What all shows up on a credit report?

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.**

What are 3 things you might find on a credit report

Your credit report contains personal information, credit account history, credit inquiries, and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.**

Does a credit report show everything you owe

Your credit report lists the amount owed on every account, along with its status and payment history, and contact information for the creditor handling the debt. Under federal law, you can obtain one free copy of your credit report every 12 months by visiting AnnualCreditReport.com.**

What will not appear on a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records, or level of education. It also doesn’t include your credit score.**

What are 5 things not in your credit score

However, they do not consider: Your race, color, religion, national origin, sex, and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.**

Does a credit report show bank accounts

Bank transactions and account balances are not reported to the national credit bureaus and do not appear on your credit reports—but unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and hurt your credit scores.**

What is the most important thing in a credit report

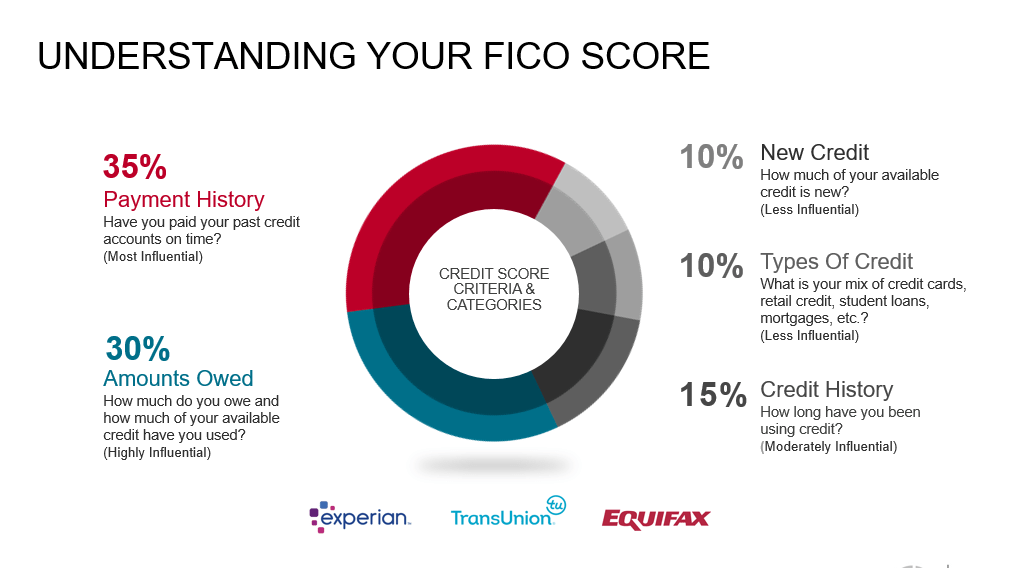

Payment history—whether you pay on time or late—is the most important factor of your credit score, making up a whopping 35% of your score.**

How can I hide my debt on my credit report

How to remove negative items from your credit report yourself:

– Get a free copy of your credit report.

– File a dispute with the credit reporting agency.

– File a dispute directly with the creditor.

– Review the claim results.

– Hire a credit repair service.**

Will a credit report show bank accounts

Your bank account information doesn’t show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings, and assets to determine whether you have the capacity to take on more debt.**

What are some red flags on credit reports

Common red flags on credit reports:

– Too many new credit cards.

– Inaccurate information.

– Bare minimum payments.

– Cash advances.

– Collections.

– Not having a diverse credit profile.

– Using the maximum credit available.

– Cosigning for a deadbeat.**

What hurts credit score the most

1. Payment History: 35%

Your payment history carries the most weight in factors that affect your credit score because it reveals whether you have a history of repaying funds that are loaned to you.**

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

Cached

What are 3 things you might find on a credit report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.

Cached

Does a credit report show everything you owe

Your credit report lists the amount owed on every account, along with its status and payment history, and contact information for the creditor handling the debt. Under federal law, you can obtain one free copy of your credit report every 12 months by visiting AnnualCreditReport.com.

What will not appear on a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

Cached

What are 5 things not in your credit score

However, they do not consider: Your race, color, religion, national origin, sex and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

Does a credit report show bank accounts

Bank transactions and account balances are not reported to the national credit bureaus and do not appear on your credit reports—but unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and hurt your credit scores.

What is the most important thing in a credit report

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score.

How can I hide my debt on my credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Will a credit report show bank accounts

Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

What are some red flags on credit reports

Common red flags on credit reportsToo many new credit cards.Inaccurate information.Bare minimum payments.Cash advances.Collections.Not having a diverse credit profile.Using the maximum credit available.Cosigning for a deadbeat.

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What looks bad on a credit score

Your credit record may be negatively impacted by: late payments. missed payments. bankruptcy.

What has biggest impact on credit score

Payment History

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you. This component of your score considers the following factors:3.

How far back does a credit report show

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

What type of debt Cannot be erased

No matter which form of bankruptcy is sought, not all debt can be wiped out through a bankruptcy case. Taxes, spousal support, child support, alimony, and government-funded or backed student loans are some types of debt you will not be able to discharge in bankruptcy.

What Cannot be removed from your credit report

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

Is your income on your credit report

“Income isn't even on your credit reports so it cannot be considered in credit scores because credit scores only consider what's on your credit reports,” Ulzheimer explains. “In fact, no wealth metrics are factored into your credit scores.”

What are covered accounts red flags

The Red Flag Rule stipulates that any financial institution or creditor must evaluate whether any new or existing accounts are considered “covered accounts” by the regulations. Covered accounts are described as those that are typically used by individuals and households to facilitate multiple transactions.

What is the Red Flag Rule

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to “red flags”—patterns, practices or specific activities—that could indicate identity theft.

What will destroy your credit score

Highlights: Even one late payment can cause credit scores to drop. Carrying high balances may also impact credit scores. Closing a credit card account may impact your debt to credit utilization ratio.

Is 500 a really bad credit score

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 500 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

What bills affect your credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

What are the 5 factors that affect your credit score

The 5 factors that impact your credit scorePayment history.Amounts owed.Length of credit history.New credit.Credit mix.

Is it true that after 7 years your credit is clear

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.