What is the most common identity fraud?

Identity Theft: Common Types and Prevention

What is the #1 type of identity theft?

Financial identity theft

This is the most common form of identity theft (including the credit card example described above). Financial identity theft can take multiple forms, including: Fraudsters may use your credit card information to buy things.

What are the 4 types of identity fraud?

The four types of identity theft include medical, criminal, financial, and child identity theft.

What is the most common crime in identity theft?

According to the Federal Bureau of Investigation’s (FBI) 2021 Internet Crime Report, the most common type of cybercrime in the US is phishing/vishing/smishing – all of which involve stealing users’ personal data. These types of cyber crimes occur almost 4 times more than any other.

What are the 3 most common causes of identity theft?

Identity theft usually begins when your personal data is exposed through hacking, phishing, data breaches, or other means. Next, a criminal makes use of your exposed information to do something illegal, such as opening an account in your name.

What is a common method of identity theft?

Phishing and SMiShing

Do not reply to these and never supply personal information via unsolicited email. Thieves have also taken to text messaging through a tactic called SMiShing. SMiShing is similar to phishing in that you will receive a fraudulent text message asking you to verify a purchase or account information.

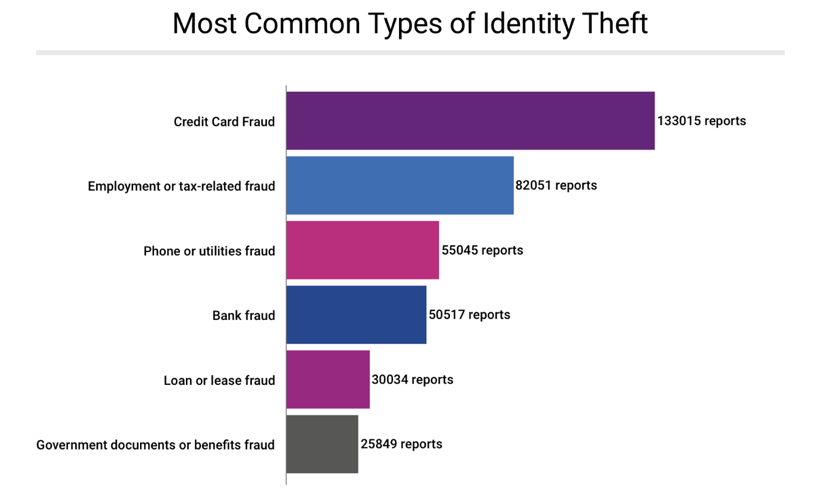

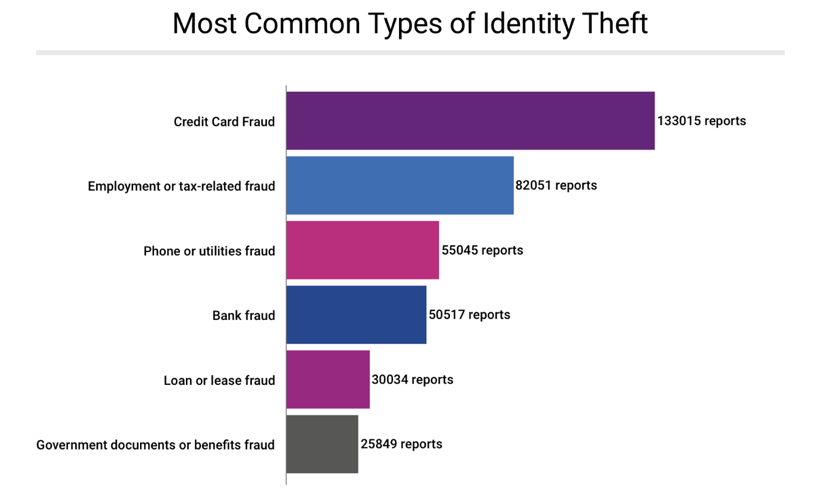

What are 6 common forms of identity theft?

The 6 Types of Identity Theft

- New Account Fraud. Using another’s personal identifying information to obtain products and services using that person’s good credit standing.

- Account Takeover Fraud.

- Criminal Identity Theft.

- Medical Identity Theft.

- Business or Commercial Identity Theft.

- Identity Cloning.

What are 3 ways someone can steal your identity?

How can a thief steal my identity?

- Steal your mail or garbage to get your account numbers or your Social Security number.

- Trick you into sending personal information in an email.

- Steal your account numbers from a business or medical office.

- Steal your wallet or purse to get your personal information.

What are the most common things stolen during identity theft?

Examples of Identity Theft

- Stolen Checks. If you have had checks stolen or bank accounts set up fraudulently, report it to the check verification companies.

