Why does Capital One need my SSN?

Why Does Capital One Need My SSN?

1. Is it normal for Capital One to ask for Social Security number?

Credit card issuers that do not require an SSN for authorized users include Capital One, Chase, Citi, and Barclays. The cardholder will be asked to provide a name, birthdate, address, relationship to the cardholder, and possibly citizenship status of the authorized user.

2. Can I open Capital One account without SSN?

The answer is yes. You’ll simply enter information such as your date of birth and ID numbers on the bank’s application page.

3. Should I give SSN to credit card company?

Most card issuers in the United States will request credit card applicants to provide a Social Security number (SSN). This helps credit card companies prevent fraud and protects the general public from identity theft. This requirement is not universal for all cards, however.

4. Why is Capital One asking for proof of identity?

By asking you to upload pictures of your license and SSN card, they are verifying that it is indeed you who applied for the credit card and that you are able to provide valid identification in the event of any large-scale or suspicious transactions.

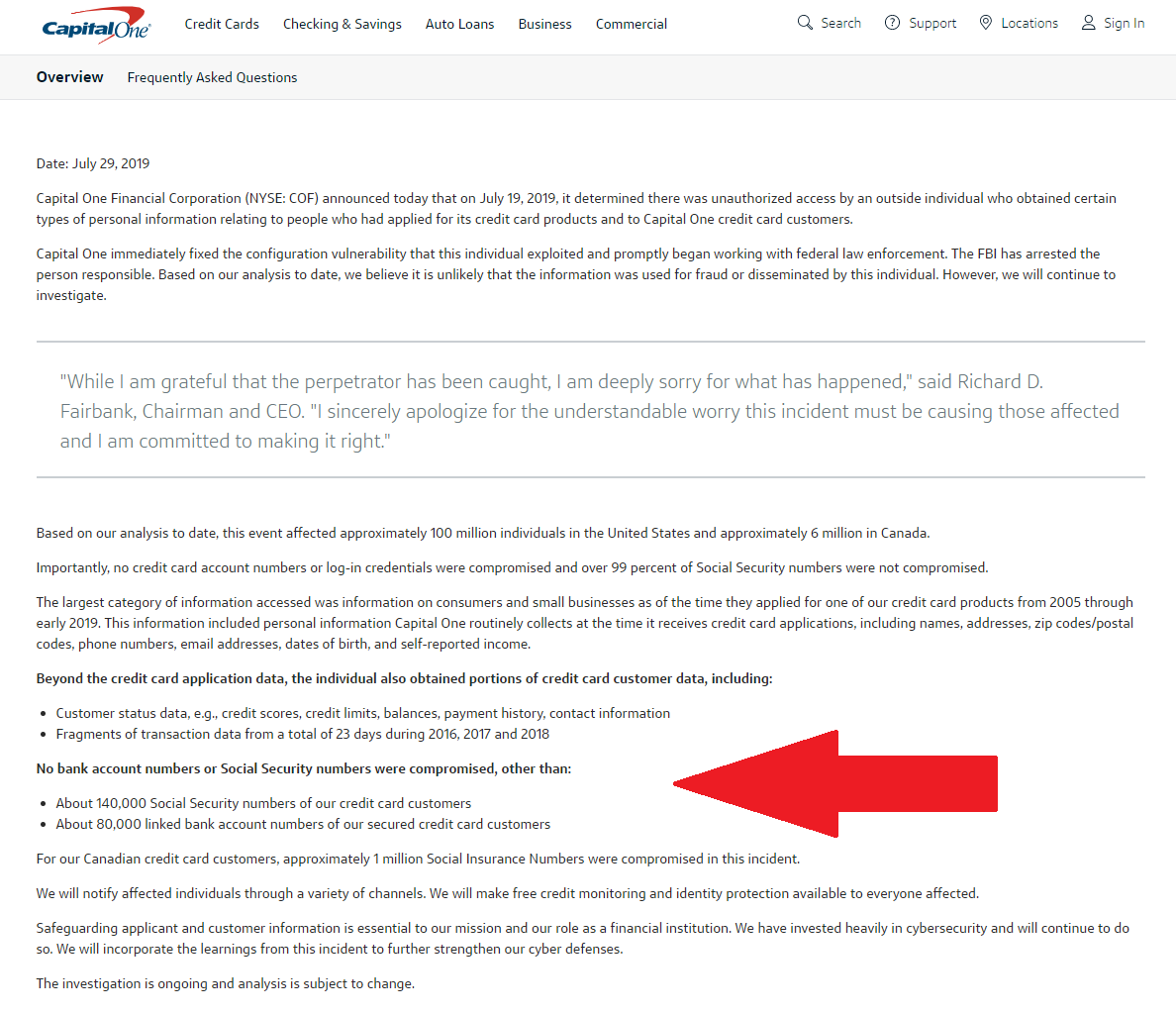

5. Is Capital One data breach legitimate?

The Federal Bureau of Investigation captured the hackers, but 140,000 social security numbers were accessed by the hackers, as well as 80,000 bank account numbers. In December 2021, Capital One was sued for breach, but decided to settle the lawsuit for $190 million.

6. Is it safe to give SSN to customer service?

You should never provide your SSN to someone you don’t know who calls you on the phone and requests it. This same warning applies to unsolicited emails and any forms you fill out on the Internet. In general, don’t give your SSN to anyone unless you are absolutely certain they have a reason and a right to have it.

7. What banks don’t require SSN to open an account?

Here are some banks and credit unions that don’t require you to have an SSN to open an account: Bank of America, Chase, Wells Fargo, Marcus by Goldman Sachs, Self-Help Federal Credit Union, Latino Credit Union.

8. Which bank does not require SSN to open an account?

Citibank: No SSN or ITIN required; you will need to verify your address. PNC: No SSN or ITIN required. Wells Fargo: No SSN required.

9. Can I refuse to give my Social Security number?

Anyone can refuse to disclose his or her number, but the requester can refuse its services if you do not give it. Businesses, banks, schools, private agencies, etc., are free to request someone’s number and use it for any purpose that does not violate a federal or state law.

