Which is best monthly income plan?

Summary of the Article:

Which insurance is best for monthly income

Best Monthly Income Plans You Should ConsiderPost Office Monthly Income Scheme.Long-Term Government Bonds.Corporate Deposits.Monthly Income Plans.Pradhan Mantri Vaya Vandana Yojana.Life Insurance Plus Saving.Systematic Withdrawal Plans.Equity Share Dividends.

How can I make $1000 a month in passive income

However, they have less earning potential than high-involvement passive income streams.Purchase Series I Bonds.Create a CD Ladder.Become a Paid Online Shopper.Use Rewards Credit Cards.Use a Robo-Advisor.Invest in the Stock Market.Invest in Real Estate.Start a YouTube Channel.

How to make $5,000 a month in passive income

Building passive income takes time and effort, and it’s important to remain patient and persistent.Invest in Dividend-Paying Stocks:Rental Properties:Peer-to-Peer Lending:Create and Sell Digital Products:Invest in Real Estate Investment Trusts (REITs):High-Yield Savings Accounts and Certificates of Deposit (CDs):

What is the best way to get monthly income

Best Investment Plan for Monthly IncomePost Office Monthly Income Scheme.Government Bond.Corporate Deposits.Monthly Income Plan.Senior Citizen Savings Scheme.Pradhan Mantri Vaya Vandana Yojana (PMVVY)Systematic Withdrawal Plans (SWP)Guaranteed Income Insurance Plans. Related Articles.

Is monthly income plan good

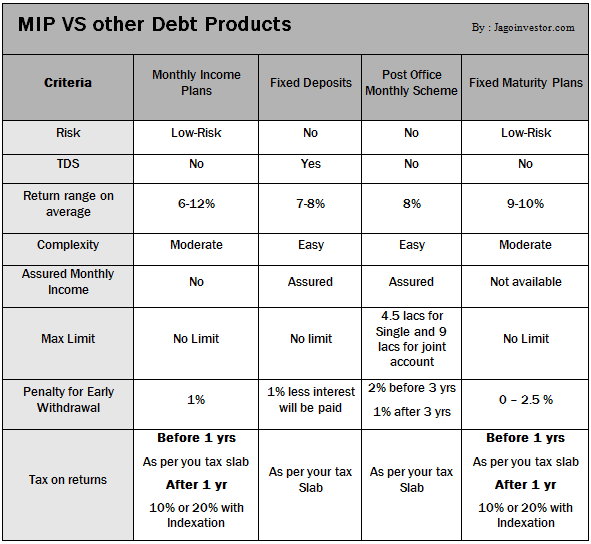

Monthly income plans are a great way for investors to ensure they get a steady stream of income. Well-suited for retirees and older investors, these plans pay investors dividends and interest income by primarily investing in lower-risk assets like debt securities. This is offset by a smaller position in equities.

Is $200 a month a lot for health insurance

According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How to passively make $2,000 a month

Become a Blogger and earn with affiliate marketing.Offer Proofreading Services as a side hustle from home.Complete paid online surveys for money.Create Graphic Designs from Home as a Freelancer.Earn money by testing apps and websites.Transcribe videos, phone calls, and other recordings from home.

Can you live off of rental income

Effectively managing and maximizing cash flow for your investment properties will allow you to live off the rental property income. Several factors can impact your ability to maintain a positive cash flow. You’ll need to show your rental property in the best light possible to attract high-quality residents.

How to make 50k a month in passive income

5 Ways To Make $50,000 a Year in Passive IncomeBuy a Rental Property Online.Launch Your Own Mini-Fleet of Rental Cars.Stake Cryptocurrency.Buy a Blog.Buy Into a ‘Goldilocks’ Dividend Stock Fund.

How to make $3,000 a month fast

Here are my favorite in-demand side hustles — some can earn you up to $3,000 a month — and where to find them:Selling stock photos.Transcribing audio.Renting out your car.House-sitting, babysitting or pet-sitting.Product testing and research studies.Mystery shopping.Selling unwanted stuff.Junk hauling.

How to make $1,500 in a month fast

Which insurance is best for monthly income

Best Monthly Income Plans You Should ConsiderPost Office Monthly Income Scheme.Long-Term Government Bonds.Corporate Deposits.Monthly Income Plans.Pradhan Mantri Vaya Vandana Yojana.Life Insurance Plus Saving.Systematic Withdrawal Plans.Equity Share Dividends.

How can I make $1000 a month in passive income

However, they have less earning potential than high-involvement passive income streams.Purchase Series I Bonds.Create a CD Ladder.Become a Paid Online Shopper.Use Rewards Credit Cards.Use a Robo-Advisor.Invest in the Stock Market.Invest in Real Estate.Start a YouTube Channel.

How to make $5,000 a month in passive income

Building passive income takes time and effort, and it's important to remain patient and persistent.Invest in Dividend-Paying Stocks:Rental Properties:Peer-to-Peer Lending:Create and Sell Digital Products:Invest in Real Estate Investment Trusts (REITs):High-Yield Savings Accounts and Certificates of Deposit (CDs):

What is the best way to get monthly income

Best Investment Plan for Monthly IncomePost Office Monthly Income Scheme.Government Bond.Corporate Deposits.Monthly Income Plan.Senior Citizen Savings Scheme.Pradhan Mantri Vaya Vandana Yojana (PMVVY)Systematic Withdrawal Plans (SWP)Guaranteed Income Insurance Plans. Related Articles.

