What are the 4 types of grants?

Summary

Grants are a form of funding provided by the government to support various programs and projects. There are different types of grants available, each serving a specific purpose. Program/project grants are the most popular type, as they specify that the funding should only be used for the proposed program or project.

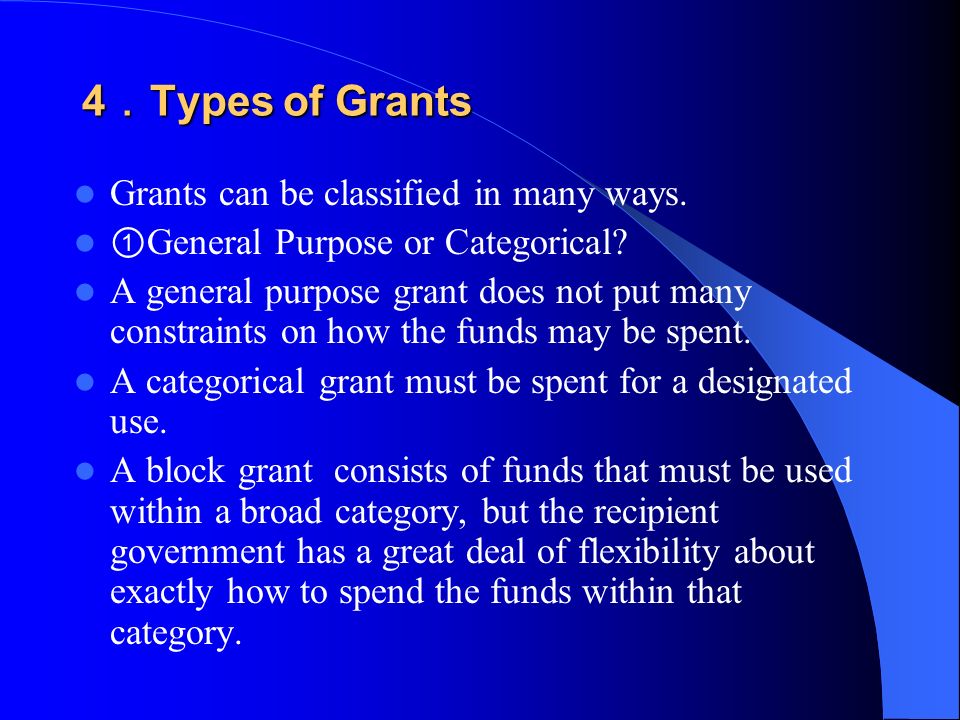

When it comes to grants given to states, three main types exist: categorical grants, block grants, and general revenue sharing. These grants are provided by the federal government to support state and local governments in specific areas.

Discretionary grants and formula grants are the two main types of federal grants. Discretionary grants are awarded through a competitive process, while formula grants are determined by Congress and have no application process. Additionally, student loans or grants are available to help students attend college.

It’s important to note that federal grants are typically not available for individuals. They are primarily aimed at states and organizations. However, individuals may be eligible for federal loans for purposes such as education or starting a small business. Visit USA.gov’s benefits page for assistance with food, healthcare, and utilities.

The Department of Health and Human Services (HHS) is the largest grant-making agency in the US. Most HHS grants are provided directly to states, territories, tribes, and educational and community organizations for distribution to eligible recipients.

Grants offer several advantages over loans. Grants are non-repayable, meaning there is no need to worry about monthly payments or accumulating debt. This makes grants more valuable and desirable compared to loans which require repayment.

Common types of government grants include formula grants, congressionally directed awards, discretionary grants, cooperative agreements, and payment programs.

Examples of federal grants include contributions to State and local governments for programs like Medicaid health insurance, education, and transportation infrastructure.

A grant-in-aid is a type of grant provided by the federal government to fund public services. These grants are often given to states, nonprofits, and other organizations. Medicaid is one such example of a federal grant-in-aid program.

When it comes to government loans, Stafford Loans are easy to qualify for and may include interest subsidies. PLUS Loans are available for parents but require repayment.

Questions and Answers

- What is the most popular type of grant?

Program/project grants are the most common type of grant. They are specific to the proposed program or project. - What are the three types of grants that can be given to states?

The three general types of federal grants given to states are categorical grants, block grants, and general revenue sharing. - What are the two main types of federal grants?

The two main types of federal grants are discretionary grants and formula grants. Discretionary grants are awarded competitively, while formula grants use formulas determined by Congress. - Is the US government giving out grants?

Federal grants are typically not available for individuals. However, federal loans for education, small businesses, and other purposes may be available. Visit USA.gov’s benefits page for assistance with basic needs. - What is the largest federal grant program?

The Department of Health and Human Services (HHS) is the largest grant-making agency in the US. They provide grants to states, territories, tribes, and eligible organizations. - Why is a grant better than a loan?

Grants do not require repayment, making them more beneficial than loans. Unlike loans, grants do not add to your debt burden. - What are the common types of government grants?

Common types of government grants include formula grants, congressionally directed awards, discretionary grants, cooperative agreements, and payment programs. - What is an example of a federal grant?

Examples of federal grants include contributions to State and local governments for programs like Medicaid, education, and transportation infrastructure. - What are considered federal grants?

Federal grants support various public services and economic stimulus initiatives. They are listed in the Catalog of Federal Domestic Assistance (CFDA). - What is a type of grant in aid given by the federal government?

