hands, they might lead to identity theft and you might get in trouble due to someone else's actions. It's important to protect these digits and make sure they do not end up in the wrong hands.

Is it OK to put the last 4 digits of SSN

Giving someone the last four digits of your SSN could lead to identity theft as this is the direct way to do the most damage to your financial information. Why Banks and other official institutions often only request the last four digits of your SSN to confirm your identity.

How important is the last 4 digits of SSN

The last 4 digits of an SSN are important because if they're in the wrong hands, they might lead to identity theft and you might get in trouble due to someone else's actions. It's important to protect these digits and make sure they do not end up in the wrong hands.