Why did my home insurance premium go up?

Why do house insurance premiums go up

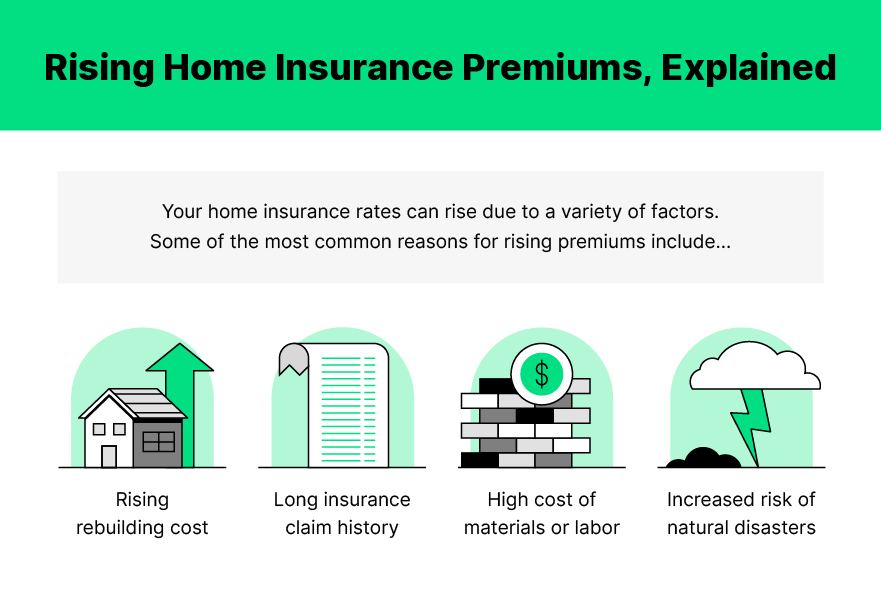

Your rates are based heavily on how much dwelling coverage is in your policy — this is the part of your home insurance that pays to rebuild your home if it’s damaged or destroyed. Higher rebuild costs due to inflation means homes are requiring higher dwelling coverage limits to keep up with the rising prices.

How much did homeowners insurance increase in 2023

Average premiums for homeowners insurance are slated for yet another big increase in 2023, according to a new report. Nationwide, the average cost of homeowners insurance is projected to jump 9%, or by about $150, according to a recent report by online marketplace Insurify.

Why has my homeowners insurance doubled

In most cases, the recent surge in homeowners insurance premiums can be attributed to the inflationary environment or recent natural disasters, but there are other factors that could be weighing on your insurance costs. The age of your home is one example.

What are 3 things that could make home insurance go up

Why Homeowners Insurance Rates Go Up1: Filing Claims May Mean Higher Premiums.2: Property Changes & Attractive Nuisances.3: Inflation Strikes Again.4: Construction Costs in Your Area Affect Your Rebuild Cost.5: Your Insurance Score Dropped.

What would be one way to lower your premiums on your home insurance

Raise your deductible

The higher your deductible, the more money you can save on your premiums. Nowadays, most insurance companies recommend a deductible of at least $500. If you can afford to raise your deductible to $1,000, you may save as much as 25 percent.

For what two reasons might your insurance premiums be higher

Being involved in a car accident, especially if you were at fault. Being arrested for a motor vehicle offense, such as a DUI/DWI or reckless driving. Multiple comprehensive claims in a limited time frame. Being a teenage driver or a driver over the age of 70.

Can you negotiate home insurance rates

Is homeowners insurance negotiable You cannot negotiate your homeowners insurance quote, but you can lower the amount you pay by taking a variety of steps—maintaining a good credit score, paying in full, installing protective devices, researching discounts, and more.

What is the insurance forecast for 2023

We forecast premiums to grow by 7.5% in 2023 and 5.5% in 2024. Slowing rate gains in commercial liability will likely be partly offset by acceleration in property and personal lines. Reserve adequacy poses a key downside risk if inflation causes losses to develop more than expected.

What might result in a higher homeowners insurance premium

Factors like where you live, your home’s replacement cost, and your policy deductible generally affect your home insurance premiums the most.

What factor affects home insurance premiums the most

Factors like where you live, your home’s replacement cost, and your policy deductible generally affect your home insurance premiums the most.

What 2 things could reduce your insurance premium

Always avoid speeding, getting into accidents, and other driving incidents. Not only do you prevent expensive speeding tickets or other moving violation costs, you also help k

Why do house insurance premiums go up

Your rates are based heavily on how much dwelling coverage is in your policy — this is the part of your home insurance that pays to rebuild your home if it's damaged or destroyed. Higher rebuild costs due to inflation means homes are requiring higher dwelling coverage limits to keep up with the rising prices.

Cached

How much did homeowners insurance increase in 2023

Average premiums for homeowners insurance are slated for yet another big increase in 2023, according to a new report. Nationwide, the average cost of homeowners insurance is projected to jump 9%, or by about $150, according to a recent report by online marketplace Insurify.

Why has my homeowners insurance doubled

In most cases, the recent surge in homeowners insurance premiums can be attributed to the inflationary environment or recent natural disasters, but there are other factors that could be weighing on your insurance costs. The age of your home is one example.