A federal grant-in-aid is an appropriation made by the federal government to fund public services. Medicaid represents one of the largest federal grant-in-aid programs. - What is the easiest government loan to get?

Stafford Loans are typically easy to qualify for, and interest subsidies may be available. PLUS Loans are available for parents but require repayment.

What is the most popular type of grant

Program/project grants

This is the most common type of grant. Program/project grants specify that funding may only be used to support the program or project referenced in your proposal.

What are the 3 types of grants that can be given to states

The three general types of federal grants to state and local governments are categorical grants, block grants, and general revenue sharing (see Table 1).

Cached

What are the two main types of federal grants

Discretionary grants: awarded using a competitive process. Student loans or grants: to help students attend college. Formula grants: uses formulas determined by Congress and has no application process.

Cached

Is the US government giving out grants

The government does not offer "free money" for individuals. Federal grants are typically only for states and organizations. But you may be able to get a federal loan for education, a small business, and more. If you need help with food, health care, or utilities, visit USA.gov's benefits page.

What is the largest federal grant program

HHS is the largest grant-making agency in the US. Most HHS grants are provided directly to states, territories, tribes, and educational and community organizations, then given to people and organizations who are eligible to receive funding.

Why is a grant better than a loan

No repayment necessary: Grants are non-repayable. Once you're awarded the grant money, it's yours without any strings attached. There's no need to worry about monthly payments or piling on more debt. Repayment is the fundamental difference between a grant and a loan, and also what makes grants more valuable than loans.

What are the common types of government grants

Types of FundingFormula grants,Congressionally directed awards,Discretionary grants,Cooperative agreements,Payment programs.

What is an example of a federal grant

Examples of formula grants include the Federal governments' contributions to State and local governments for programs such as Medicaid health insurance, education, and transportation infrastructure.

What are considered federal grants

A Short Summary of Federal Grants

What is a grant A grant is a way the government funds your ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs listed in the Catalog of Federal Domestic Assistance (CFDA).

What is a type of grant in aid given by the federal government

A federal grant-in-aid is an appropriation made by the federal government to provide funding for public services, often given to states, nonprofits, and other organizations. Medicaid is the largest federal grant-in-aid program, but there are many others.

What is the easiest government loan to get

Common loan programs include: Stafford Loans: These are easy to qualify for, and you might receive interest subsidies. PLUS Loans: Parents can borrow substantial amounts, but that means parents will have to repay. 2.

Are grants treated as income

A good general rule to keep in mind is that all income, regardless of its source, is considered taxable income unless the tax law specifically states an exception. Since a grant is considered income, it is considered taxable unless the law has provisions that state otherwise.

What program receives the most funding

Overview. Medicaid is by far the largest federal grant to states, making up 65 percent of total grant funding in 2018. From 2008 to 2018, Medicaid was the main driver of the 42 percent increase in total federal grants to states.

What is the largest Pell Grant you can receive

$7,395

The maximum amount of money you can get from a Pell Grant is: $7,395 (2023–24). The amount granted depends on your Expected Family Contribution (EFC), cost of attendance, your status as a full-time or part-time student, and your plans to attend school for a full academic year or less.

What are the disadvantages of a grant

In reality, grants can often become a source of frustration and stress for a non-profit.Grants Cannot Help You Start Off.Grants Come with a Lot of Strings Attached.Grants Take a Long Time to be Approved.Grants Have Complex Reporting Requirements.Grants are Short-Termed.

Why would you want a grant

Grants can provide valuable resources for organizations to carry out projects or provide services they otherwise would not be able to. It is important to remember, however, that grants are competitive. A lot of time and preparation are required to find grant opportunities, plan a project, and then develop a proposal.

Do federal grants count as income

You may also wish to review the IRS FAQ on Grants, Scholarships, Student Loans, Work Study. Non-Degree Students: If you are a non-degree student, the full amount of any grant, scholarship or fellowship you receive is subject to federal income tax, even if it is spent on educational expenses.

Is federal grant the same as financial aid

A grant is a form of financial aid that doesn't have to be repaid (unless, for example, you withdraw from school and owe a refund, or you receive a TEACH Grant and don't complete your service obligation).

What is the largest category of federal grant in aid money

The federal government distributes grants to states and localities for many purposes, but the bulk are dedicated to health care.

What are the three types of financial aid provided by the federal government

Types of Financial Aid: Loans, Grants, and Work-Study Programs.

What loan is guaranteed by the federal government

Which loans are guaranteed by the federal government Government loans are usually not applied for directly from the government agency and are applied for through private lenders offering government-backed mortgages. The three most common federally funded loans are VA loans, USDA loans, and FHA loans.

Can I borrow money from my Social Security benefits

Social Security does not allow recipients to borrow against their future benefits.

Are grants reported on taxes

How to Report. Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows: If filing Form 1040 or Form 1040-SR, include the taxable portion in the total amount reported on Line 1a of your tax return.

Are grants counted on taxes

A good general rule to keep in mind is that all income, regardless of its source, is considered taxable income unless the tax law specifically states an exception. Since a grant is considered income, it is considered taxable unless the law has provisions that state otherwise.

What is the largest source of financial assistance

The single largest provider of financial assistance in the United States is the federal government, via the U.S. Department of Education.