Is monthly income plan good

Monthly income plans are a great way for investors to ensure they get a steady stream of income. Well-suited for retirees and older investors, these plans pay investors dividends and interest income by primarily investing in lower-risk assets like debt securities. This is offset by a smaller position in equities.

Is $200 a month a lot for health insurance

According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How to passively make $2,000 a month

Become a Blogger and earn with affiliate marketing.Offer Proofreading Services as a side hustle from home.Complete paid online surveys for money.Create Graphic Designs from Home as a Freelancer.Earn money by testing apps and websites.Transcribe videos, phone calls, and other recordings from home.

Can you live off of rental income

Effectively managing and maximizing cash flow for your investment properties will allow you to live off the rental property income. Several factors can impact your ability to maintain a positive cash flow. You'll need to show your rental property in the best light possible to attract high-quality residents.

How to make 50k a month in passive income

5 Ways To Make $50,000 a Year in Passive IncomeBuy a Rental Property Online.Launch Your Own Mini-Fleet of Rental Cars.Stake Cryptocurrency.Buy a Blog.Buy Into a 'Goldilocks' Dividend Stock Fund.

How to make $3,000 a month fast

Here are my favorite in-demand side hustles — some can earn you up to $3,000 a month — and where to find them:Selling stock photos.Transcribing audio.Renting out your car.House-sitting, babysitting or pet-sitting.Product testing and research studies.Mystery shopping.Selling unwanted stuff.Junk hauling.

How to make $1,500 in a month fast

Best Ways to Make 1500 Dollars FastRent Out Space.Food Delivery Gigs.Odd Jobs on TaskRabbit.Play Games on Your Phone.Welcome Bonuses.Claim Free Stocks.Real Estate Investing.Sell Items Online.

What are the disadvantages of the monthly income plan

Disadvantages of Monthly Income Plan (MIP)

Involves Risk: No investment scheme is risk-free. The level of risk involved in the MIPs depends upon the proportion of equity involved. Irregular Income: The return on MIPs is ultimately dependant on the market volatility, and therefore the income is not guaranteed.

Is it good to save $1500 a month

Saving $1,500 a month is an excellent goal to have. It can help you build up your savings and put you in a better financial position for the future. Having this amount of money saved each month can give you more flexibility when it comes to making decisions about spending or investing.

What is the cheapest health insurance right now

Medicaid is the cheapest health insurance for those with low incomes.

What does the average US citizen pay in health insurance a month

The average cost of health insurance in the U.S. is $560 per month.

Can one person live off of $1000 a month

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

What is the rental income 1% rule

What Is The 1% Rule In Real Estate The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

How much passive income is enough to retire

Percentage Of Your Salary

Some experts recommend that you save at least 70 – 80% of your preretirement income. This means if you earned $100,000 year before retiring, you should plan on spending $70,000 – $80,000 a year in retirement. A benefit of this strategy is that it's easy to calculate.

How to make an extra $2,000 a month passive income

How Can I Make an Extra $2,000 a Month 8 Easy WaysFreelancing.Online Tutoring.Virtual Assistant.Blogging.Delivery Driving.Dog Walking.Rent Out Your Place.Photography.

How to make $20 000 in one month

Pick one or more ideas to test out and then put in the work to get up to $20,000 a month!Make Money Blogging. One way to make 20k a month is to start your own blog.Start An Ecommerce Business.Make Money With YouTube.Consulting.Online Coaching.Real Estate Rentals.Retail Arbitrage.Sell Digital Downloads.

How to make $5,000 in a month

Top 10 Ways to Make 5K a MonthFreelancing with Skills You Already Have.Blogging or Content Creation.Virtual Assistant.Start an Amazon FBA Business.Taking Pictures and Selling Stock Photos.Proofreading or Editing.Facebook Marketing.Self-Publishing Books on Amazon KDP.

Is getting paid monthly better than weekly

High-wage companies favor monthly pay cycles, whereas low-wage companies typically prefer to pay weekly. While high-income earners can often manage with only one paycheck per month, those on a lower income may need a weekly check to help pay bills and budget their finances.

Is saving $50 a week good

If you were to save $50 each week, that would result in an annual savings of $2,600. Over the span of 30 years, that's $78,000. That's not something you can retire on. But if you invested those savings into a safe growth stock, you could potentially have $1 million by the time you retire.

How much will I have if I save $100 a month for 30 years

You plan to invest $100 per month for 30 years and expect a 6% return. In this case, you would contribute $36,000 over your investment timeline. At the end of the term, your bond portfolio would be worth $97,451. With that, your portfolio would earn more than $61,000 in returns during your 30 years of contributions.

What is the most accepted health insurance

Popular insurance company: Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) has high-quality health insurance and is rated slightly ahead of other major competitors such as UnitedHealthcare and Humana. It also is the most popular health insurance company in the country.