What is an example of identity fraud?

Summary of the Article: Types and Examples of Identity Fraud

Identity fraud is a serious issue in today’s digital world. It encompasses various types of theft, including medical, criminal, financial, and child identity theft. Examples of identity theft include stolen checks, fraudulent change of address, social security number misuse, and false civil and criminal judgments.

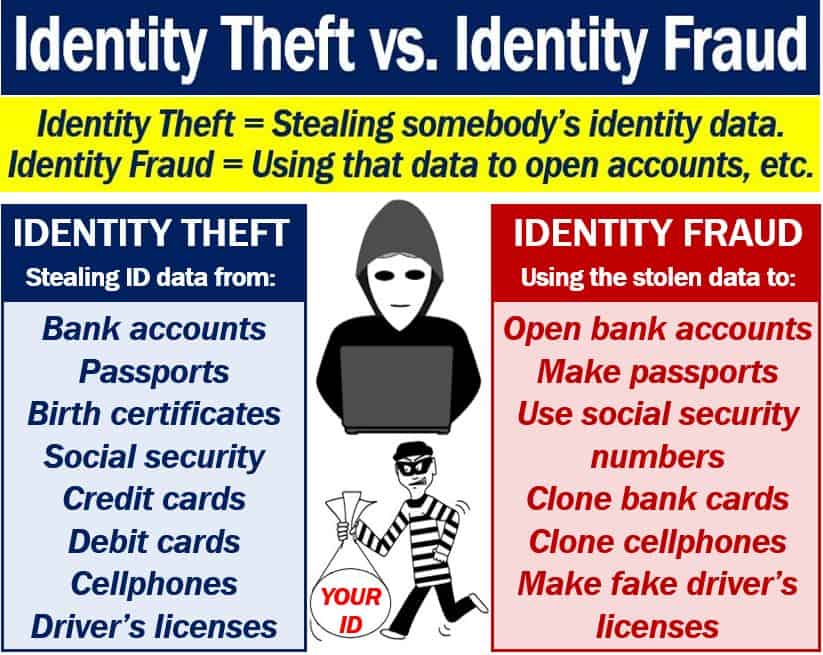

Identity fraud involves the theft of personal information such as social security numbers, bank account numbers, and credit card information. Identity thieves can obtain this information through various means, including sifting through trash bins looking for statements and using phishing emails to trick individuals into revealing their personal details.

There are six common forms of identity theft: new account fraud, account takeover fraud, criminal identity theft, medical identity theft, business or commercial identity theft, and identity cloning. These forms of theft involve using another person’s personal information for personal gain.

Thieves employ various tactics to steal identities, such as phishing and SMiShing, dumpster diving, wireless hacking, and fake lottery winnings or job offers. They may also target ATM and payment machines to obtain sensitive information.

The most common causes of identity theft usually involve the exposure of personal data through hacking, phishing, data breaches, or other means. Criminals then use this information to carry out illegal activities, such as opening accounts in the victim’s name.

It’s important to note that the unauthorized use of a stolen credit card is often considered consumer fraud rather than identity fraud. Additionally, certain actions like using fake names and falsifying documents to hide one’s true identity can also be considered identity fraud.

Signs that indicate you may be a victim of identity fraud include the loss or theft of important documents like passports or driving licenses and the appearance of unrecognized items on bank or credit card statements.

Both physical theft and technology-based methods are frequently used to steal identities. Examples of physical theft include dumpster diving, mail theft, skimming, change of address, and government records. Technology-based methods include phishing, pharming, DNS cache poisoning, and the use of malware and viruses.

In conclusion, identity fraud is a widespread problem with various types and examples. It is crucial to be aware of the different tactics used by identity thieves and to take appropriate measures to protect personal information.

What are the 4 types of identity fraud

The four types of identity theft include medical, criminal, financial and child identity theft.

What are three examples of identity theft

Examples of Identity TheftStolen Checks. If you have had checks stolen or bank accounts set up fraudulently, report it to the check verification companies.ATM Cards.Fraudulent Change of Address.Social Security Number Misuse.Passports.Phone Service.Driver License Number Misuse.False Civil and Criminal Judgements.