10. Is it safe to give SSN on online credit card application?

If you get email offering you a credit card, and perhaps asking for your Social Security number, don’t assume it’s legitimate and don’t share any information. If you’re interested in the offer, call the bank.

11. Why does Capital One ask for so many documents?

Capital One takes security seriously and fights hard to prevent identity theft, which protects both of us. To confirm your identity, we need information from a number of sources. This sometimes means sharing your information (e.g., name, address) with limited third parties solely for fraud prevention services.

Is it normal for Capital One to ask for Social Security number

Credit card issuers that do not require an SSN for authorized users include Capital One, Chase, Citi, and Barclays. The cardholder will be asked to provide a name, birthdate, address, relationship to the cardholder, and possibly citizenship status of the authorized user.

Cached

Can I open Capital One account without SSN

The answer is yes. You'll simply enter information such as your date of birth and ID numbers on the bank's application page.

Should I give SSN to credit card company

Most card issuers in the United States will request credit card applicants to provide a Social Security number (SSN). This helps credit card companies prevent fraud and protects the general public from identity theft. This requirement is not universal for all cards, however.

Cached

Why is Capital One asking for proof of identity

By asking you to upload pictures of your license and SSN card, they are verifying that it is indeed you who applied for the credit card and that you are able to provide valid identification in the event of any large scale or suspicious transactions.

Is Capital One data breach legitimate

The Federal Bureau of Investigation captured the hackers, but 140,000 social security numbers were accessed by the hackers, as well as 80,000 bank account numbers. In December 2021, Capital One was sued for breach, but decided to settle the lawsuit for $190 million.

Is it safe to give SSN to customer service

You should never provide your SSN to someone you don't know who calls you on the phone and requests it. This same warning applies to unsolicited emails and any forms you fill out on the Internet. In general, don't give your SSN to anyone unless you are absolutely certain they have a reason and a right to have it.

