What is status updated on credit report?

Summary of the Article: Understanding Credit Report Statuses

In this article, we will explore the various statuses that can appear on a credit report and their meanings. These statuses include open, paid, closed, refinanced, transferred, and foreclosed. Additionally, we will discuss the types of records that can appear on a credit report, such as mortgages, student loans, auto loans, credit cards, charge cards, and service accounts.

1. What are the statuses on a credit report?

The statuses on a credit report can include open, paid, closed, refinanced, transferred, and foreclosed.

2. When is a credit score updated?

Credit scores typically update at least once a month.

3. What does the payment status “current” mean?

A current payment status means that there is either no payment due currently or only the minimum payment for the current month.

4. How can I update my credit status?

To update your credit status, you can generally do so by updating your personal information with your creditors, such as your address.

5. What does the status on a credit application mean?

The phrase “Subject to Status” on a loan application means that the success of the application depends on factors like income and credit history.

6. What does a credited status mean?

A credited status refers to a lender’s willingness to lend money based on the borrower’s ability to repay.

7. How long does it take for a credit report to update?

It can take 4-6 weeks for new account information to appear on a credit report.

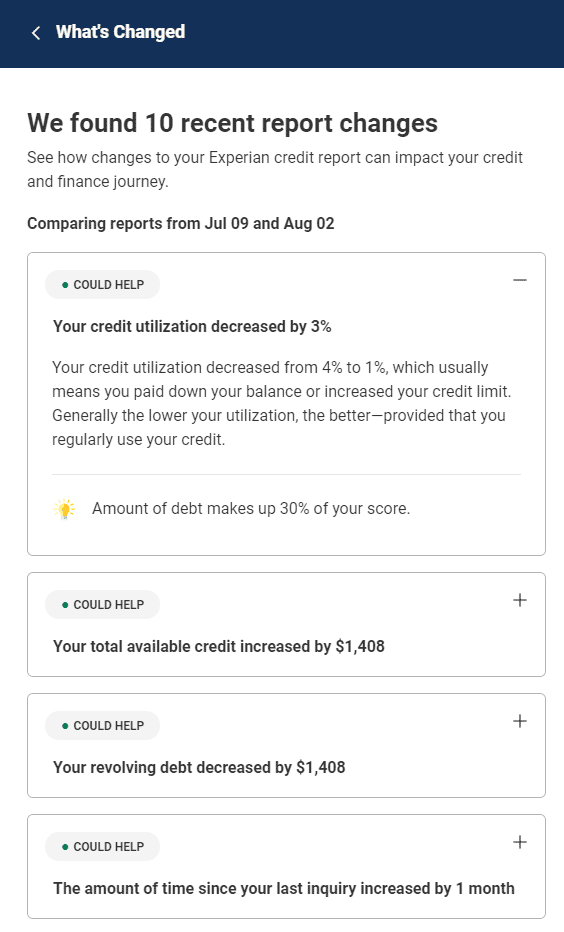

8. How often is an Experian credit report updated?

Experian credit reports are typically updated once every month.

9. What are the different types of payment statuses?

Payment statuses can include pending, complete, refunded, failed, abandoned, revoked, preapproved, and cancelled.

10. What is the worst payment status?

The worst payment status is when an account has a payment that was at least 30 days late and/or has a derogatory status reported by the lender.

These are the key points regarding credit report statuses and their meanings. Understanding these can help individuals manage and improve their credit health.

What are the statuses on credit report

Other common statuses include: open, paid, closed, refinanced, transferred and foreclosed. The date when your account was opened as reported by your creditor. The types of records appearing on your credit report, such as mortgages, student loans, auto loans, credit cards, charge cards and service accounts.

When credit score is updated

Your credit scores typically update at least once a month.

Cached

What does payment status current mean

When an account is current, there is either no payment due right now because you've recently made a payment, or the only payment due now is the minimum payment for the current month. Your credit card issuer wants you to bring your account current because delinquent accounts mean they're losing money.

How do I update my credit status

If you need to update your personal information on your credit report, you can generally do this by updating your information with your creditors. For example, if you move, you'll need to update your address to ensure the creditor can send you mail, including your monthly statements.

What does status mean on a credit application

Updated April 5, 2023. The phrase “Subject to Status”, when applied to a loan, means that the success of a loan application will be subject to certain factors – e.g. the applicant's income and credit history. Many may have noticed this phrase used on loan applications, wondering why it's there and what it even means.