CachedSimilar

What does identity fraud include

Identity theft occurs when someone steals your personal information—such as your Social Security Number, bank account number, and credit card information. Identity theft can be committed in many different ways. Some identity thieves sift through trash bins looking for bank account and credit card statements.

Cached

What are 6 common forms of identity theft

The 6 Types of Identity Theft#1 New Account Fraud. Using another's personal identifying information to obtain products and services using that person's good credit standing.#2 Account Takeover Fraud.#3 Criminal Identity Theft.#4 Medical Identity Theft.#5 Business or Commercial Identity Theft.#6 Identity Cloning.

What are 6 ways someone can steal your identity

Common Tactics Thieves Use To Steal Your IdentityPhishing and SMiShing. Phishing involves sending you a fraudulent email that looks to be authentic, say an email from your bank asking you to verify your account information.Dumpster Diving.Wireless Hacking.Fake Lottery Winnings, Jobs, Etc.ATM and Payment Machines.

What are the 3 most common causes of identity theft

Identity theft usually begins when your personal data is exposed through hacking, phishing, data breaches, or other means. Next, a criminal makes use of your exposed information to do something illegal, such as opening an account in your name.

What is not an identity fraud

The unauthorized use of a stolen credit card is commonly not considered identity fraud, but may be considered consumer fraud. The use of fake names, ID cards, falsified or forged documents, and lying about their own age to simply "hide" their true identity is sometimes also regarded as identity fraud.

How can you tell identity fraud

What signs should I look out forYou have lost or have important documents stolen, such as your passport or driving licence.Mail from your bank or utility provider doesn't arrive.Items that you don't recognise appear on your bank or credit card statement.

What is the most common method used to steal your identity

Physical Theft: examples of this would be dumpster diving, mail theft, skimming, change of address, reshipping, government records, identity consolidation. Technology-Based: examples of this are phishing, pharming, DNS Cache Poisoning, wardriving, spyware, malware and viruses.

What is the most common way to get your identity stolen

Here are a few of the most common.Phishing and SMiShing. Phishing involves sending you a fraudulent email that looks to be authentic, say an email from your bank asking you to verify your account information.Dumpster Diving.Wireless Hacking.Fake Lottery Winnings, Jobs, Etc.ATM and Payment Machines.

What are three 3 warning signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What are the signs of identity fraud

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What are red flags to identify fraud

There are four elements that must be present for a person or employee to commit fraud: • Opportunity • Low chance of getting caught • Rationalization in the fraudsters mind, and • Justification that results from the rationalization.

How do I know if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

What are the first signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

What information does someone need to steal your identity

What they want are account numbers, passwords, Social Security numbers, and other confidential information that they can use to loot your checking account or run up bills on your credit cards. Identity thieves can take out loans or obtain credit cards and even driver's licenses in your name.

What are red flags of ID theft

Information on ID card is inconsistent with information on file in the organization. Application appears forged, altered and reassembled. Personal information is inconsistent across multiple sources. Lack of correlation between social security number range and date of birth exists.

What are the three factors of fraud

In the 1970s, criminologist Donald R. Cressey published a model called the “fraud triangle”. The fraud triangle outlines the three conditions that lead to higher instances of occupational fraud: motivation, opportunity, and rationalization.

What is one of the most common red flags of fraud behavior

Fraudsters' common behavioral red flags

Management and co-workers may see warning signs of “fraudsters.” According to the ACFE reports, the two most common red flags continue to include living beyond one's means and financial difficulties. Other warning signs include: Getting too close to vendors or customers.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I find out if a credit card has been opened in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I find out if someone opened a bank account in my name

How to find out if bank accounts are fraudulently opened in your name. If scammers open bank accounts in your name, you may be able to find out about it by taking a look at your checking account reports. These consumer reports include information about people's banking and check-writing history.

How do I know if my identity is being used without my knowledge

Regularly check your credit report and bank statements.

Check for the warning signs of identity theft — such as strange charges on your bank statement or accounts you don't recognize. An identity theft protection service like Aura can monitor your credit and statements for you and alert you to any signs of fraud.

What is the most common fraud detection method

Fraud Detection by Tip Lines

One of the most successful ways to identify fraud in businesses is to use an anonymous tip line (or website or hotline). According to the Association of Certified Fraud Examiners (ACF), tips are by far the most prevalent technique of first fraud detection (40 percent of instances).