What banks don’t require SSN to open an account

Here are some banks and credit unions that don't require you to have an SSN to open an account:Bank of America.Chase.Wells Fargo.Marcus by Goldman Sachs.Self-Help Federal Credit Union.Latino Credit Union.

Which bank does not require SSN to open an account

Citibank: No SSN or ITIN required; you will need to verify your address. PNC: No SSN or ITIN required. Wells Fargo: No SSN required.

Can I refuse to give my Social Security number

Anyone can refuse to disclose his or her number, but the requester can refuse its services if you do not give it. Businesses, banks, schools, private agencies, etc., are free to request someone's number and use it for any purpose that does not violate a federal or state law.

Is it safe to give SSN on online credit card application

If you get email offering you a credit card, and perhaps asking for your Social Security number, don't assume it's legitimate and don't share any information. If you're interested in the offer, call the bank.

Why does Capital One ask for so many documents

Capital One takes security seriously and fights hard to prevent identity theft, which protects both of us. To confirm your identity, we need information from a number of sources. This sometimes means sharing your information (e.g. name, address) with limited third parties solely for fraud prevention services.

What does Capital One need to verify identity

Scanning a government-issued IDU.S. State-issued Driver's License or Learner's Permit (including Guam, Puerto Rico and the US Virgin Islands)State Issued Non-Driver ID.Passport (Book or Card)U.S. Military ID (includes Common Access Card issued by the Department of Defense)

How do I know if I qualify for Capital One data breach settlement

How do I know if I am part of the Settlement You are a Settlement Class Member if you are among the approximately 98 million U.S. residents identified by Capital One whose information was accessed in the Capital One Data Breach. If you received a notice, you are likely a member of the Settlement Class.

What is the Capital One controversy

In 2020, Capital One agreed to pay $80 million to settle federal bank regulators' claims that it lacked security measures it needed to protect customers' information. In December, the bank settled for $190 million a class-action lawsuit filed by customers whose data was exposed in the breach.

Can someone access my bank account with my Social Security number

Can someone access my bank account with my Social Security number No, because you would have to provide even more personal details to authenticate your identity like physical evidence of your passport, ID, driver's license, etc.

Why do banks ask for Social Security number when depositing cash

The bank needs your Social Security number or individual taxpayer identification number so it can report any interest income you earn to the IRS.

Is asking for SSN legal

There is no law that prevents businesses from asking for your SSN. And you may be denied service if you don't give the number. If giving your SSN to a business doesn't seem reasonable to you, ask if you can show another form of identification.

Does credit card without SSN affect credit score

You can get a credit score without an SSN. Although in most cases a social security number is required, some banks offer special credit cards for those who don't have an SSN. This can help build your credit history and FICO or other credit scores.

Does Capital One verify your income

Applicants must provide their previous two years' W-2's, and their most recent pay stub. The pay stub must be computer-generated, include year-to-date earnings and taxes withheld, contain no alterations, and must have been issued within 40 days of the faxed date.

Is Capital One legitimate

Capital One Bank is among the 10 largest U.S. banks by assets. While it offers branches in a handful of states, customers can access accounts online from just about anywhere. The bank offers high rates on its savings and CD accounts, and a free checking account that pays interest.

How long does it take to get Capital One card after verifying identity

The exact timeline for getting approved for a credit card can vary. But issuers must tell you their decision within 30 days. Once it's approved, many credit card issuers, including Capital One, say you can expect to receive your new card in the mail within 7 to 10 days.

How much are people getting from Capital One settlement

Capital One $190 Million Data Breach Settlement: Today Is the Last Day to Claim Money. Qualified customers can collect up to $25,000 for lost time and expenditures stemming from a 2019 cyberattack.

Will everyone get money from Capital One settlement

Capital One said the data breach affected 98 million people — and they're all eligible for settlement money.

Why not approved Capital One

A credit card issuer has to make sure you have enough income to make the required payments for your card. If you don't have enough income to make the minimum payments, you might not be approved.

Can Capital One be trusted

Overview. Capital One has a rating of 1.4 stars from 685 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers complaining about Capital One most frequently mention customer service, credit card, and late fee problems. Capital One ranks 303rd among Banking sites.