What does credited status mean

From Longman Business DictionaryRelated topics: Finance ˈcredit ˌstatus [uncountable] a measure of a lender's willingness to lend money to a particular person or organization, depending on their ability to repaySYNCREDIT RATING, CREDIT STANDINGThe country has a good credit status, large hard-currency reserves, a stable …

How long does your credit report take to update

4-6 weeks

Updates aren't real-time

You may need to wait for updates to be made to your credit report. It can take 4-6 weeks for new account information to show up on your file as credit reference agencies rely on information being provided by lenders. If they are behind with their updates, there will be a delay.

How often is your Experian credit report updated

once every month

Lenders, credit card issuers and other data reporters typically update your credit information at the three national credit bureaus (Experian, TransUnion and Equifax) once every month.

What are the different types of payment status

A payment may have a variety of statuses, here's a list of each and what they mean.Pending. This is a payment that has begun, but is not complete.Complete. This is a payment that has been paid and the product delivered to the customer.Refunded.Failed.Abandoned.Revoked.Preapproved.Cancelled.

What is worst payment status

Description. Your credit file is showing an account with a payment that was at least 30 days late and/or on which a lender has reported a derogatory status. Late payments are a proven indicator of increased risk. People with late payments are at risk of being overextended, putting existing credit with lenders at risk.

What does statused account mean

Account Statuses refer to the different states of an account. Different rules can be applied to the accounts based on their status in order to better manage data entry. Examples of statuses include 'Active' and 'Inactive' but Quadra allows you to create other statuses as needed.

How do I know if my credit application is approved

The issuer lets you know if your application is approved.

In many cases, this process takes just minutes to complete. Yet in some cases, it can take a few days to evaluate and verify your application. It could take even longer if you mailed in an application.

Does credited mean refund

The difference between refunds and chargebacks

A credit card refund occurs after you make a purchase and then have the purchase amount credited back to your account. A chargeback, on the other hand, reverses the original charge and can only occur after you have filed a billing dispute with your credit card company.

Does credited mean received

Credit in Financial Accounting

In personal banking or financial accounting, a credit is an entry that shows that money has been received. On a checking account register, credits (deposits) are usually on the right side, and debits (money spent) are left.

How long does it take Equifax to update report

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

Why is it taking so long for my credit to update

Credit takes time to grow. Some key factors in your scores, like on-time payments and age of credit history, can take several months or even years to establish. Good habits, such as making payments on-time and using less of your available credit, among others, can help you improve your credit health over time.

Does Experian update automatically

Experian updates credit scores once a month. TransUnion and Equifax follow a similar schedule. Depending on creditors' reporting, you might see an update to your score every 30 to 45 days.

Is Experian or Credit Karma more accurate

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

What does approved account status mean

Approved: This status is most common for credit card transactions since approval of funding (authorization) is instantaneous. When most credit card transactions move from the Approved Transactions report to Settled, their status will be Approved.

What is the meaning of transaction status processed

Transaction processing is the process of completing a task and/or user/program request either instantly or at runtime. It is the collection of different interrelated tasks and processes that must work in sync to finish an overall business process transaction.

What is the status 3 on my credit report

2, 3, 4, 5, and 6 follow on in a very straight forward pattern – the recorded number will increase consecutively with each missed monthly payment. Any of these statuses count as arrears. The higher the number, the more serious the arrears and the more serious the impact on your Credit Report and score.

What does status mean on a check

The Payment Status column indicates Check Cleared, which means the check has been cashed by the payee and has cleared our bank. (The actual date the check cleared will be later than either the Pay Date or Disbursement Date.)

How can I get my account status

There are various methods to check balance in your bank account online such as by logging into your net banking account, using UPI apps, via mobile banking, and so on. You can also choose offline mode for account balance check through an ATM using your debit card, SMS, and passbook.

Does credit approved mean loan approved

Borrowers must complete a process called credit approval in order to qualify for a loan. Through this process, a lender assesses the ability and willingness of a borrower to fully repay (interest and principal) a loan on time.

How do I know if my refund has been credited

View Refund/ Demand StatusLogin to e-Filing website with User ID, Password, Date of Birth / Date of Incorporation and Captcha.Go to My Account and click on "Refund/Demand Status".Below details would be displayed. Assessment Year. Status. Reason (For Refund Failure if any) Mode of Payment is displayed.