- ATM Cards.

- Fraudulent Change of Address.

- Social Security Number Misuse.

- Passports.

- Phone Service.

- Driver License Number Misuse.

- False Civil and Criminal Judgements.

Do most identity thieves get caught?

In a study done in 2006, “only 1 in 700 identity theft suspects were arrested by federal authorities (0.14%). Identity thieves and cybercriminals do get caught, and more of them are being held accountable for their crimes than ever before.

What are three examples of identity theft?

Examples of Identity Theft

- Stolen Checks. If you have had checks stolen or bank accounts set up fraudulently, report it to the check verification companies.

- ATM Cards.

- Fraudulent Change of Address.

- Social Security Number Misuse.

- Passports.

- Phone Service.

- Driver License Number Misuse.

- False Civil and Criminal Judgements.

What are the first two things you need to do if your identity is stolen?

Contact the relevant authorities.

What is the #1 type of identity theft

Financial identity theft

This is the most common form of identity theft (including the credit card example described above). Financial identity theft can take multiple forms, including: Fraudsters may use your credit card information to buy things.

Cached

What are the 4 types of identity fraud

The four types of identity theft include medical, criminal, financial and child identity theft.

What is the most common crime in identity theft

According to the Federal Bureau of Investigation's (FBI) 2021 Internet Crime Report, the most common type of cybercrime in the US is phishing/vishing/smishing – all of which involve stealing users' personal data. These types of cyber crimes occur almost 4x more than any other.

Cached

What are the 3 most common causes of identity theft

Identity theft usually begins when your personal data is exposed through hacking, phishing, data breaches, or other means. Next, a criminal makes use of your exposed information to do something illegal, such as opening an account in your name.

Cached

What is a common method of identity theft

Phishing and SMiShing

Do not reply to these and never supply personal information via unsolicited email. Thieves have also taken to text messaging through a tactic called SMiShing. SMiShing is similar to phishing in that you will receive a fraudulent text message asking you to verify a purchase or account information.

What are 6 common forms of identity theft

The 6 Types of Identity Theft#1 New Account Fraud. Using another's personal identifying information to obtain products and services using that person's good credit standing.#2 Account Takeover Fraud.#3 Criminal Identity Theft.#4 Medical Identity Theft.#5 Business or Commercial Identity Theft.#6 Identity Cloning.

What are 3 ways someone can steal your identity

How can a thief steal my identitysteal your mail or garbage to get your account numbers or your Social Security number.trick you into sending personal information in an email.steal your account numbers from a business or medical office.steal your wallet or purse to get your personal information.

What are the most common things stolen during identity theft

Examples of Identity TheftStolen Checks. If you have had checks stolen or bank accounts set up fraudulently, report it to the check verification companies.ATM Cards.Fraudulent Change of Address.Social Security Number Misuse.Passports.Phone Service.Driver License Number Misuse.False Civil and Criminal Judgements.

Do most identity thieves get caught

In a study done in 2006, "only 1 in 700 identity theft suspects were arrested by federal authorities (0.14%)." Identity thieves and cybercriminals do get caught and more of them are being held accountable for their crimes than ever before.

What are three examples of identity theft

Examples of Identity TheftStolen Checks. If you have had checks stolen or bank accounts set up fraudulently, report it to the check verification companies.ATM Cards.Fraudulent Change of Address.Social Security Number Misuse.Passports.Phone Service.Driver License Number Misuse.False Civil and Criminal Judgements.

What are the first two things you need to do if your identity is stolen

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

How do I find out who took my identity

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

Who is at higher risk for identity theft

Do you know the biggest targets of identity theft The answer may surprise you – while everyone should be aware of identity theft, children and the elderly are at an especially high risk of becoming victims.

What are three 3 warning signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

How can I find out if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How can I find out if someone is using my identity

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

How do I find out if a credit card has been opened in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do you check if your SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How do I know if my identity is being used without my knowledge

Regularly check your credit report and bank statements.

Check for the warning signs of identity theft — such as strange charges on your bank statement or accounts you don't recognize. An identity theft protection service like Aura can monitor your credit and statements for you and alert you to any signs of fraud.

Who is identity theft usually committed by

family member

Most identity theft is perpetrated by a family member of the victim, and some may not be able to obtain new credit cards or open new bank accounts or loans.

What are red flags of ID theft

Information on ID card is inconsistent with information on file in the organization. Application appears forged, altered and reassembled. Personal information is inconsistent across multiple sources. Lack of correlation between social security number range and date of birth exists.

How can you tell if someone is using your identity

How To Know if Someone Stole Your IdentityTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

How do you check to see if someone stole your identity

How To Know if Someone Stole Your IdentityTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.