Cached

What are 3 things that could make home insurance go up

Why Homeowners Insurance Rates Go Up1: Filing Claims May Mean Higher Premiums.2: Property Changes & Attractive Nuisances.3: Inflation Strikes Again.4: Construction Costs in Your Area Affect Your Rebuild Cost.5: Your Insurance Score Dropped.

Cached

What would be one way to lower your premiums on your home insurance

Raise your deductible

The higher your deductible, the more money you can save on your premiums. Nowadays, most insurance companies recommend a deductible of at least $500. If you can afford to raise your deductible to $1,000, you may save as much as 25 percent.

For what two reasons might your insurance premiums be higher

Being involved in a car accident, especially if you were at fault. Being arrested for a motor vehicle offense, such as a DUI/DWI or reckless driving. Multiple comprehensive claims in a limited time frame. Being a teenage driver or a driver over the age of 70.

Can you negotiate home insurance rates

Is homeowners insurance negotiable You cannot negotiate your homeowners insurance quote, but you can lower the amount you pay by taking a variety of steps—maintaining a good credit score, paying in full, installing protective devices, researching discounts, and more.

What is the insurance forecast for 2023

We forecast premiums to grow by 7.5% in 2023 and 5.5% in 2024. Slowing rate gains in commercial liability will likely be partly offset by acceleration in property and personal lines. Reserve adequacy poses a key downside risk if inflation causes losses to develop more than expected.

What might result in a higher homeowners insurance premium

Factors like where you live, your home's replacement cost, and your policy deductible generally affect your home insurance premiums the most.

What factor affects home insurance premiums the most

Factors like where you live, your home's replacement cost, and your policy deductible generally affect your home insurance premiums the most.

What 2 things could reduce your insurance premium

Always avoid speeding, getting into accidents, and other driving incidents. Not only do you prevent expensive speeding tickets or other moving violation costs, you also help keep your insurance rates lower by proving you're a less risky driver.

Can you negotiate home insurance premiums

Is homeowners insurance negotiable You cannot negotiate your homeowners insurance quote, but you can lower the amount you pay by taking a variety of steps—maintaining a good credit score, paying in full, installing protective devices, researching discounts, and more.

What are 5 factors that influence insurance the price of your insurance premium

Common factors include:Driving record.Garaging of the vehicle.Gender and age of drivers.Marital status.Prior insurance coverage.Miles driven and use of vehicle.Make and Model of vehicle.Licensed drivers in your household.

What is a strategy to reduce the premium on homeowners insurance

Raise your deductible

The higher your deductible, the more money you can save on your premiums. Nowadays, most insurance companies recommend a deductible of at least $500.

Can I ask my insurance company to lower my premium

Auto insurance prices are non-negotiable, so you can't ask your car insurance company to lower your rates. However, there are several ways to find more affordable premiums. Compare quotes from multiple insurers. Although states regulate the cost of car insurance, different companies offer varying rates.

What are the pain points of the insurance industry in 2023

Research shows that inflation , digital transformation and climate change stands out as the top 3 of the biggest challenges of the Insurance industry in 2023. Inflation was named as the top challenge for 2023 by more than one-third of insurance sector insiders, according to a survey.

What will 2023 look like financially

In 2023, economic activity is projected to stagnate, with rising unemployment and falling inflation. Interest rates are projected to remain high initially and then gradually decrease in the next few years as inflation continues to slow.

What are 4 or more factors that will increase your homeowners insurance premiums

The location of your home. Home location is one of the biggest factors that insurers use to determine homeowners insurance premiums.The replacement cost of your home.Your policy deductible.The condition of your roof.Your dog's breed.Your claims history.The age of your home.A home renovation or remodeling project.

What is one way to reduce insurance premiums

Always avoid speeding, getting into accidents, and other driving incidents. Not only do you prevent expensive speeding tickets or other moving violation costs, you also help keep your insurance rates lower by proving you're a less risky driver.

What is one way to reduce the cost of a homeowners insurance policy

Increase your deductible

A quick way to reduce your premium is to raise your homeowners insurance deductible, the amount you pay if you have to make a claim. If you have a $1,000 deductible, you could save an average of 11% a year by increasing it to $2,500, according to NerdWallet's rate analysis.

Is a $2500 deductible good home insurance

Is a $2,500 deductible good for home insurance Yes, if the insured can easily come up with $2,500 at the time of a claim. If it's too much, they're better off with a lower deductible, even if it raises the amount they pay in premiums.

What are 4 factors that are used to determine the cost of insurance premiums

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose.

How can you reduce your premium

7 easy ways to help lower your car insurance premiumsChoose car safety and security features.Set higher deductibles on your auto insurance.Take a defensive driving course.Park your car in a garage.Compare auto insurance quotes.Bundle insurance policies.Get good grades.

What actions can be taken to lower these insurance premiums

5 ways to lower insurance premiumsReview your policy coverage. Look over your policies annually, because prices can change from year to year.Check your deductibles.Make home improvements.Discontinue extra coverage.Ask for discounts.

How long will the recession last in 2023

That's the prediction of The Conference Board. But some economists project the U.S. will avoid a contraction in GDP altogether.